Economy

Why India Urgently Needs Fiscal-Monetary Coordination To Tackle The Economic Slowdown

- Much of the hand-wringing about structural slowdown is wrong-headed. Robust policy action is the tonic that is needed to dispel the gloom and doom.

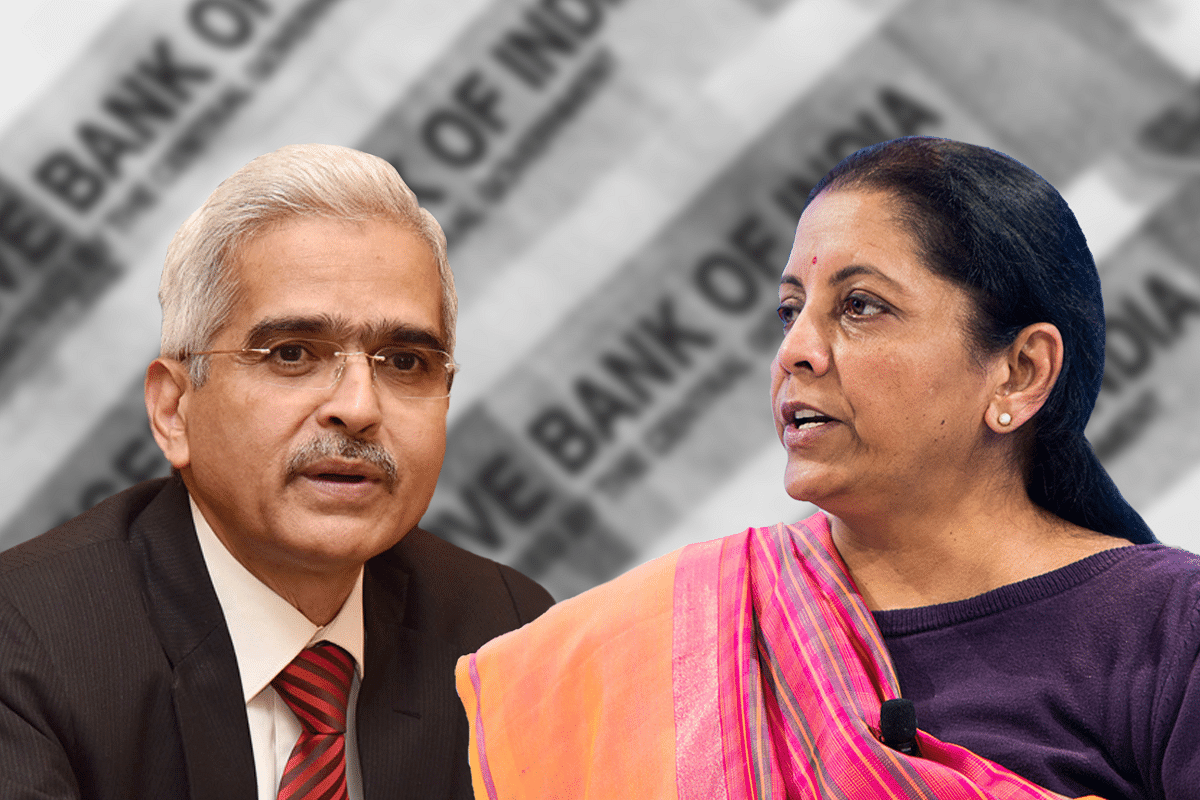

Finance Minister Nirmala Sitharaman and RBI Governor Shaktikanta Das.

The Indian economy is in the midst of a ‘great slowdown’, a term coined by former chief economic adviser (CEA) Arvind Subramanian. He is not alone — many economists and policymakers have sounded alarm bells about the Indian economy.

The former CEA sees India facing a four balance sheet challenge. The economist Hyman Philip Minsky, who was a pioneer in studying balance sheets and financial instability, identified two pillars of dealing with balance sheet problems — ‘big bank’ and ‘big government’.

By big bank Minsky meant a central bank that stood behind the financial system as a lender of last resort, or to use a more modern jargon do whatever it takes to stabilise the financial system.

Big government means the use of countercyclical fiscal policy to boost demand and speed up the private sector’s balance sheet recovery. The worry that fiscal policy will push up interest rates can easily be addressed by appropriate monetary policies.

In fact, the Reserve Bank of India (RBI) has already taken a step in that direction by its recent manoeuvre of buying long-term bonds while selling short-term securities. Fiscal-monetary coordination is a buzzword in Western policy circles — India needs it urgently.

Urgent Need To Revive Growth

In the last quarter, India’s nominal gross domestic product (GDP) growth rate fell below the yield on the 10-year government bond. This is an important indicator for government and private debt sustainability.

If nominal GDP is growing faster than bond yields, governments can run substantial deficits without having to worry about the debt-to-GDP ratio rising uncomfortably.

For the private sector, nominal GDP is a barometer of income and cash flows, and cost of debt being higher than the growth rate makes it harder to grow out of debt and therefore non-performing assets (NPA) problems fester.

Moreover, longer the low growth regime persists, more likely that they become embedded in the expectations of businesses and individuals, making them reluctant to invest and spend aggressively, depressing aggregate demand and completing the vicious cycle.

Larger the gap between nominal growth and interest rate, greater the willingness of businesses to take risk and vice versa. India is at risk of entrenching diminished expectations and extending the economic malaise.

What Needs To Be Done

The major lesson from balance sheet crises around the world is that procrastination is deadly.

Japan dragged out its crisis by refusing to recognise the NPA problems for eight years after the bubble burst and then taking four more years to recapitalise banks. They were also slow to cut rates and timid in their use of fiscal policy in the 1990s.

China has chosen to keep inflating balance sheets, a strategy that is fast reaching its denouement.

The US, in contrast, quickly resolved its balance sheet problem by embarking on massive lender of last resort actions, swiftly moving to recapitalise banks, rapidly cutting rates to the floor, and running large deficits to boost demand.

The US was by no means perfect but 10 years after the worst crisis in 75 years, the US has an unemployment rate at 50-year lows.

There comes a time in every financial crisis when the central banker and the government working in tandem make a firm stand. The time has come to do that in India with the non-banking finance companies (NBFCs).

Since the NBFCs do not directly come under RBI’s purview, this is an area where fiscal monetary coordination is vital. The government/RBI need to set up a mechanism for speedy resolution of the NBFC problems, including taking the insolvent ones into receivership.

At the same time, they should indicate in no uncertain manner that they are not going to let the entire NBFC system collapse — they will do whatever it takes. The restoration of confidence itself will work wonders and go long way toward mending the broken monetary policy transmission mechanism.

On the fiscal policy front, the government should take three steps.

First, ease of on pressing for more collections. The falloff in collection is entirely due to the weak economy and is a natural countercyclical balancing force.

Second, enact a temporary cut in central goods and services tax (GST) rates for a few big-ticket consumer durable items. This will bring forward purchases and provide an immediate boost to demand.

Third, embark on a time bound plan to resuscitate water bodies, thereby killing three birds with one stone — boosting demand, building assets, and addressing a long-brewing crisis.

For its part, the RBI can work on interest rate and yield curve policies to keep the borrowing costs in check.

Basically, the conventional policy mix of the central bank focusing on inflation and aggregate demand management and the government managing the budget to address fiscal sustainability is a destabilising policy framework, especially when the country is facing a balance sheet problem.

The appropriate policy framework is to allow fiscal policy to support demand and set monetary policy to address debt sustainability. Concerns about inflation should be relegated to the backburner simply because they are phantom worries at this point.

At any rate, the RBI has been quietly accumulating reserves and preventing an appreciation of the rupee. It will come in handy if oil prices rise, the rupee comes under pressure, and inflationary pressure rise. At that point, the RBI should not hesitate to support the rupee.

Much of the hand-wringing about structural slowdown is wrong-headed. Robust policy action is the tonic that is needed to dispel the gloom and doom.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest