Insta

Govt Likely To Set Aside Rs 25,000 Crore In Budget 2021 For Providing Capital To State-Run Banks: Report

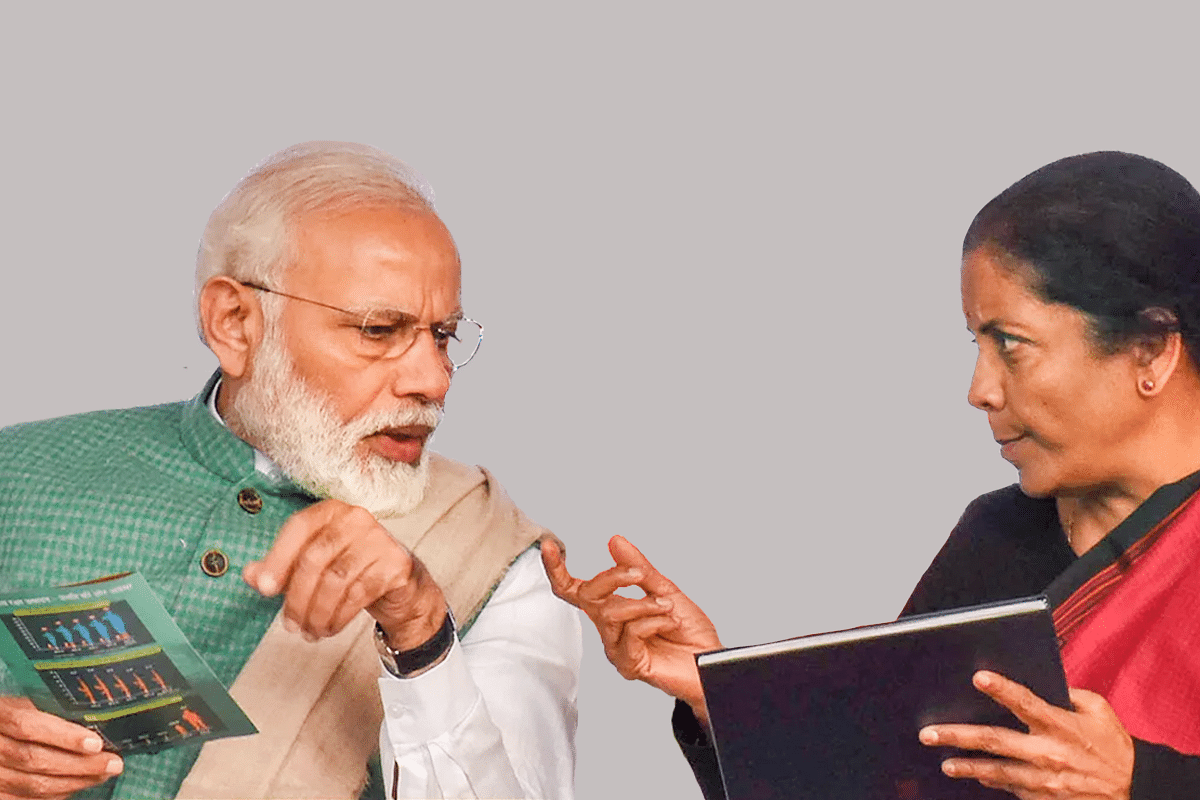

Prime Minister Narendra Modi with Finance Minister Nirmala Sitharaman.

The government is likely to keep aside Rs 25,000 crore in the Union Budget 2021 for capital infusion in the public sector banks, reports Economic Times.

The development comes as the Reserve Bank of India (RBI) in its Financial Stability Report, which was released last month, had said that the public sector banks’ gross non-performing assets may rise from 9.7 per cent in September 2020 to 16.2 per cent by September 2021 in the baseline case scenario. This will lead to banks requiring more capital.

According to the report, the Ministry of Finance has sought details from the banks on capital requirements, estimated bad loans and plans to raise funds. The final decision on the capitalisation amount will reportedly be done after these discussions.

“While various proposals including a bad bank are being discussed, an assessment is being done on the capital requirements for banks,” a government official was quoted as saying.

“These are some projections which may vary depending on various factors such as the banks’ plan to raise capital, and spike in bad loans," the official added.

It should be noted that for the FY21 Budget, the government had not provided funds for bank recapitalisation. However, later the Centre had earmarked Rs 20,000 crore for this through a supplementary demand.

“This amount may also vary on how further ahead the government is able to divest its stake in some lenders,” said the government official.

The government had infused Rs 2.65 lakh crore into the public sector banks (PSBs) between FY18 and FY20, which led to a significant improvement in Banks' health. However, there could be a reversal if the non-performing assets rise due to Covid-related stress.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest