Economy

The Ignored B.R Shenoy Report of 1966

An instance of missed opportunity for Sri Lanka?

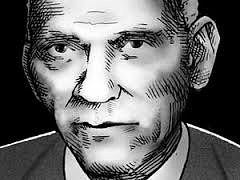

Kumar Anand’s article on B. R. Shenoy, in which Milton Friedman is quoted as calling him a prophet without honour in his own country reminded me of Shenoy’s tryst with Sri Lanka and a similar tale that panned out in the mid-1960s.

Shenoy, the Indian classical libertarian economist, was no stranger to Ceylon (as Sri Lanka was known then). He was a lecturer in economics at the University College which was affiliated to the University of London initially and later became the University of Ceylon, in 1940s. However, he is little known in present day Sri Lanka. And what is not known at all is that Sri Lanka lost a valuable opportunity to change the course of the nation, because the advice he gave to completely reform the country’s economy and its economic policy was rejected.

Shenoy was engaged in 1966 by J.R Jayewardene (JR), then the Minister of State and Deputy Prime Minister, when the economic crisis faced by the country had escalated to a critical level. As JR’s biographers, K.M de Silva and Howard Wriggins, write in their book, J. R Jayewardene of Sri Lanka, the man who would go to become President was looking for “an economist or economists who could come up with some fresh ideas on how to deal with the malaise in Sri Lanka’s economy”. JR did not trust academicians at Sri Lankan universities because they were Marxists or advocates of policies that promoted state expansion as the way out for Sri Lanka. Such state expansion was the root cause of the country’s economic malaise and it was quite natural for JR to look for someone who was free from such ‘state-worshipping ideologies’. It was Esmond Wicheremesinghe, a newspaper magnate connected to the ruling party, who introduced Shenoy to JR.

At that time, Shenoy was director of the School of Social Sciences of Gujarat University and had been noted for his independence of opinion free from political pressures and daring to call a spade a spade if it did not fall in line with sound economics, as his famous note of dissent on the Second Five-Year Plan showed.

An economy under siege

At the time Shenoy was hired, Sri Lanka’s economy had been under siege from many fronts. When it gained independence in 1948, it had comfortable foreign exchange reserves, sufficient to meet 13.4 months of imports. However, this reserve declined in subsequent years and had fallen to 1.9 months of imports by 1966. The main reason for this unsavoury development was the weak balance of payments position of the country that heavily depended on the export of three major tree crops – tea, rubber and coconut — to meet all its import requirements. As such, the balance of payments was continuously in deficit from around 1956, causing a heavy haemorrhage of its foreign reserves.

On the budgetary front, the country had overspent its resources running a continuous overall budget deficit in the region of about 5-7 per cent of GDP, prompting Singapore’s Lee Kuan Yew to call Sri Lanka a country notorious for living by auctioning non-existent assets. The fragile budgetary situation was the result of successive governments since independence, especially after 1956, following a policy of state expansion, committing the scarce resources of the government, and also of the country, to maintain an ever-expanding state sector. The undesired corollary was that the government had to borrow heavily to incur deficit financing, specifically from the domestic markets. Accordingly, the total public debt which had stood at 18 per cent of GDP in 1948 had shot up to 66 per cent of GDP by 1966. Since the government was running a sizeable budget deficit, the repayment of public debt as well as payment of interest thereon was done by resorting to further borrowing thereby entrapping the country in a vicious debt trap.

Meanwhile, money supply had increased over and above the growth in the real economy, putting an upward pressure on prices. This was evident from the substantial increase in the money-GDP ratio – from 17 per cent in 1950 to 29 per cent in 1966 – and the need for the government to resort to price and foreign exchange controls to suppress inflation and the growing pressure for the devaluation of the rupee. Economic growth during 1950-66 had been at an average level of slightly above 3 per cent per annum.

Shenoy to the rescue

Shenoy was engaged by the government to study and report on the necessary economic reforms to be implemented in the country in the light of the prevailing situation. He submitted his report – ‘Economic Situation and Trends in Ceylon: A Programme of Reform’ – to the government in December 1966. This writer had the opportunity of mastering the report which remains in mimeograph form in the J.R Jayewardene Centre in Colombo.

Shenoy started his report by remarking that Ceylon’s economy has been inflicted with 3Ps of maladies in the 1950s and 1960s – production, prices and (balance of) payments. According to him, while the bad performance of these three attributes indicates economic ill health, the good performance is a sign of economic good health. He asserted that, as in the case of addressing a human ailment, correct diagnosis of the ailment is only half of the cure; the full cure lies in taking remedial policies to address them.

Shenoy found that economic growth during 1960-65 amounted to less than 2 per cent a year and, with a population growth of 2.7 per cent the per capita income had been declining. However, even this meagre economic growth was conveniently appropriated by the higher echelon of society facilitating them to “maintain their consumption standards at undiminished levels of affluence”. What it meant was, according to him, a more rapid erosion of mass well-being than what the national income statistics suggested. His prognosis was that such growing inequality in income distribution was a “serious matter in a democracy, especially in the context of two more or less evenly balanced party alignments, where the opposition is ever on the alert to capitalise on the errors of policy ill-effects of the party in power”. Hence, he opined that “a major policy objective should be to halt the decline in the living standards of the masses and to reverse this trend without delay”. Shenoy was prophetic in his prognosis, as was demonstrated by the youth insurrection of 1971. Had the political leaders taken his advice seriously, the bloody insurrection that ended in the loss of thousands of young lives could have been avoided.

To many, libertarian economics means supporting capitalists at the expense of the masses at large. But that is not the case. While libertarian economics upholds the liberty of choice, whether it is by the capitalist or by the worker, it necessarily frowns upon a growing inequality in income distribution leading to social, economic or political disorder. Hence, it always recommends policies to prevent such a situation. Shenoy’s observation and recommendation were in line with this thinking. Sri Lanka’s was a classic case where, despite the adoption of many pro-poor policies, the Gini coefficient of income equality/inequality remained stubbornly at about mid level at 0.5 throughout its post independence history, indicating wide income inequality. All the successive governments of Sri Lanka had to pay a high price due to their failure to take notice of his recommendation.

Shenoy noted that “the cost of living index does not seem to present the full picture of the extent of price inflation” since that index had been vitiated by controlled prices that do not show the price changes in response to emerging market conditions. (This is true for Sri Lanka even today.) He found that since money supply had increased faster than the real economic growth, inflationary pressure had been there; but due to controlled prices, inflation had not been reflected in the cost of living index. Successive governments, Shenoy pointed out , have been resorting to bank financing to meet their capital expenditure programmes since the domestic savings had not been adequate. According to him, the single biggest impediment to accelerate economic growth had been “the shortage of national savings”. Hence, he noted that “inflation in Ceylon cannot be controlled without balancing the Budget” just like “the problem of flood control cannot be tackled by restricting the water down the canals”. Hence, it is the source that has to be beaten and not the symptoms.

Balancing the budget

Shenoy, therefore, suggested a series of actions to balance the budget before it ballooned to unmanageable levels. Since Ceylon had a satisfactory revenue ratio at about 22 per cent of GDP in the 1950s and 1960s (as against 12 per cent today), he did not recommend an increase in taxation which would have reduced national savings further. Instead, he recommended halting expenditure leakages in the form of unproductive subsidies, expansion of the state sector and non-rationalisation of the capital expenditure programmes. Hence, Shenoy recommended the denationalisation of selected state corporations in fisheries, manufactures and trading and increase in the current account surplus of the budget by reducing unnecessary recurrent expenditure programmes so that capital expenditure could be undertaken wholly by using such surplus. The implication of this latter recommendation is that it would generate a zero overall deficit in the budget which would be non-inflationary and supportive of the Central Bank’s monetary policy actions to control inflation. But throughout the post-independence period, governments had been generating inflation and the Central Bank had been punishing the private sector by imposing restrictive monetary policies.

Listing state corporations

While recommending that selected state corporations should be denationalised, Shenoy suggested that the other state corporations should be listed in the stock exchange so that they would be disciplined by the market, instead of by political authorities. This measure would also help them to mobilise funds from the market for capital expenditure programmes by allowing their internal strengths to be tested in the market instead of relying on the government. It should be noted that during this era, the stock exchange was vibrant with the share transactions of plantation companies and what Shenoy had suggested was to augment its operations by listing public corporations as well.

Cash subsidies instead of commodity subsidies

He also recommended that consumer subsidies should be scaled down and the popular rice subsidy that was prevalent at that time should be replaced by a cash subsidy instead of a commodity subsidy. Such a measure, while helping the needy with government support, would keep the budgetary commitments at a fixed level making it easy for long term budgetary planning. While the expenditure side of the budget should be tackled by these measures, he had suggested that the tax rates which stood at 80 per cent at the margin too should be scaled down drastically in order to promote national savings, since, according to him, “taxation destroys potential national savings into a bonfire of public consumption” which has not helped the economy to pick up. He also suggested that the public’s concern for Ceylonisation of foreign enterprises could be fulfilled by freeing the public from high marginal tax rates and increasing their savings potential. Many years later, American economist Arthur Laffer also came up with this Shenoy Theorem in what later came to be known as Laffer curve that held that when tax rates are increased beyond a certain level, tax revenue would fall instead of increasing.

Float the rupee and remove exchange and import controls

The most revolutionary proposal by Shenoy was to adopt a completely freely floating exchange rate to address the persistent balance of payments difficulties in the wake of uncertainty about the receipt of donor funding. It should be noted that this recommendation was two decades ahead of global best practices which advocated flexible exchange rates. The strict exchange and import controls have generated a massive black market for foreign exchange on the one hand and a thriving smuggling business on the other. The reaction of the authorities was to impose more and more penalties on the culprits. Hence, there was a substantial disparity between the official exchange rate and black market rate; the result was the over invoicing of imports and under invoicing of exports so that saved foreign exchange could be lucratively sold in the black market. Shenoy had termed it as ‘disastrous for the country’s balance of payments. Hence, he recommended abolition of exchange controls, import and export restrictions and liberalisation of external trade along with the floating of the rupee.

Costly disregard of Shenoy’s recommendations

The report, by any standard, was well ahead of the time. None of the countries in South Asia at that time would even dare to consider them as viable, thereby making their adoption a completely non-issue. That is what happened in Sri Lanka as well. According to JR’s biographers, he was impressed by Shenoy’s policy reform package. However, when it was submitted to the cabinet, Prime Minister Dudley Senanayake is reported to have become nervous, thinking that it was a ploy by JR to oust him from leadership. Hence, the policy package was dismissed and it remained a dusty document with JR till it was transferred to J R Jayewardene Centre in Colombo as a vital document. According to his biographers, many of Shenoy’s recommendations were adopted in November 1977 and thereafter by the UNP government led by JR.

Shenoy was deeply influenced by Friedrich A. Hayek when he did his doctoral studies at the London School Economics in the 1930s. Interestingly, Margaret Thatcher had engaged Hayek to advise her on how the British economy should be reformed after she came to power in 1979. So Sri Lanka was literally one period ahead of Britain when it engaged Hayek’s disciple to do the same job 13 years earlier. The difference was that while Britain implemented most of Hayek’s recommendations, Ceylon ignored them.

Singapore, a nation ranked at the same economic status as Ceylon in the mid-1960s, implemented a policy package similar to that recommended by Shenoy. Through that policy, it was successful in producing an economic miracle and earning the status of a developed country within a single generation.

Sri Lanka, unfortunately, missed an opportunity to reform the economy and set it on a firm recovery road. Strangely, Sri Lanka’s economy today is mostly beset with the same maladies as in the mid-1960s and Shenoy recommendations could be adopted without any amendment.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest