Technology

In A Major Coup, Indian Brands Have Come To Dominate Key 'Wearables' Sector

- Three out of five, top-selling smart-watch brands are home grown.

- The number 1 earwear in India, is from desi brand, BoAt.

- Next wave of ‘wristables’ will allow use of e-SIMs

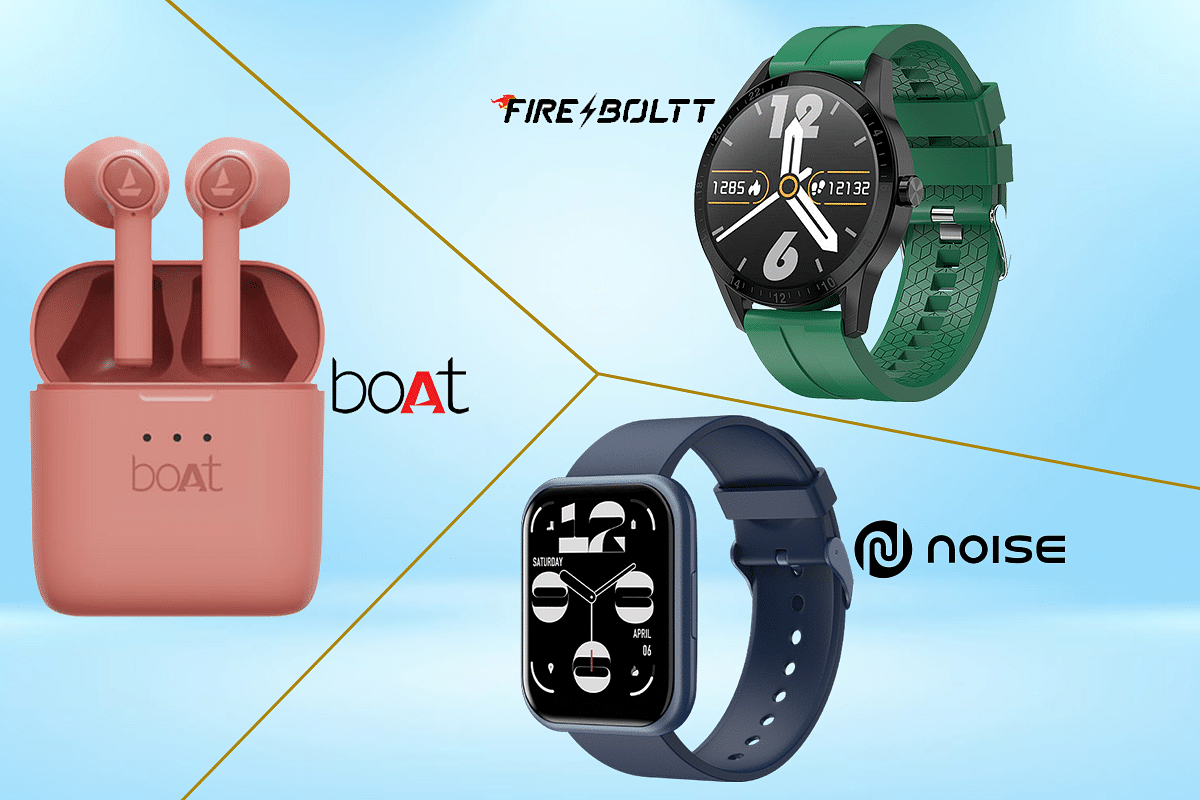

Indian market leaders in wearables: True Wireless Earbuds from boAt, FireBoltt smartwatch and ColorFit smartwatch from Noise.

That shrewd Indian perception of paisa vasool or value for money, today transcends old perceptions of “phoren is best”. This is particularly apparent in the burgeoning market for smart wearables—health trackers and bands, smart watches and “earwear” or in-ear audio devices—which sees Indian consumers preferring desi brands in most product categories.

A study by market intelligence specialists, IDC, released this week, suggests that the almost doubling of wearable purchases in recent months, was largely to the benefit of Indian brands like BoAt, Noise, Fire-boltt and pTron, which in many cases displaced international names like Amazfit, Xiaomi, OnePlus and Samsung, from the top-selling slots.

It’s all about aggressive pricing and agility in bringing the latest technology. Says IDC market analyst Anisha Dumbre: “Affordability has been the key for Indian brands, and these brands have been immensely successful in gaining a significant portion of the watch market with competitive pricing, aggressive marketing, and faster adoption of new features.”

Making waves at CES

This did not happen overnight: At the last Consumer Electronics Show—CES 2020—to be held in its full format in Las Vegas (US), just before the global pandemic lockdown, audio devices maker, BoAt Lifestyle, became the first Indian brand to be showcased at both Google and Amazon booths. The home-grown brand unveiled its Rockerz 315 SVA smart wireless earphones with an inbuilt Google Assistant. It also showcased its Stone 200A, smart speaker with inbuilt Alexa voice capabilities like playing music, checking the news, weather forecasts, controlling smart home devices and accessing over 30,000 Alexa skills across genres.

BoAt, a 5-year old enterprise started by Aman Gupta and Sameer Mehta, reprises this double whammy, when one examines the wearable market numbers just released by IDC for the most recent, April-June 2021 period: It has by far, the best selling product in the earwear category with a dominant 45.5 per cent share, while the next-best sellers, like OnePlus and Samsung, have shares of 8.5 per cent and 7.9 per cent. Within this category it also leads with a 39.6 per cent share in the very competitive category of True Wireless Stereo (TWS) earbuds.

In the other Indian brand-dominated class of wearables - smart watches – BoAt, with a 26.9 per cent share in the same period, is only just behind the leader, Noise, a Gurugram-based company founded in 2014 by Amit and Gaurav Khatri, which is credited with a 28.6 per cent share. In fact, says IDC: “Among the top five brands, three spots are captured by Indian brands, while Huami and Realme are at third and fifth positions.” The other Indian player in the watches Top Five, is FireBoltt.

The only category of wearables where international brands like Xiaomi and One Plus dominate, is the health or wristband – but here too, the Tata-owned Titan has a 21.3 per cent share in the second quarter of this year.

While Indian brands like Noise and BoAT have the big selling numbers by volume, they lag behind high-priced global biggies when the value of sales is computed. Apple is estimated to have a 37 per cent share by value in India, followed by Samsung with 18 per cent and Fossil with 10 per cent.

Many of the Indian players in wearables have their own manufacturing lines in the country, but it needs to be stated, that the economics of volume being a reality, none of them can afford to indigenously make all the items in their inventory or catalogue: some ‘Indian’ wearable brands still source their sub-units and in some cases, the full unit, from abroad. But the push to increasing indigenisation has come.

‘Wristable’ – a key smart wearable

Another recent study by techARC says, 5.4 million “wristables” – new combo jargon for fitness bands and smart wrist watches – were strapped on by Indians in 2020, and this translates into a total value of $540 million or Rs 3,800 crore.

Says techARC founder & chief analyst, Faisal Kawoosa: “Wristables has become a key smart wearable category for users even beyond health and fitness tracking. It reduces the frequent unlocking of smartphones to check on notifications and messages, where users don’t necessarily need to respond and are mostly for information only.”

The techARC study also notes that “Health tracking has become more important, since the pandemic of Covid-19 surfaced. As a consequence, an SPO2 feature to measure oxygen saturation rate is increasing in wristables. This will become a mainstream feature going forward.”

Most health bands sold in India, except the very basic models, already measure heart (pulse) rate and blood pressure. Some also provide a basic ECG trace. These have become very important, particularly for elderly users who are hard pressed to make regular visits to a clinic for a health checkup. Self-measurement with these new age health-bands coupled with a virtual consultation on a telemedicine platform has come as a blessing in these lockdown days.

What’s the next wave in wearables then? Tech watchers predict that next-generation smart watches will offer an e-SIM feature, something that Samsung and Apple are already promoting. This will allow users to switch mobile service providers without having to replace a physical SIM. And the chances are, Indian players in the wristable business will be there at the vanguard of companies offering this feature.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest