News Brief

Reliance Share Price Fall After Supreme Court Prevents Future Retail From Proceeding With RIL Merger Deal

- Reliance Retail's share price fell more than 2 per cent while Future Retail's stock dropped 10 per cent following the Supreme Court's decision.

- The SC ruled that Singapore's Emergency Arbitrator ruling, which barred FRL from proceeding with its merger with RIL, is enforceable under the Arbitration and Conciliation Act.

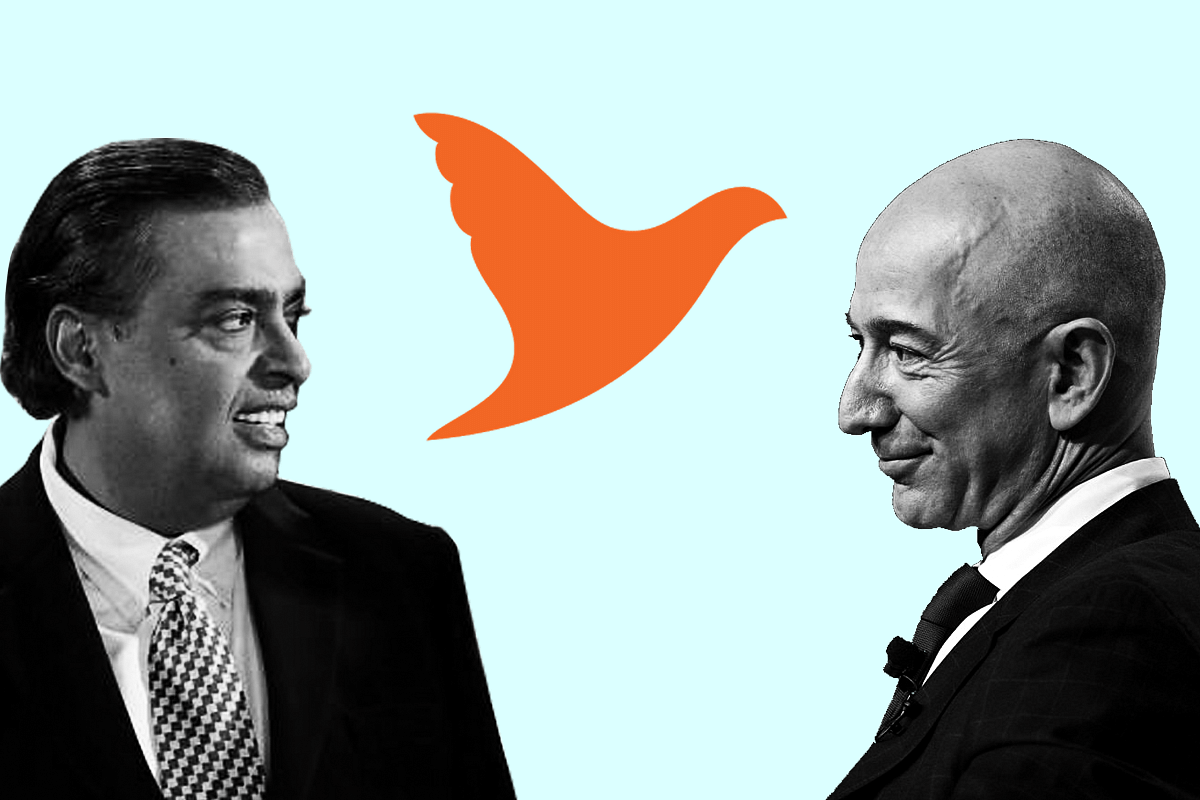

Mukesh Ambani (left) and Jeff Bezos (right)

The Indian Supreme Court ruled on Friday that Singapore's Emergency Arbitrator (EA) ruling, which barred Future Retail from proceeding with its merger with Reliance Retail, is enforceable under the Arbitration and Conciliation Act.

The decision is a major victory for e-commerce behemoth Amazon in the quest for India's massive market. The combination of Future Retail Ltd (FRL) and Reliance Retail had been challenged by the American firm. The judgement was handed down by an SC bench of Justices R F Nariman and B R Gavai, who had reserved it on 29 July after hearing lawyers, including senior counsel Harish Salve and Gopal Subramanium, who were representing FRL and Amazon, respectively.

However, as per Financial Express, RIL's share price fell more than 2 per cent on 6 August to Rs 2,087 per share, while FRL's stock dropped 10 per cent to Rs 58.20 per share following the Supreme Court's decision. Additionally, Future Enterprises and Future Lifestyle both have lost 10 per cent of their value.

The American e-commerce giant first filed a petition in the high court (single judge) seeking implementation of the EA judgement issued by the Singapore International Arbitration Centre (SIAC) on 25 October last year, preventing FRL from proceeding with the deal with Reliance Retail. The single-judge judgement was stayed by the high court division bench because FRL was not a party to the share subscription agreement (SSA) between Amazon and Future Coupons Pvt Ltd (FCPL), and the American corporation was not a party to the FRL-Reliance agreement.

According to The Times of India, in its appeal, FRL stated that if the 2 February order was not overturned, it would be an "absolute disaster" for the company because the National Company Law Tribunal's approval of the merger scheme had been placed on hold. It argued that the single judge's status quo ruling would effectively halt the entire plan, which had already been approved by statutory authorities in conformity with the law.

The Future group agreed to sell its retail, wholesale, logistics and warehousing operations to Reliance in August 2020. Following that, Amazon brought FRL into EA before the SIAC for the alleged contract breach by the Future group.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest