News Brief

Future Group's ‘Clandestine Takeover’ Raises Many Questions

- Given the complexity of the relationships between stakeholders, and Reliance’s decision to take over Future’s properties and employees, the outcome of the entire saga remains to be seen.

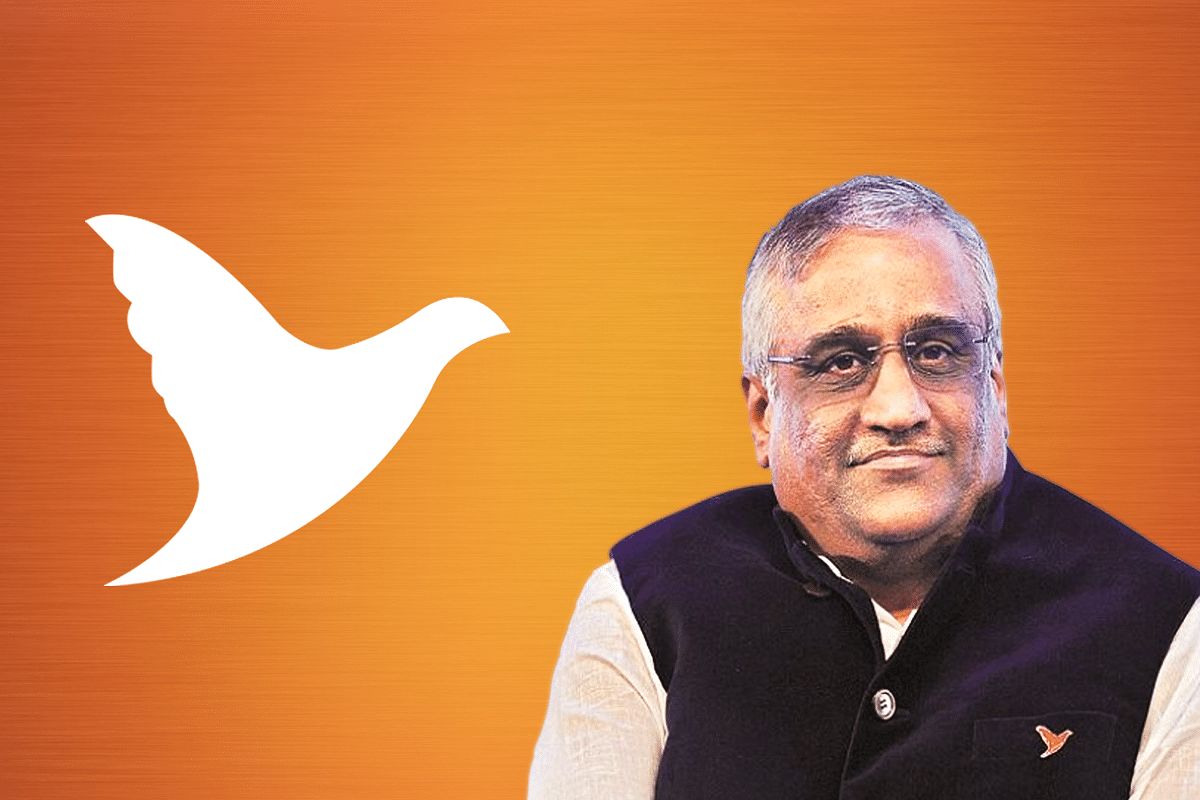

Kishore Biyani, founder, Future Group.

The Future Group, which had been struggling with the Covid-19 pandemic and legal issues with Amazon, said that it has objected to Reliance’s takeover of its stores across the country. In a disclosure to stock exchanges, the company has clarified that it does not support Reliance’s actions of attempting to take over Future’s stores and hire the store employees.

After the pandemic began, the Future Group began losing money on its operations, leading to defaults on payments to creditors. As a result, Future Group entered into an arrangement with Reliance, for a sale of the company’s retailing, warehousing, logistics and wholesale businesses, for a sum of Rs 24,713 crore. In addition, Reliance took over Future’s leases from the landlords and subleased the properties to Future Group’s stores.

However, over the past few months, Reliance has been terminating these subleases to Future and offering to joining letters to Future Group’s staff. The Future Group has said that it was shocked at the way Reliance conducted the deal, and took over the stores.

However, the strongest opposition to the deal has come from Amazon. The US-based e-commerce giant has alleged that the deal has purposefully been conducted in a clandestine manner. Amazon has been attempting to stall any takeover of Future Group, even before the pandemic began. In August 2019, the company signed a deal with Future Coupons Limited for a 49 per cent stake in return for Rs 1,500 crore.

According to Amazon, the agreement with Future Group gives it a right to be present for any restructuring of the Future Group. As a result, since the Rs 24,000 crore acquisition deal came through, the company has been fighting tooth and nail to stop Reliance from acquiring Future Group. Future Group and Amazon have been fighting it out in Indian and international courts over the last couple of years.

The Competition Commission of India alleged that Amazon had not disclosed the possibility of putting its “foot-in-the-door” in the retail sector. Other industry experts have speculated that Amazon used the contract to secure its position over Future Group until India’s foreign direct investment rules became more lenient, and allowed a higher threshold of shareholding. However, Future Group alleged that Amazon wanted to shut down Future’s operations, rather than help the retail group survive the crisis.

However, Reliance which had remained out of the legal tussle appears to have directly taken over the leases of Future Group’s properties, rather than waiting for the outcome of the legal battle. As a result, Amazon has published advertisements in newspapers alleging that the entire transaction was a ruse to transfer assets from Future Group to Reliance. It accused the two groups of colluding together and allowing the Mukesh Dhirubhai Ambani Group (MDA Group) to take over the assets of Future Group. It has accused the Future Group of filing false submissions in the Supreme Court.

Reliance, already the largest physical retail chain in India, would control more than half the physical retail market once the transaction goes through. Over the past few years, the focus on growing the retail business has borne fruit. The group is already winning over kirana store operators with high discounts and quick delivery. Its stores, with their multiple offerings, cater to millions of Indians across India.

In a country with a gross domestic product (GDP) driven largely by consumption, retail has emerged as a highly competitive category with giants like Amazon and Reliance vying for a meaningful part of the pie. With Reliance and Future combining their strengths, Amazon is left far behind in the physical retail space. Reliance, which had a limited online presence until a few years ago, has been spending heavily on acquiring companies in the space. Its online sales platforms offer discounts, free deliveries, and other features to attract new users.

Nevertheless, the entire Future Group, Reliance and Amazon triangle has brought up more questions than answers. Future’s lenders issued a public warning against entities dealing in the assets of Future Retails Limited, as these assets had been used to secure loans. In contrast, the listed entities of Future Group fell in value after Future Group made its surprise over Reliance’s takeover public.

Amazon, as reported earlier, has published its dissatisfaction in newspapers and has filed a petition in the Supreme Court. Given the complexity of the relationships between stakeholders, and Reliance’s decision to take over Future’s properties and employees, the outcome of the entire saga remains to be seen. It is likely that Future’s employees would take up the new offer as Future struggles with its cash flows, and the retail sector recovers slowly to pre-pandemic levels.

This article was first published on Business's Newsletter, and has been republished here with permission.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest