Economy

When It Comes To Proving The Success Of DeMo, Burden Of Proof Lies With The Government

- For keeping the government in check as well for keeping the sanity in discourse, it will serve us well if we emphasise that the burden of proof that a certain policy worked rests on the government

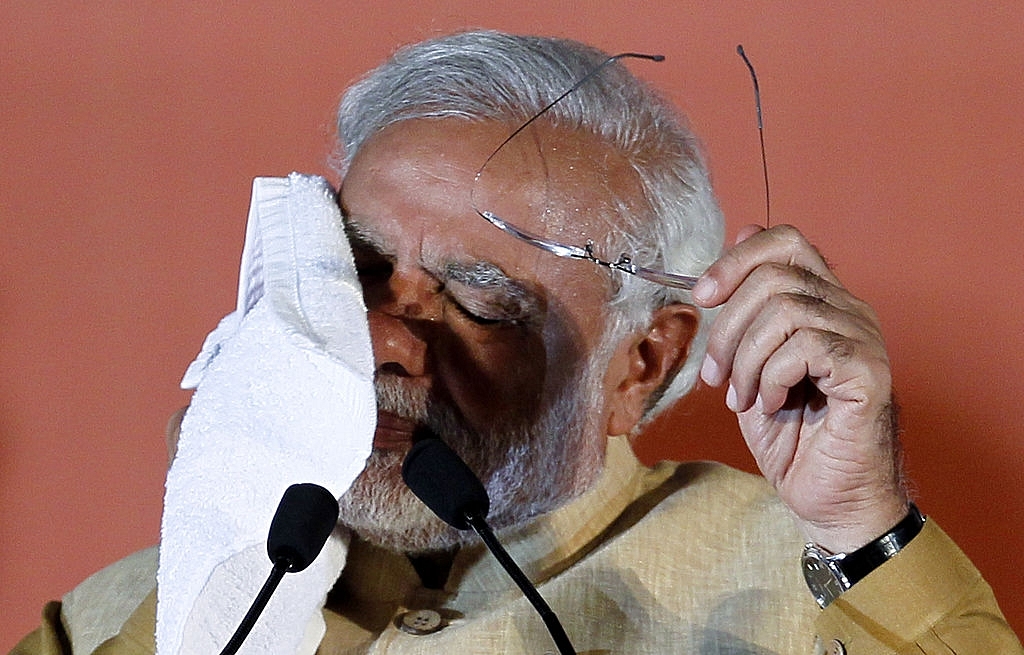

Narendra Modi wipes the sweat from his face during an election rally at MMRDA ground, BKC on April 21, 2014 in Mumbai, India. (Kunal Patil/Hindustan Times via Getty Images)

Finally the cat is out of the bag. All those three people in RBI who were counting notes since January are, finally and fortunately, done. The total amount of returned currency would not make Narendra Modi proud, as we all know. Out of the 15.44 Lakh Crore Rupees about 15.28 Lakh Crore Rupees have come back. We Indians should be proud of the extraordinarily innovative ways in which our fellows have managed to return their “hard-earned” “tax-free” money. That “anti-national western educated” Raghuram Rajan who has “no stakes in India” had predicted this outcome is a different matter. The ensuing discussions about whether demonetisation was worth it and whether the returned currency is the right metric to judge the success or failure of the policy would continue for weeks.

A few people in the mainstream media as well as social media have criticised those calling demonetisation a failure. Their argument is that it is too soon to call demonetisation a failure mainly because the amount of money returned to RBI is merely one amongst many measures of success. More importantly would the number of taxpayers and the total tax collection go up significantly in the long run? Money doesn't become white simply by depositing it in the bank. The account holders will need to justify how they acquired that money in the event of a query. As Jaitley observed in the budget speech, deposits of more than 80 lakh rupees were made in 1.48 lakh accounts with an average deposit of 3.3 crore. Apparently, the government has employed a number of analysts working on "big-data", yes you need that today for everything under the sun. At 30 per cent tax collection out of that, the amount would be 1.5 lakh crores which would, by all accounts, make demonetisation a decent success. At 40 per cent and above it would, almost certainly, be hailed as quite successful even in the short run.

Sounds like a sensible argument except that it does not bode well for a discourse on public policy - The burden of proof that demonetisation has indeed produced increased tax collections or gains in any other form rests solely on the government.

This is crucial because, governments and bureaucracies are almost always inefficient. I hope that I am forgiven for committing the cardinal sin of suggesting that even Modi is a mortal in that the inefficiencies may have persisted in his era. Therefore, it is either wrong and/or stupid to ask the critics of demonetisation the following question: Do you think the government will not catch those who have deposited huge sums? It may or may not but until the government can demonstrate successfully that it has done so, as citizens we must not accept that these people will be caught.

Some social media warriors have suggested that 99 per cent money coming back to RBI is simply too good to be true. Therefore, the UPA must have committed a Telgi-like scam by printing fake currency etc. In general it is a good idea to not waste time on conspiracy theories. However, even if one were to deviate from that policy, this argument makes Modi and demonetisation almost infallible. After all, if the only conclusion one can draw is that there must have been much more currency than reported by the RBI, then no amount of data can ever prove that demonetisation failed, at least on this count. And yet again, even if this theory were true the burden of proof rests with the proponents of the theory. To simply assert that it is “too good to be true” is nonsense.

Proponents of the theory also need to pause and think about the fact that 99 per cent money coming back to RBI could not have happened without a number of conniving forces in the government. This number has established the obvious -The state capacity is extremely weak in monitoring and curbing corruption at lower levels. inexplicably, it is the same state we are expecting to miraculously go after the miscreants with full gusto and efficiency. One must bear in mind that the process now involves successfully proving that the concerned individuals owe large sums to the government and then also recovering the same. There is an argument to be made that the income tax department is a more centralised organisation and will, therefore, be more efficient than the banks around the country that were receiving cash from people. Yet, whether the efficiency translates into material gains remains to be seen.

However, most importantly, unless and until the gains are shown to the citizens, the standing assumption has to be that there are no gains to show for two reasons. First, from a political perspective, the government has every incentive to show the increased tax collections if indeed that is the case. Second, as citizens our job is to ask questions to the government and seek answers that can be verified.

For keeping the government in check as well for keeping the sanity in discourse, it will serve us well if we emphasise that the burden of proof that a certain policy worked rests on the government. Let the government declare what it views as concrete gains from demonetisation. Making those who question the move go through the slugfest of arguing with the social media warriors can be a political masterstroke. But, hopefully, the warriors will wane in numbers and energy so that we can focus on some real topics.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest