Economy

What India's New Bankruptcy Code May Look Like

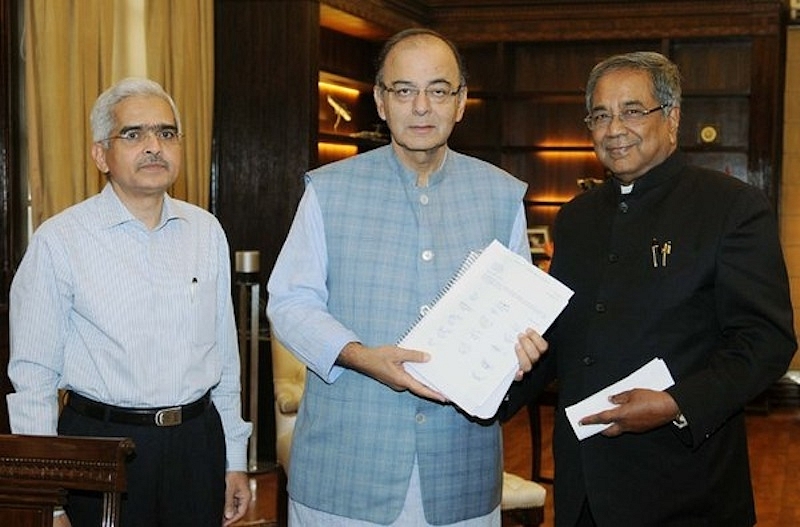

An overview of the recommendations in the Bankruptcy Law Reform Committee report submitted yesterday.

The TK Vishwanathan Committee that submitted its final report on a new insolvency and bankruptcy law on Wednesday November 4 has said that all laws relating to insolvency of companies, limited liability entities including limited liability partnerships, unlimited liability partnerships and individuals that are currently scattered across various legislations be consolidated into a single legislation that may be called The Insolvency and Bankruptcy Bill 2015.

It has proposed that insolvency resolutions should be completed within 180 days in most cases, with extension allowed only in exceptional cases. The committee has also proposed fast track resolutions which can be completed in as little as 90 days.

One of the most significant recommendations of the committee pertains to dealing with insolvencies of individuals with limited means. The committee has called for writing off debts of individuals with gross annual income of less than Rs 60,000 and gross asset of less than Rs 20,000 to allow the person a fresh start, subject to some conditions. The default and write off will, however, be recorded in the individual’s credit history.

All these recommendations of the committee have been built into a draft bill submitted to the government to consider and enact.

The committee felt that such a comprehensive law was necessary for greater clarity on dealing with insolvencies and bankruptcies as well as to facilitate consistent and coherent application of the law to different stakeholders affected by business failure or inability to pay debt. The new law envisaged swift and effective resolution of bankruptcies, improve the handling of conflicts between creditors and debtors, avoid destruction of value, distinguish malfeasance vis-a-vis business failure and clearly allocate losses in macroeconomic downturns.

The Committee has recommended that the government establish an insolvency adjudicating authority to hear and dispose of cases by or against debtor as well as an insolvency regulator to exercise oversight over insolvency professionals, insolvency professional agencies and informational utilities. The insolvency adjudicating authorities would be the Debt Recovery Tribunal and its appellate tribunal and the National Company Law Tribunal and its appellate tribunal.

The Debt Recovery Tribunal will decide on cases of individuals and unlimited liability partnership firms while the National Company Law Tribunal will decide insolvency cases of companies and other limited liability entities.

The draft Bill prescribes a timeline of 180 days to deal with applications for insolvency resolution. The timeline can be extended for 90 days by the adjudicating authorities only in exceptional cases. The committee has also recommended that the management of the debtor is placed in the hands of an interim resolution professional/resolution professional during the insolvency resolution period – that will help preserve the value of the company and its assets. The committee has also recommended that the first course of action should be insolvency resolution and that businesses should be liquidated only if insolvency resolution was not acceptable to the majority of the financial creditors.

The draft Bill provides for a fast track insolvency resolution process that may be allowed to certain categories of entities. Under the fast track process, the insolvency resolution has to be completed within 90 days from the trigger date. However, on a request from the resolution professional, the adjudicating authority can grant a one-time extension of 45 days.

The government intends to take the insolvency Bill to Parliament in the winter session, finance ministry Arun Jaitley told delegates at World Economic Forum summit in Delhi on Wednesday morning. It is not clear at this stage if the government will move the Bill drafted by the Vishwanathan committee or seek to move amendments to the Companies Act 2013 to facilitate easier rescue or liquidation of sick industrial corporate entities to begin with and later absorb these into the proposed Insolvency and Bankruptcy Act.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest