Insta

Arun Jaitley Defends 12 Per Cent GST On Sanitary Napkins, Calls Out Ill-Informed Debate

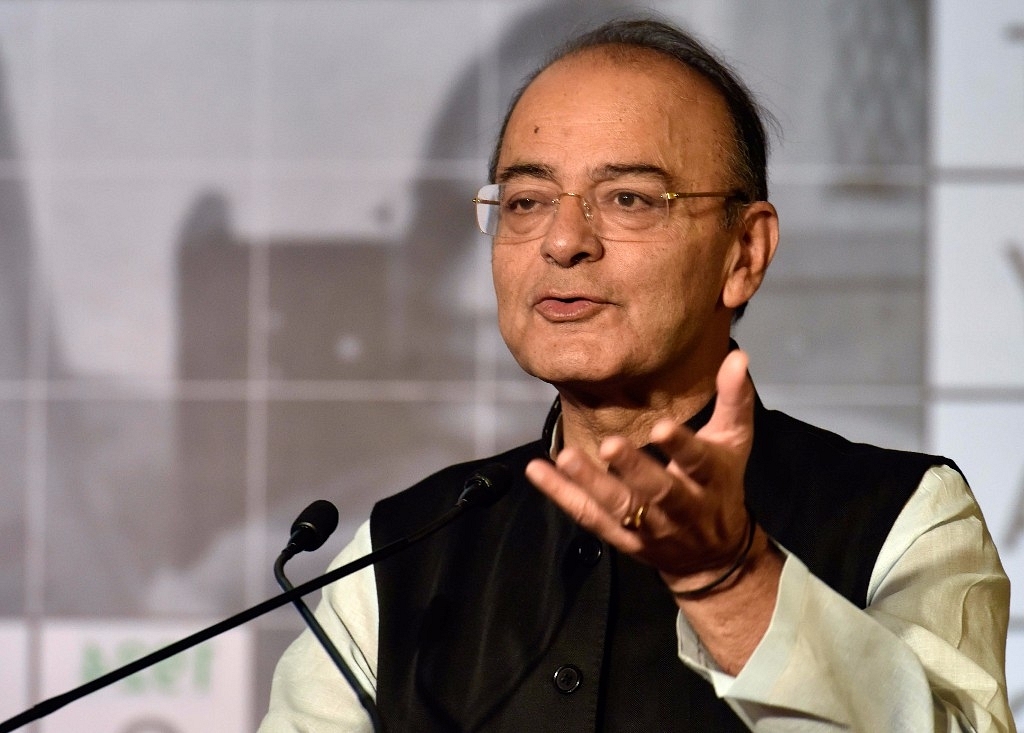

Finance Minister Arun Jaitley. (Kunal Patil/Hindustan Times via Getty Images)

Finally opening up on the row kicked up by the media over the supposed high tax on sanitary napkins, Finance Minster (FM) Arun Jaitley today explained why the 12 per cent goods and services tax (GST) is necessary and how it protects Indian manufactures from foreign ones.

Speaking at the Hindustan Times Leadership Summit, Jaitley was posed the question by a member of the audience, as to how basic sanitation products like sanitary pads could fall under the high tax bracket.

One of the key components of the new taxation regime under GST is the Input Tax Credit system. Stated simply, the total tax a manufacturer has to pay to the government over a product that they sell, is the tax rate on the product set by the government minus the tax that has already been paid on the raw materials for that product. This amount that the manufacturer gets to keep with themselves is called the Input Tax Credit.

In case of sanitary pads for example, as explained by Jaitley, the tax mandated is 12 per cent of the cost set by the manufacturer. However, when he buys various raw materials for the sanitary pad from their manufacturer, he already pays a GST on each of them, many of which actually fall in the 18 per cent bracket. The tax that he hence pays to the government, is the final tax on his price minus the taxes he has paid while buying the raw materials. This in turn reduces manufacturing costs for him. This is how the input credit system protects the manufacturer.

Before the GST regime was implemented, several hidden taxes and duties led to Sanitary Pads having an effective tax of 13 per cent over the price. So that is already reduced to 12 per cent by bringing it under the GST. Add to it the input tax credit to the manufacturer, and it then gets reduced in the range of 3-4 per cent effectively that has to be paid to the government, significantly cutting down manufacturing cost for the manufacturer. Since the manufacturing costs are cut, the benefit can even be passed on to the customer in the form of lower base price.

Apart from the input tax credit boosting the indigenous manufacturers, it also protects them from Chinese imports. This is because the Chinese imports have a lower base price than Indian products. Removing the GST completely from the sanitary pads would result in loss of input credit to Indian manufacturers and would drive up manufacturing costs even further. Thus, the GST keeps Indian goods competitive.

Jaitley called out the ill-informed debate around the issue and talked about several other measures that the government had recently undertaken to boost the economy.

You can watch the video here.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest