News Brief

Deficit Target Of 6.8 Per Cent For FY 2022: Why Fiscal Hawks Should Relax

- The government needs unprecedented fiscal space to fight the Covid battle to the finish.

- Besides, fiscal credibility is built by going one better on your promises, not by allowing your promises to remain a dead letter.

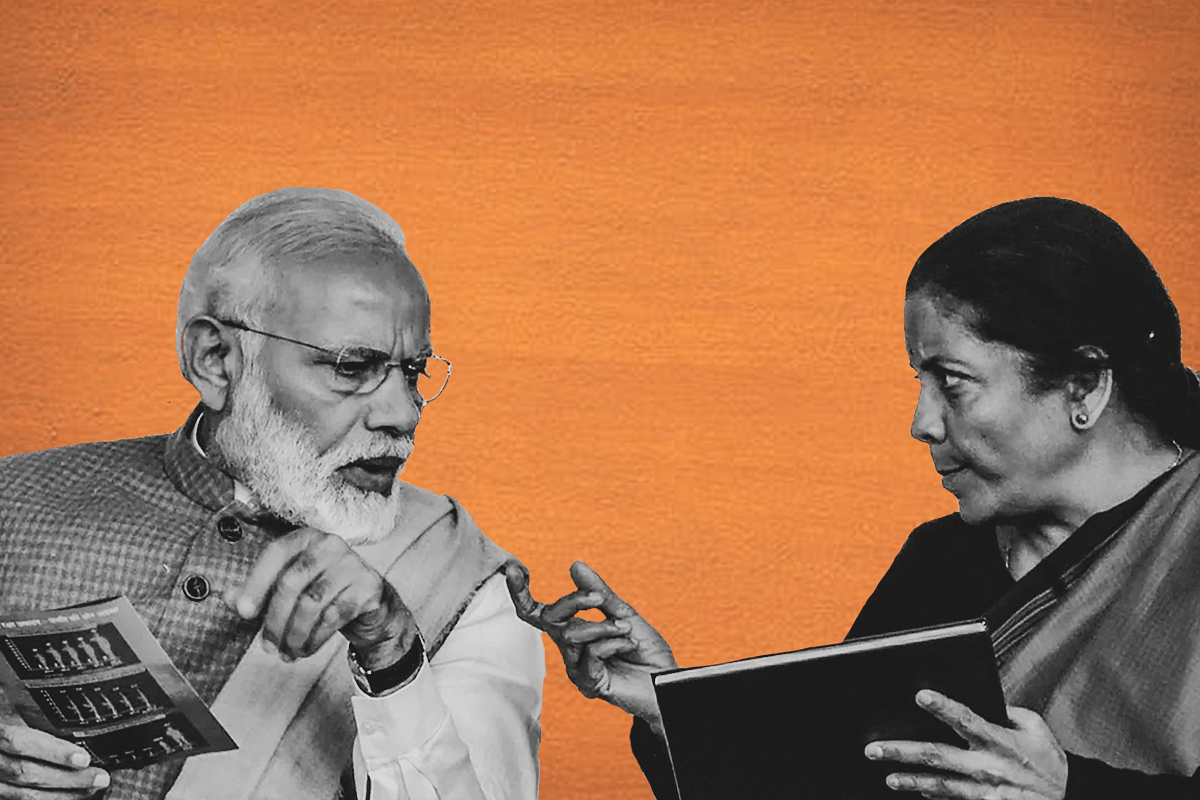

Prime Minister Narendra Modi and Finance Minister Nirmala Sitharaman.

Union Finance Minister Nirmala Sitharaman informed Parliament today (1 February) that the government is targeting a fiscal deficit of 6.8 per cent for the financial year 2021-22 (FY 2022).

The estimated deficit for the current fiscal stood at 9.5 per cent, she said.

A fiscal deficit is the difference between a government's expenditure and income.

A figure of 9.5 per cent should not surprise anyone given the unprecedented Covid-19 pandemic that spread through the world in 2020.

By all measures, India was one of the countries which managed the pandemic and its fallouts well.

Such a sustained and effective response would not have been possible without substantial expenditure on part of the government.

In fact, many experts had estimated a high fiscal deficit for the current financial year. The State Bank of India’s economic team estimated the figure at 7.4 per cent.

The target of 6.8 per cent for FY 2022 might have some fiscal hawks frowning.

An answer to them, is however, simple.

The government needs unprecedented fiscal space to make the investments needed to revive growth and fund the massive costs of vaccinating millions of vulnerable people in India so as to achieve herd immunity.

The immediate follow-up question can be: what if inflation rages?

The answer again, is simple: the vulnerable sections of society can and should be protected, and the headline retail inflation numbers can be managed through supply side and administrative measures on food and fuel, both of which are amenable to such management.

If, perchance, inflation rages above 6 per cent, one can even allow the rupee to rise against the dollar and bring it down.

India has enough stocks of food and foreign exchange reserves, not to speak of leeway to cut petro-taxes, to manage all the three main components of non-core inflation.

There is also the likelihood of large slippages in bad loans which the government has to plan for.

The RBI says it could rise to as much as 13.5 per cent by September 2021 – the government must plan on providing for a larger dose of capital infusions into public sector banks.

Even though public sector bank shares have risen fast in recent weeks, their ability to raise lots of capital from the markets cannot be assumed.

The creation of a bad bank to take away their excess load of bad debts, and a holding company for bank shares will help meet some of the challenges in raising capital, but government infusions are a must. More so if banks have to fund credit expansion next year.

This is another reason why the fiscal deficit target for 2021-22 should not be aggressive.

It is always better to keep the target high and, if growth and revenues pick up during the year, Sitharaman can always announce a big improvement by the time the next budget is presented in February 2022, instead of doing the opposite: be too optimistic on targets, and then announce a slippage.

Fiscal credibility is built by going one better on your promises, not by allowing your promises to remain a dead letter.

There is yet another reason why the Finance Minister is right in announcing a fiscal deficit target of 6.8 per cent for FY 2022. The government must budget for large goods and services tax (GST) compensation numbers, especially the amounts due to be paid to states in this fiscal.

States need the fiscal space to invest in infrastructure, including health infrastructure and vaccines. Making them borrow too much with the promise of amortising this debt by continuing the GST cess beyond 2022 is not a great idea.

The sooner we remove the cess and rationalise GST rates to a simple three-tier structure the better.

If a high central fiscal deficit allows for a faster rationalisation of GST, so much the better. Kicking the can down the road is not required for no one can be sure that another crisis will not meet us head-on in the next five years.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest