Insta

Check Out : Income Tax Department Launches Online Calculator To Compare Tax Payable Under Old Vs New Regime

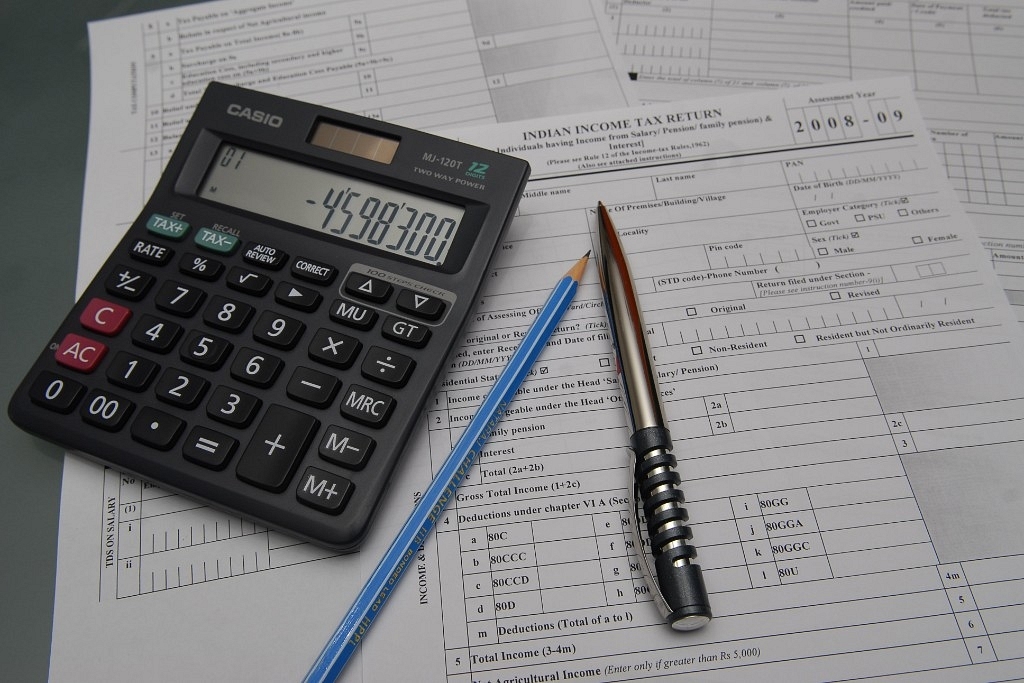

Income Tax Returns form (Rajkumar/Mint via Getty Images)

The Income Tax (IT) Department has introduced an e-calculator making it easy for people to estimate their tax liability if they choose the new tax slabs for IT Return filing, which were announced in the latest Union Budget, Bloomberg Quint reported on Thursday (6 February) attributing officials.

Tax payers will be able to know their estimated tax return amount without claiming deductions and exemptions.

The calculator has been made available, for resident individuals (financial year 2020-21), on the official e-filing website of the IT department -- https://www.incometaxindiaefiling.gov.in, the web portal that is used by individuals and various other categories of taxpayers for filing of electronic ITRs.

A comparative table has also been provided to individuals to compare taxes in both the old as well as the new tax regime.

Taxpayers belonging to three age categories of normal citizen (below 60 years), senior citizens (60-79 years), and super senior citizen (above 79 years) can fill in their estimated annual income from all of their sources, all eligible deductions and exemptions to know their total taxable income. This will help individuals in deciding if they want to proceed for the new tax slabs or stay in the old one.

The e-calculator, that was launched after Finance Minister Nirmala Sitharaman announced the new tax regime in her Budget speech, takes into account all eligible deductions and exemptions proposed under new regime.

In the new regime, tax rates are significantly lower (about 5 per cent on an average) for incomes upto Rs 15 lakh – in income buckets of Rs 2.5-5 lakh (tax rate: 5 per cent), Rs 5-7.5 lakh (10 per cent), Rs 7.5-10 lakh (15 per cent), Rs 10-12.5 lakh (20 per cent) and Rs 12.5-15 lakh (25 per cent). Above Rs 15 lakh, the rates are 30 per cent.

The existing tax rate regime permits a standard deduction of Rs 50,000 and investment of Rs 1.5 lakh in saving plans at a rate of 5 per cent, 10 per cent or 30 per cent tax subject to various income levels.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest