World

China Real Estate Crisis: Global Investor Losses Continue To Pile Up

- The real estate market troubles began with the Evergrande Group, stranded with over $330 billion in liabilities.

- The group missed dollar bond payments worth $2 billion in March.

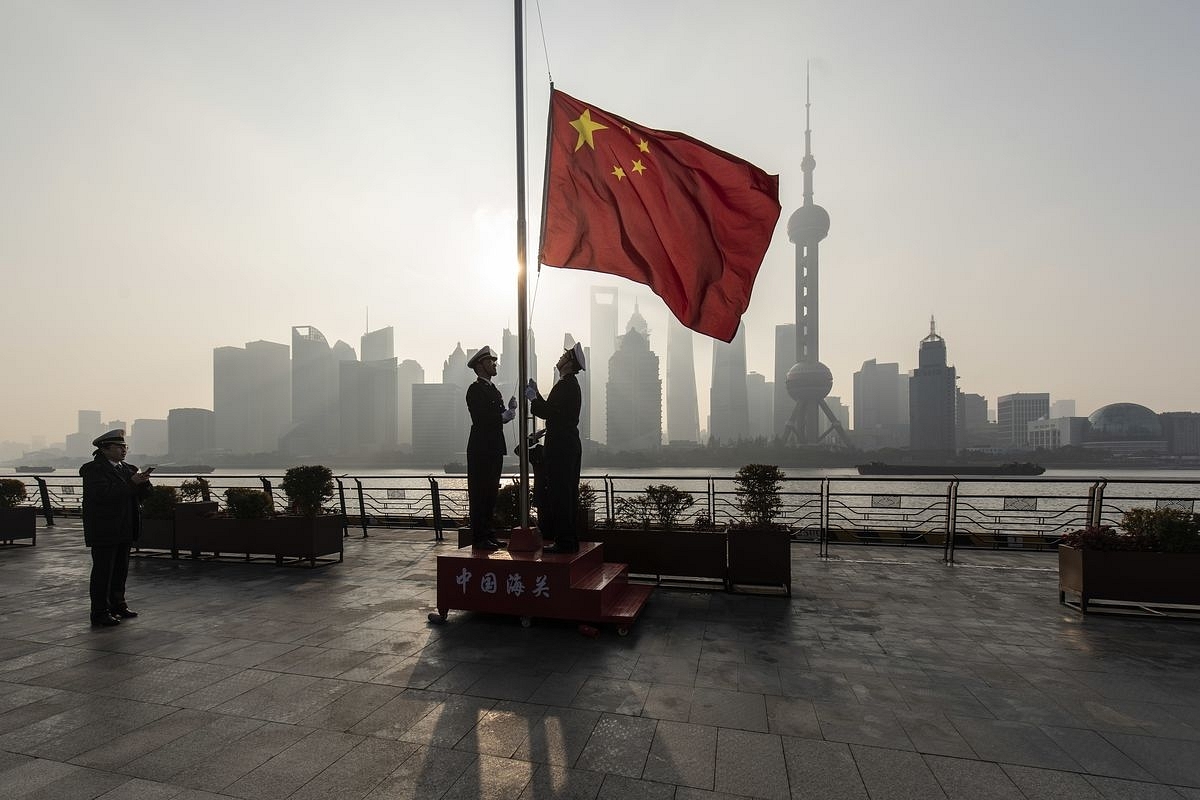

Soldiers hoisting the flag of People's Republic of China in Shanghai.

Investors globally are staring at losses worth $130 billion in dollar-dominated bonds, given China's faltering real estate market.

According to an analysis by the Financial Times, nearly two-thirds of the five-hundred dollar bonds issued by real estate developers in China are priced below 70 cents on the dollar. To put things in perspective, bonds are trading as low as $0.09, in this case of the Kaisa Group.

Shimao Group, another real estate group, has its bond trading at $0.10. Together, investors will lose more than $530 million on the bonds issued by both companies. In totality, on outstanding dollar bond payments worth $200 billion, the losses are estimated to be $130 billion.

Beyond the sales numbers and credit growth, the dollar bond repayments are also indicators of the health of the real estate sector. However, in 2022 alone, real estate groups have missed payments worth more than $31 billion.

Many real estate groups are troubled because not only do they have to make the interest payments on the bonds, but also the maturity amount, that is when the principal borrowed on the bond has to be repaid to the investors.

The real estate market troubles began with the Evergrande Group, stranded with over $330 billion in liabilities. The group missed dollar bond payments worth $2 billion in March.

However, the troubles are expanding to other real estate groups. Kaisa Group, for instance, defaulted on dollar bonds worth more than $3 billion in January. Shimao Group defaulted on bonds worth a billion dollars in July.

The offshore bond holders, however, will have to prepare for a haircut or a prolonged payment process and perhaps may have to settle for as much as 20 cents on a dollar.

For offshore borrowing through bonds, a Chinese company’s offshore subsidiary raises money from foreign investors with the parent company based in mainland China. Otherwise not allowed to borrow from foreign investors directly, the parent company employs an offshore subsidiary, which guarantees the financial backing and payment on the bonds issued.

Therefore, there is no formal guarantee from the parent company in mainland China on the bond. In case of defaults, as with Evergrande, no formal avenue or recourse is available. Thus, the impact is being felt by other developers who used dollar bonds to take on more debt to continue their building spree.

In March 2022, some of these bonds were paying a 32 per cent yield, higher than what was in 2008. In the last few quarters, the quantum of dollar bonds issued has decreased significantly compared to 2018 and 2019.

For Q1, 2022, the issuance was down by 97 per cent compared to Q1, 2021, thus triggering another crisis for the developers. The other worrying sign is the $13 billion payment in interest due for the next 12 months. In 2019, China’s real estate sector raised more than $60 billion in dollar-dominated bonds. In 2022, the figure has not crossed $10 billion.

S&P Global Ratings has already issued a warning, citing that 20 per cent of the country’s real estate groups are on the brink of insolvency. Hammered by the protests by homebuyers unwilling to pay their mortgages, the CCP is staring at a massive crisis in the sector responsible for as much as 30 per cent of the growth.

All eyes are now on China’s Central Bank, expected to bailout the sector with a massive stimulus package, but will it be enough to arrest the falling demand, decreasing house prices, correct the course of over-leveraged real estate groups, and regain investor confidence is too difficult to affirm today.

The music is slowing down in Beijing.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest