Economy

Why Imposing MAT On Foreign Investors Was A Bad Idea

The MAT imposed on foreign investors would have been accepted as a rational decision, had its imposition not been arbitrary. In the current circumstances hence, exempting them from MAT was the only correct decision.

The prospect of the government levying a Minimum Alternate Tax (MAT) retrospectively on Foreign Institutional Investors (FII) as well as Foreign Portfolio Investors (FPIs) has been a major drag on the performance of India’s equity markets of late.

Finally the government has decided to accept the recommendations of the Justice AP Shah Committee, which rightly suggested that foreign investors should be exempted from the retrospective tax demand.

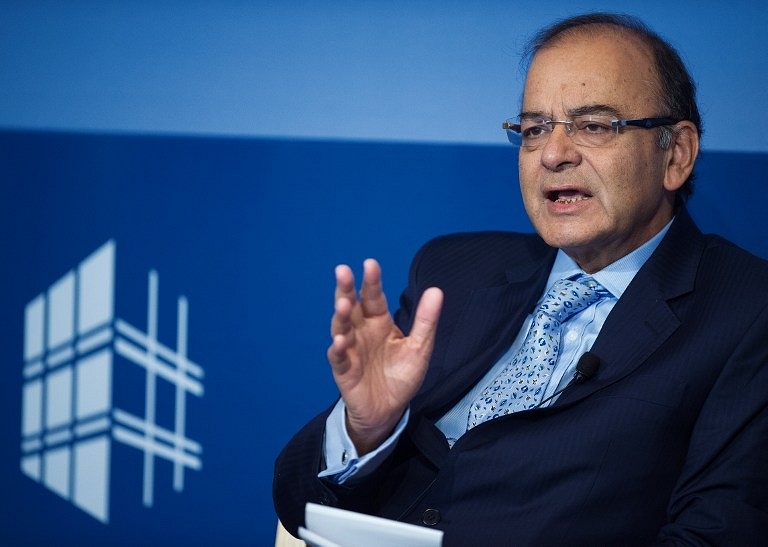

This committee, chaired by the erudite Justice AP Shah of the Law Commission, was formulated by Finance Minister Arun Jaitley in May to look into the MAT issue and suggest appropriate policy measures, after the government received flak from global investors over the retrospective tax demand. The flak was even more severe given the fact that these investors have been buoyant about the government’s commitment to implement economically liberal reforms, which, among other things, include not just reasonably lower taxes but also stability and consistency.

To the uninitiated among us, the whole brouhaha may seem gibberish. Focusing on keeping temporary investors such as FIIs and FPIs happy by sacrificing tax revenue that potentially runs into billions would make little sense. Except that that argument only considers one side of the coin.

The government needs to meet its disinvestment target of Rs. 69,500 crore, of which only around Rs. 12,600 crore has been garnered so far. Disinvestment is a major source of revenue for the government to meet its fiscal deficit target of 3.9 per cent of GDP for the year. To make sure its disinvestment plans succeed without LIC having to come to its rescue like always, it needs to win the confidence of these investors. The cost of losing their confidence could throw our fiscal situation into imbalance.

That argument notwithstanding, the tax demand on foreign investors would not have been completely irrational had it not been arbitrarily imposed. Arbitrarily because the government chose to consider a 2012 ruling of Authority of Advance Rulings (ARR) in the Castleton case, in which the Mauritius-based entity Castleton Investments Ltd. was asked to pay MAT on capital gains. It conveniently ignored an earlier ruling by AAR in the Timken case, where the America-based entity was exempted from MAT because the applicant “did not have a physical presence in India”.

So yes, the real cause of this problem is AAR. But the government used the tribunal’s inconsistent rulings to its advantage, perhaps because India has one of the lowest tax-to-GDP ratios among G20 countries at 10 per cent and the government is in desperate need of garnering significantly more funds to finance its spending goals. Thanks to the investor backlash in April, the formulation of the committee in May and its recent report against MAT applicability to foreign investors, the government finally announced it would not go ahead with tax demands.

It is worthwhile to note that the report by Justice AP Shah committee also discusses how none of the BRICS nations (namely Brazil, Russia, India, China, and South Africa) levy MAT. Some OECD countries do, but they do not charge it to companies that do not have a permanent establishment in those countries. India, in that regard, is an outlier.

Finally, the government has only issued a circular so far, advising field authorities to suspend pending assessment proceedings in cases of FIIs/FPIs. It must further seek to amend Section 115JB of the Income Tax Act clarifying the complete lack of applicability of the MAT provisions to these investors.

This would institutionalize the solution in a way that subsequent governments will not be easily able to impose their whims with respect to MAT arbitrarily. The government, on its part, has accepted this suggestion of the committee and promised to carry out the amendment. If only it had not pressed with the demands initially, this fracas could have been avoided. But then, it also needs more revenue, and targeting foreign investors seemed like an easy option.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest