Commentary

Beyond Assembly: India Inc Urges Rethink On Chinese FDI Curbs And Import Tariffs To Boost Component Manufacturing

Amit Mishra

Jun 24, 2024, 06:59 PM | Updated Aug 05, 2024, 03:43 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

To become a global electronics manufacturing hub, India needs to reassess its trade relationship with China, highlights a report by the Confederation of Indian Industry (CII).

Towards this end, the industry body has suggested a review of Press Note 3 in its study titled "Developing India as the Manufacturing Hub for Electronics Components and Sub-Assemblies".

The Press Note 3 of 2020 amended the foreign direct investment (FDI) policy, mandating prior government approval (“PN3 Requirement”) for investments from countries sharing a land border with India, including China.

Background

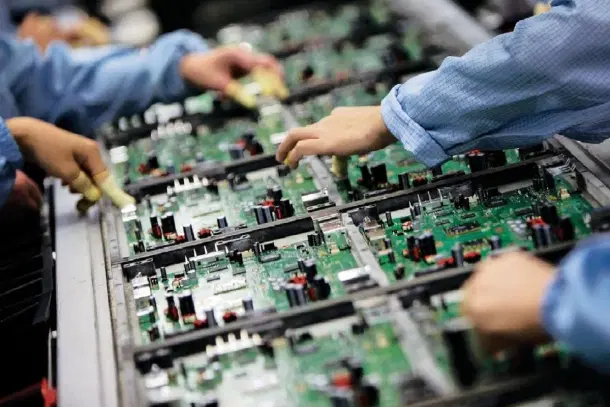

India's electronics sector currently operates under an "import-dependent, assembly-led manufacturing" model, which hinders its global competitiveness compared to rivals like Vietnam and China. The report underscores the necessity for India to transition towards "component-level, value-added manufacturing".

The demand for electronic components is largely met through imports, with China supplying 62 per cent of these imports.

In 2023, India required $45.5 billion worth of components and sub-assemblies to support $102 billion in electronics production. By 2030, this demand is expected to rise to $240 billion to support $500 billion in electronics output.

This heavy reliance on imported components poses a significant risk to the long-term sustainability of India's domestic manufacturing ecosystem.

The CII report highlights that restrictions on Chinese investments have hurt India’s component ecosystem development and sent out a message of “non-friendly investment environment”.

The report suggests India should adopt a non-restrictive approach towards investments, encourage technology transfers in deficient areas, and ease the movement of skilled labour. “Review of Press Note 3 with adequate guardrails should be considered in the current context,” it said.

Initially, the report identifies five critical components for India: lithium-ion batteries, camera modules, mechanical enclosures, displays, and PCBs, prioritising their domestic production.

In response to broader demands, the Indian government has started cautiously approving Chinese investments on a case-by-case basis, as reported by ET.

Tariff Reduction

Recognising that in an interdependent world no country can produce all components domestically, the report cites China as an example. Despite being the largest electronics manufacturer with a $1.6 trillion international electronics trade, China relies on imports for 42 per cent of its components.

Therefore, India should aim for a balance between importing and exporting high-value-added products for sustained industrial growth.

To achieve this, the report calls for rationalising import tariffs on key components to align with competing economies.

Presently, India's import duties on electronic components range from zero to 27.5 per cent, with many facing tariffs of 10-15 per cent, which escalates manufacturing costs. Approximately 47.2 per cent of electronic imports enter tariff-free, while the remainder faces variable tariffs, primarily exceeding 10 per cent.