Economy

Too Stiff A Deadline On The GST? Let A GST Mantri Take Full Charge

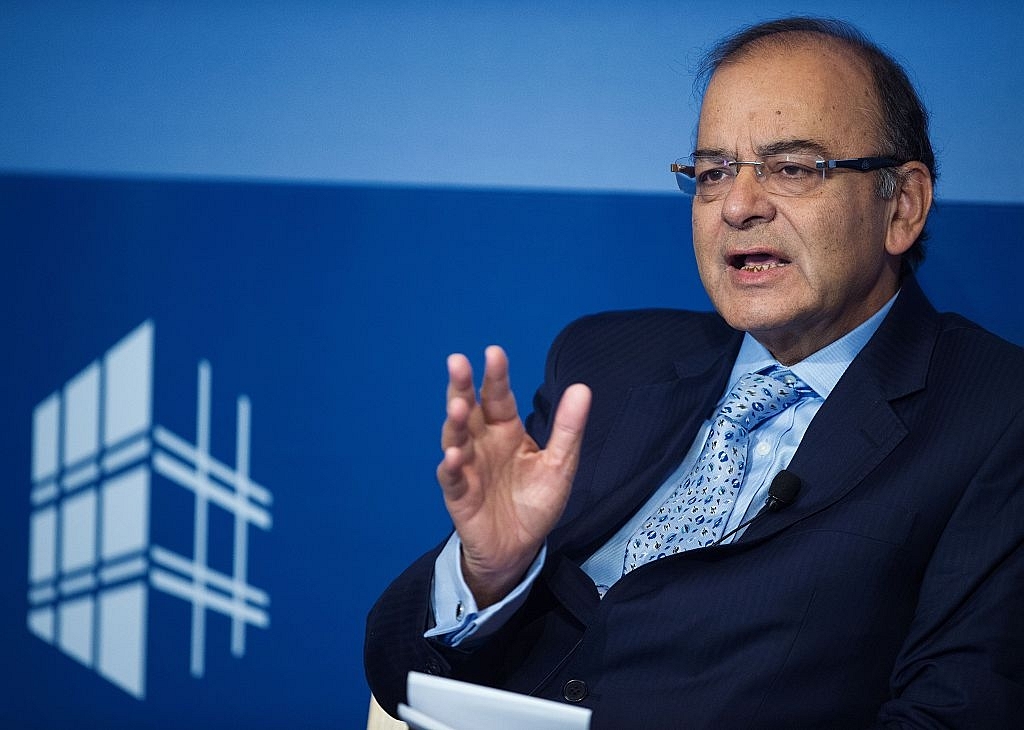

Photo By PAUL J. RICHARDS/AFP/Getty Images

Speaking at The Economist-India Summit organised by the World Economic Forum, India’s Finance Minister Arun Jaitley said that the deadline for rolling out the Goods and Services Tax (GST), which happens to be 1 April 2017, was stiff, adding that the GST will plug the leakages and stabilise the tax rate in the long run.

“We look ahead, it’s a very stiff target,(sic) we are running against time. I would certainly like to give it a try,” he was quoted as saying at the event.

Being very different from the existing taxation system in the country, the GST will not only require the states and the Centre to formulate policies and regulations for combating precarious issues but also structural reforms in bureaucracy – both at central and state levels – for effective implementation.

“In order to maintain uniformity under the GST, all units availing area-based exemptions will be asked to pay tax and get a refund,” Jaitley said at the summit. Pending decisions regarding the geographical or area-based exemptions make the Finance Minister’s job tougher. With the GST requiring 24X7 attention from the Finance Ministry and the Prime Minister’s Office, which are already working under stringent deadlines on different fronts, appointing a smart, tech-savvy minister under the Union Finance Minister will ease Jaitley’s job.

As discussed earlier on Swarajya, the process of implementing the GST will initially double the Finance Minister’s job, subsequently reducing it by half as the act eventually becomes self-enforcing. After the implementation of the GST, the Centre-State GST Council will act as the new indirect Tax Ministry.

With the GST Council taking major decisions regarding the change in rates or rate bands or shifting items from one band to the other, the Union Finance Ministry will be left to deal only with direct taxes – income tax and corporation tax.

Also Read:

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest