Insta

Big Relief For MSMEs As GST exemption Limit Doubled To Rs 40 Lakh, Opens Composition Scheme To Services

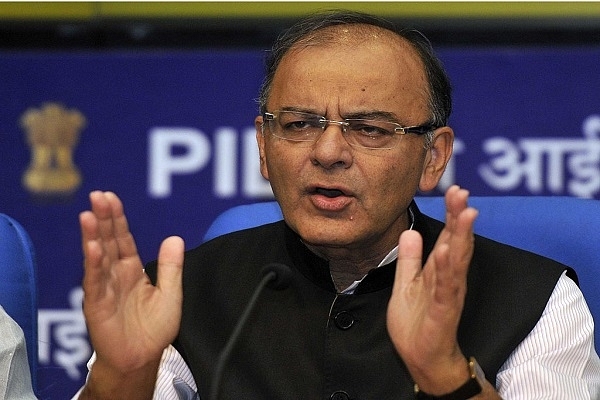

Union Finance Minister, Arun Jaitley (Vipin Kumar/Hindustan Times via Getty Images)

In a huge relief to micro, small and medium enterprises (MSMEs), the GST Council under the chairmanship of Union finance minister Arun Jaitley on Thursday (10 December) decided to double the GST exemption limit over annual turnover from Rs 20 lakh to Rs 40 lakh. For North East and hilly states, the limit has been enhanced to Rs 20 lakh from Rs 10 lakh.

Ushering in major changes in the composition scheme, the GST council increased the current turnover limit to Rs 1.5 crore from Rs 1 crore. In another significant step, the Council also opened the composition scheme for service providers.

Service providers with a turnover of up to Rs 50 lakh can now avail the composition scheme at a rate of 6 per cent. However those who avail the scheme will have to pay tax quarterly, though returns can be filed annually.

The Composition Scheme is a simple and easy scheme under GST for taxpayers that enables small taxpayers to avoid GST formalities and pay the tax at a fixed turnover rate.

The Council also agreed to allow Kerala to levy a calamity cess of 1 per cent on intra-state sales for a maximum period of two years. Kerala is the first state to levy a calamity cess and set a precedent for other states.

Kerala mooted the idea of state-specific cess to mop up additional revenues for the flood-ravaged state. While the central government was not in favour of a state-specific cess, it was finally agreed and decided that a time-bound national disaster cess can serve as an institutionalised fundraising mechanism for such disasters in any part of the country.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest