News Brief

Larry Fink, CEO Of World's Largest Asset Management Firm Blackrock, Rejects Accusation Of Pursuing 'Woke Capitalism', 'ESG Virtue Signalling'

- Larry Fink, the founder-CEO of the world's largest asset management firm Blackrock , has dismissed accusations of using its heft and influence to support a politically correct or progressive agenda.

- Some critics of the firm have accused it of ESG related virtue-signaling as a way to top camouflage its deep ties with Chinese communist regime

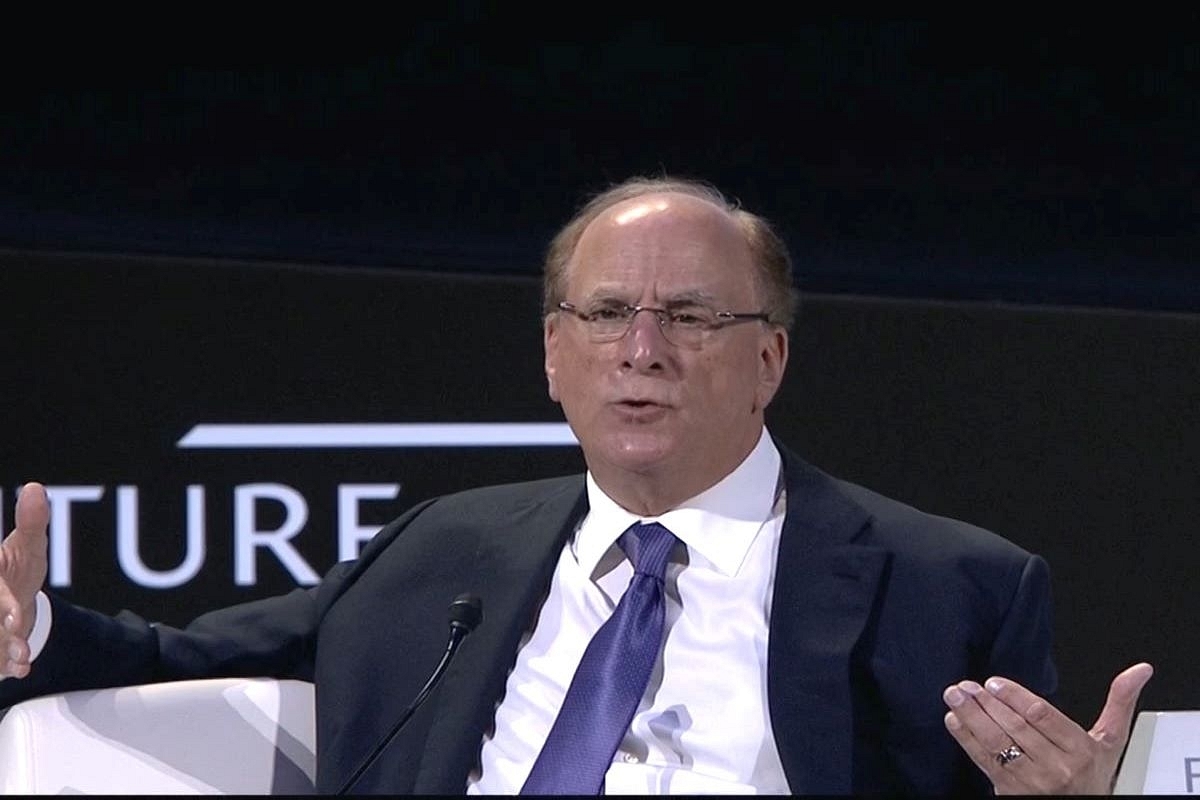

Larry Fink, CEO, Black Rock

Larry Fink, the founder-CEO of the world's largest asset management firm Blackrock , has dismissed accusations of using its heft and influence to support a politically correct or progressive agenda.

In his customary annual letter to corporate leaders, Fink mounted a spirited defence of what he described as "stakeholder capitalism

“Stakeholder capitalism is not about politics. It is not a social or ideological agenda. It is not woke,” he wrote. “It is capitalism, driven by mutually beneficial relationships between you and the employees, customers, suppliers, and communities your company relies on to prosper. This is the power of capitalism.”

Fink’s letter also highlighted asset manager’s policy of engaging with companies seeking to take part in the so-called energy transition rather than divesting altogether.

Stressing that companies must play a role in 'decarbonizing the global economy', Fink said that "we focus on sustainability not because we’re environmentalists, but because we are capitalists and fiduciaries to our clients”.

Blackrock Faces Criticism For ESG 'Virtue-signalling'

Blackrock, who assets under management crossed $ 10 trillion this month, has faced criticism from conservative thinkers and politicians for aggressively foisting an investment philosophy based on environmental, social and governance (ESG) standards.

Some critics of the firm have accused it of ESG related virtue-signaling as a way to camouflage its deep ties with Chinese communist regime

“No amount of woke posturing can hide what BlackRock is really up to. The idea that an American company is taking billions of dollars and using it to bet on China’s success is extremely concerning,” wrote Will Hild, Executive Director of Consumers’ Research in a note.

"Funneling Americans’ hard earned retirement savings to China is unsafe from both a national security and financial perspective.” the note added.

In June last year, Blackrock became the first global group to gain approval to start a wholly owned mutual fund business in China

In September 2021, U.S. Senator Marco Rubio introduced the Mind Your Own Business Act, which would allow a company’s shareholders to sue the company if it adopts policies that shareholders claim are not in the company’s best interest. The legislation aims to address the corporate adoption of what Rubio describes as woke culture.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest