Insta

Direct Tax Code: Task Force Recommends Cutting Income Tax By Half For Those Earning Between Rs 5 Lakh And Rs 10 Lakh

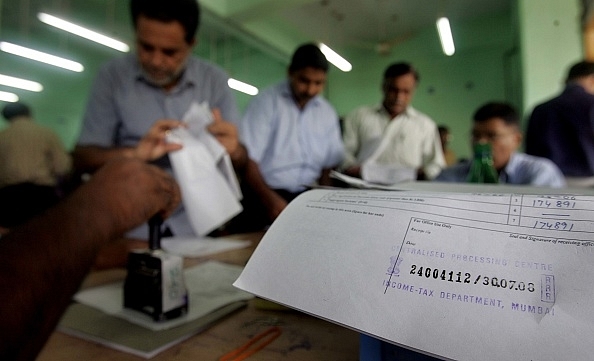

People queuing up at the Income Tax office in Mumbai to file their returns. (Satish Bate/Hindustan Times via Getty Images)

The Direct Tax Code task force’s recommendation to cut the tax rate by half for taxpayers earning between Rs 5 lakh and Rs10 lakh a year might bring major relief to the middle classes.

While this is just a recommendation that the government can accept or reject, it has given the middle-classes a reason to cheer.

In its report submitted last week, the task force suggested that the government increase the number of tax slabs or tax brackets from four to five, but lower the tax rates for many.

“Effectively, people having income up to Rs 5 lakh will have to pay zero tax. Tax will be charged for income between Rs 5 lakh and Rs 10 lakh at 10 per cent and an individual can save up to about Rs 37,500 a year (at the higher end) under the proposed regime,” Hindustan Times quoted a source as saying.

Currently, the people earning between Rs 2.5-5 lakh pay tax at five per cent rate. Taxpayers falling in Rs 5-10 lakh income bracket pay 20 per cent tax.

People in the Rs 10 lakh to Rs 20 lakh income slab who currently pay 30 per cent tax will also see relief if task force’s recommendation to reduce the rate to 20 per cent is accepted.

The panel has proposed a fourth tax slab of Rs 20 lakh to Rs 2 crore that will attract a tax rate of 30 per cent and the fifth slab, Rs 2 crore and above, that will attract a rate of 35 per cent. Under the current regime, both these slabs invite 30 per cent tax rate.

The cesses and surcharges over and above these rates increase the effective tax paid by the taxpayer. Including these, a person earning over Rs 2.5 crore pays tax at an effective rate of 42.7 per cent.

“The recommendations have something for every taxpayer. But, exact benefits can be calculated after one is clear whether the panel proposed to remove cess and surcharge or not,” said chartered accountant Jitendra Chhabra.

He added that while the rate reduction will decrease the total personal tax collections, the numbers will improve with the growth in the economy. “Also, the rate reduction will have a salutary impact on compliance, and also economic growth,” he said.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest