Economy

The Finance Bill 2017: Much Flak For Doing The Right Thing

- There was obviously no scope for debate within media or among Parliamentarians on the subsequent amendments to the Finance Bill.

- The powers offered to tax officers to undertake search with less safeguard than hitherto is a risk.

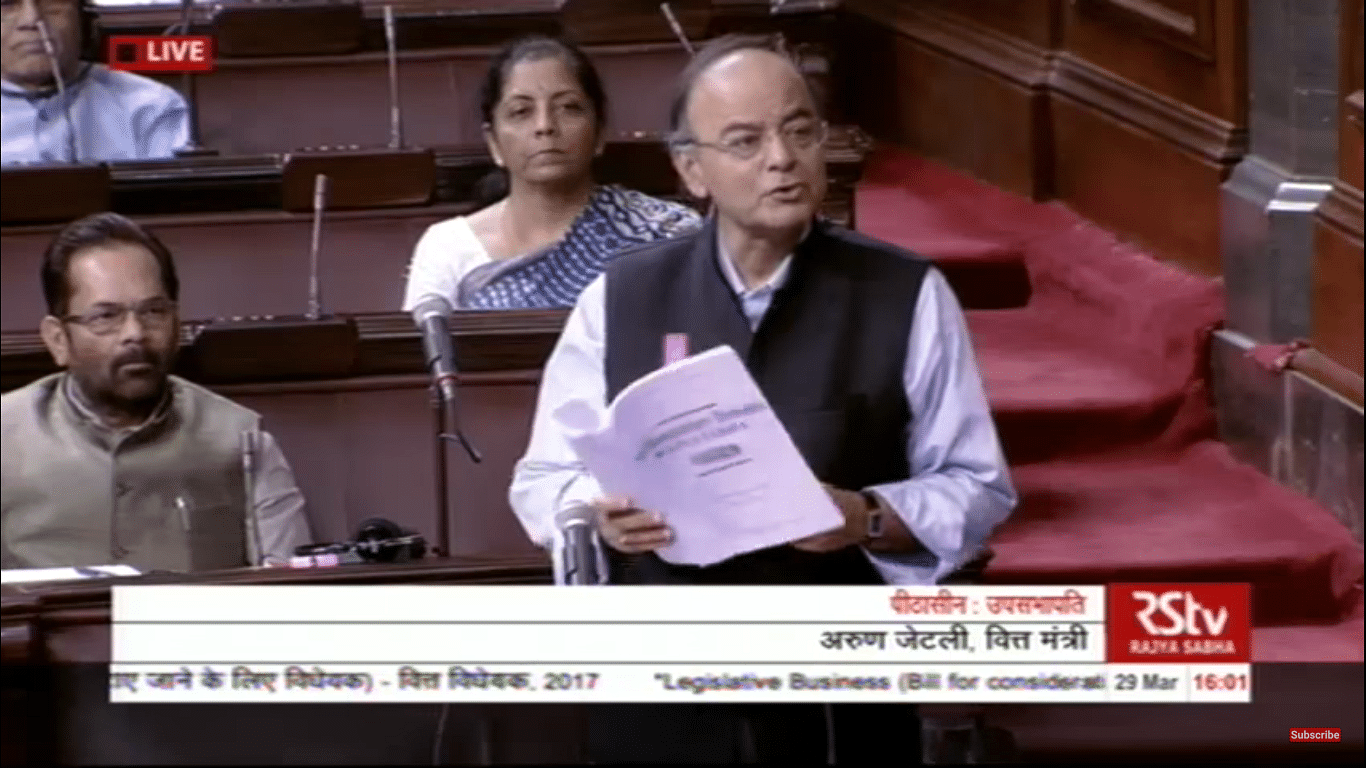

Arun Jaitley

Did the Finance Bill have any business to tread where none before has walked? The answer, yes or no depends unfortunately on the political assumption of the commentator, and this piece too can’t escape that treatment.

Be that as it may, there are two strands to the argument. The first says the changes are a priori, malafide. The second one notes that the manner of their introduction was dubious.

Let’s examine the second set of objections: It is always useful to get some facts in place in a debate. Is this the longest set of amendments made to any finance bill? It is apparently so, if one includes to the list of 150, the final set of 33 amendments the Finance Minister circulated in Parliament before the house took up the debate. But even then the numbers are not too far above the successive finance bills of previous years. The 2012 bill too had listed 150 amendments. A chronological perusal of the finance bills shows the number of amendments made each year has begun to rise spectacularly in recent years. In the Finance Bill of 2008, there were less than 50 of them. It has rapidly mounted since.

This has become necessary as successive bills have announced literally new acts as part of the Bill, almost each year. The Fringe Benefit Tax, the Banking Transaction Tax, the General Anti-Avoidance Rules and that of the Transfer Pricing Act all came through the finance bills. The biggest of them was to be the Direct Tax Code which never arrived. Each of them was about tax issues, but given the destabilising impact each of them had on the economy every year, should they have been a subset of the Finance Bill? If the answer is still yes they should have been, then most of the changes made in the Finance Bill this year, would appear appropriate too. The amendments made to link Aadhaar with Permanent Account Number would also qualify for inclusion in the Finance Bill.

And that is not all. Every year, the indirect tax department runs a huge set of amendments post the budget, that often cross three figures. Since Parliament members rarely notice those changes – to be fair since those are delegated legislations it is not their ken to do so – they pass unnoticed. Yet, plenty of those offer tax sops which make or break companies.

Those will become history from this year, post the passage of the Goods and Services Tax (GST) Act. Any change in the rates, applicability of the rules and just about anything else will now have to be cleared by the GST Council from July or 1 September 2017. The flexibility with indirect tax, especially excise and service tax are now over, at least till the tax officials find alternatives. And since changes in the customs duties usually need a corresponding change in these two, any rapid change in the sphere of the former too is ruled out, hereon.

Is it then a surprise, that these officials this time made a massive rush to the finishing line to get the indirect tax changes in place before GST became a law. Since it was not clear that GST would be in place when the Budget was firmed up in January, none of those amendments could be listed in the Finance Bill.

The one argument made repeatedly in this context is as follows: irrespective of the nature of the amendments, the second set should have been circulated well in advance of the date when the Finance Bill was taken up for debate in Parliament. In my coverage of Parliament, I don't ever recall a finance minister laying the amendments before he reads them out in Lok Sabha. Asking for tax proposals (which a government cannot obviously allow to be amended), to be circulated before they are made public in the House is the surest way to ensure someone makes a killing with the advance information.

So there was obviously no scope for debate within media or among Parliamentarians on the subsequent amendments to the Finance Bill. The argument has been floated by those who obviously are not informed on the topic. As the Parliament of India website explains, tax proposals have to be here and now: “The Finance Bill seeking to give effect to the Government’s taxation proposals which is introduced in Lok Sabha immediately after the presentation of the General Budget, is taken up for consideration and passing after the Appropriation Bill is passed. However, certain provisions in the Bill relating to levy and collection of fresh duties or variations in the existing duties come into effect immediately on the expiry of the day on which the Bill is introduced by virtue of a declaration under the Provisional Collection of Taxes Act. Parliament has to pass the Finance Bill within 75 days of its introduction”.

Now let’s turn to the first set of objections to the amendments brought in by Finance Minister Arun Jaitley – that they were malafide. Those are mainly about the additional powers the changes offer to the income tax officers in their powers of search and seizure. I have often wondered at the apparent dichotomy among commentators who are sure there is a whole lot of corrupt money stashed away among the rich but are horrified if the government decides to go for those. If the tax officer has to snoop on unaccounted income without using strong arm tactics, Aadhaar has to be in the mixture. It has not been used so far but the commentators are convinced that the information it will throw up will be substantial but also irrelevant.

How they manage to solve this jigsaw puzzle is of course not revealed. It is quite reminiscent of the campaign that ran when Yashwant Sinha wanted to tax dividend income. That his method has been revived this year in the Finance Bill, after more than a decade shows we have made some progress. The powers offered to tax officers to undertake search with less safeguard than hitherto is however a risk. It is for the finance ministry to demonstrate that it will be used responsibly but it is something that could have been replaced with the far superior platform that technology based snooping offers, especially since demonetisation has offered such a rich harvest of data to the tax men. Organising a raid is not the easiest of action, and since cash is not the target in these cases, it does not even act as a shock and awe tactic.

And now we come to the issue of tribunals. It is amazing to notice the outpouring of grief at the demise of these institutions. For me, it is more amazing that the finance ministry, having waded into the tribunals set up by other ministry, has not touched any of its tribe, except the weakest one, the Appellate Tribunal for Foreign Exchange. The eight tribunals to be wound up, except for Compat have shown only one evidence, which is that the tribunal system in India has been a disaster.

While there is little doubt that tribunals do not per se qualify under the rubric of Finance Bill, one would say it has saved a huge amount of Parliamentary hours from being wasted to rescind each of the acts under which these monstrosities had come up.

Tribunals began to expand in India post the infamous 42nd amendment of the Indian Constitution passed during the Emergency. The amended sections 323A and B opened the floodgates. Thereafter, in the first flush of liberalisation, each regulator came armed with a tribunal. Today, the Cestat (for indirect tax) has a pendency list of over a lakh cases and the myriad debt recovery tribunals (for banks) are sitting on cases that mock the side of the non-performing assets of those banks. For those who feel terrible about the passage into history of these tribunals, I suggest a visit to the nearest Motor Accidents Claims Tribunals. They might upbraid the Finance Minister for having delayed the clean-up for so long.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest