Technology

5 Things That Are Vital To The Success Of A Digital Payments Eco-System

- 1) A digital payments security law.

- 2) An insurance system that guarantees all payments upto a fixed limit.

- 3) Ensure interconnect and inter-operability.

- 4) Tax physical cash and incentivise digital cash.

- 5) Adoption should proceed geographically, with the metros leading the way, the smaller cities next, and the rural sector last.

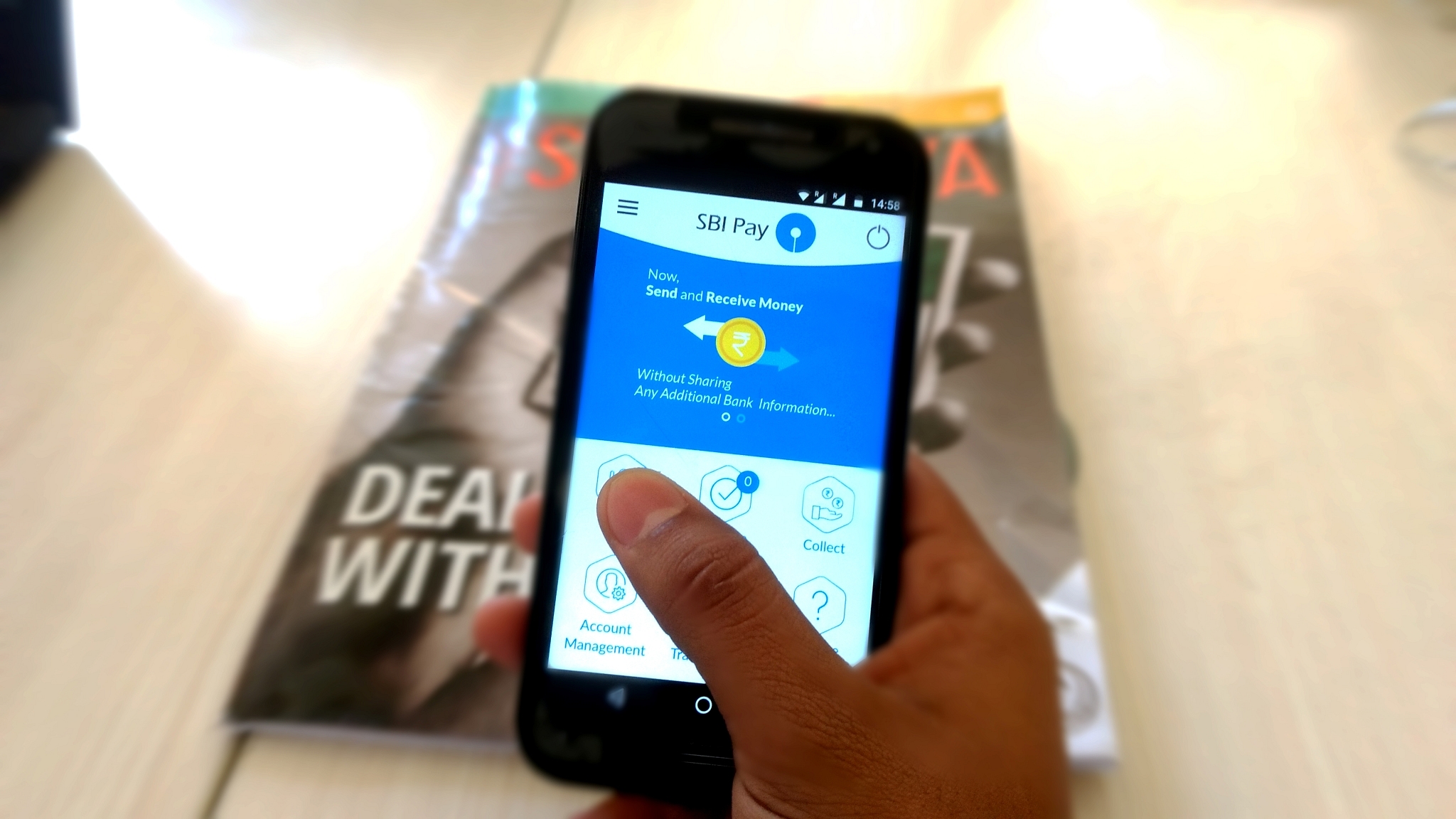

SBI’s UPI enabled app, SBI Pay. (Photo by Srikanth Ramakrishnan)

Going cashless is not going to happen in one leap, despite the shock opportunity afforded by demonetisation.

A panel headed by Andhra Chief Minister N Chandrababu Naidu, and which includes Madhya Pradesh CM Shivraj Singh Chouhan, Maharashtra’s Devendra Fadnavis, Odisha’s Naveen Patnaik and Niti Aayog CEO Amitabh Kant, among others, has been set up to draw up a plan for the rapid adoption of digital payments instruments. These include credit, debit and prepaid cards, e-wallets, net and mobile banking, and the unified payments interface (UPI) app that enables peer-to-peer payments.

The committee is sure to come up with a roadmap soon, but any roadmap must focus on the following five priorities.

First, we need a digital payments security law, which may or may not be part of the IT Act, 2000. This law needs to be in place very quickly and must address the issues of financial fraud and theft in the digital space. Cyber frauds and crimes need a separate enforcement and policing system. This structure can be part of the regular police system, but must have the independence and competence to handle these crimes efficiently and quickly. The current police system is simply not good enough to address the demands of the digital payments age, when cyber fraud is likely to grow multi-fold.

Second, there must be insurance. The main problem in digital frauds is that the loss will be apparent quickly, but detection of the criminal may take time. This means losses must be quickly compensated if faith in digital payments is not to evaporate after the first major reported crime. An insurance system that guarantees all payments upto Rs 50,000 (or whatever limit looks sensible) would go a long way in building confidence in the system. The average middle class digital payments user is unlikely to send or receive more than Rs 50,000 in digital payments in most months, and hence this level of insurance seems adequate for now. The premium can be funded through a fee based on transaction volumes passing through a service provider, whether a bank or an e-wallet or card company.

Third, interconnect and inter-operability must be ensured. With the launch of the united payments interface (UPI) and with every wallet company and bank enabling payments from mobile smartphones (and soon also through feature phones using USSD – unstructured supplementary service data), there will simply be too many service providers trying to hog the market. If a PayTM user cannot pay a Mobikwik or Pockets merchant or customer, then everyone will have to load multiple apps on the smartphone. Digital payments will spike only if the network effect kicks in – and this means any customer of any digital payments services provider should be able to pay anyone in the market. This calls for the creation of common standards and regulations on interconnecting different payments players, exactly the kind of agreements telecom players now have between them. A regulator under the overall supervision of the Reserve Bank is needed to ensure standards and fees.

Fourth, cash must be taxed. To promote digital cash, physical cash must be at a premium. A version of the Banking Cash Transaction Tax (BCTT) introduced by P Chidambaram in UPA-1 should be brought back in some form, and digital payments incentivised in the initial year (or two) by discounting payments made digitally. The discounts should be given by merchant receivers of these payments.

Fifth, first cities, then rural areas. The spread of digital payments must be done geographically, so that each city has an eco-system where digital becomes the norm, and cash payment becomes a cost. The reason why Bengaluru finds it easier than other cities to adopt digital payments is because of its digital culture, being India’s foremost tech city. This means adoption should proceed geographically, with the metros leading the way, the smaller cities next, and the rural sector last. In the immediate months after demonetisation, cash should be prioritised for the agriculture and rural sector while urban areas should be coaxed and pressured to go digital, with cash playing a fringe role.

Going cashless in urban areas should be the first goal of the Naidu committee. One year is a good timeframe to get all metros and Tier-1 cities on the digital map.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest