Economy

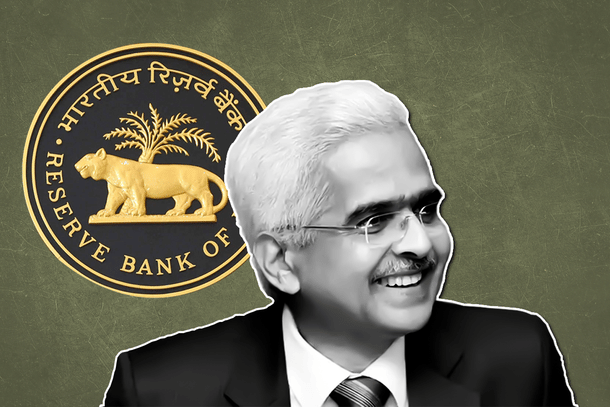

Behind Shaktikanta Das' Success: RBI and FinMin Now Work With Each Other, Not Against

R Jagannathan

Dec 10, 2024, 10:10 AM | Updated Dec 13, 2024, 05:50 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

It is possible to credit Shaktikanta Das, who has completed a super-successful, six-year stint as Governor of the Reserve Bank of India, for many things. But the most important thing he achieved goes beyond his obvious success in managing the central bank during a destabilising period for the global economy (two years of Covid, two endless wars): he has proved that a central banker can be independent without ruffling feathers in government.

Mint Street and North Block, despite different perspectives on the economy, have never been more comfortable with one another than during Das’s stint.

Given the kind of challenges faced by the India economy between December 2018, when Das took over from Urjit Patel, and now, it would have been natural for the finance ministry and Mint Street to harbour some degree of unhappiness with one another.

We saw this when P Chidambaram and Duvvuri Subba Rao verbally sparred over interest rates when growth during the UPA period was slowing down. We saw Raghuram Rajan take unnecessary political potshots at the Modi government during a difficult economic transition from UPA to NDA when he made snide references to Hitler and one-eyed kings when his own management of the central bank during the UPA period was far from ideal.

But under Das, India has vindicated the basic belief that fiscal and monetary policy have to work in tandem, and independence of the central bank is not an end in itself. Economic policy works best when Mint Street and North Block are on talking terms.

This comes with a tacit understanding in the RBI that the ultimate guarantor of economic stability, including the solvency of the banking system, is the government itself. And an equal recognition in the Modi government that the RBI has a job to do, and it is best not to dictate how it must do this.

There was also a clear understanding that fiscal irresponsibility impacts monetary policy. No government, especially in the turbulent post-demonetisation, Covid-impacted and war-scarred world has been as fiscally sensible as the Modi government. A potentially conflict ridden issue - the dividend to be paid by the RBI to the government - was resolved to everyone’s satisfaction under Das’s stewardship.

Dividends were sharply reduced to Rs 40,000 crore in 2022-23, but caused no major disappointment in the finance ministry; this year, the RBI gifted the government with a massive dividend bonanza of Rs 2.32 lakh crore. North Block now trusts the RBI more than ever.

This essential willingness to work with the finance ministry rather than against it is what makes Das’s tenure significant. After Raghuram Rajan left behind a banking system overloaded with bad loans, his successor Urjit Patel began the hard journey to force banks to start cleaning up their balance-sheets; but this happened only because the Modi government empowered the RBI to force banks to start settling their bad loans and further recapitalised banks with massive infusions of capital in the 2017-2020 period. Das completed the job begun under Patel.

Thus, while Rajan left behind a sinking banking system, Das leaves behind a robust financial system that is the envy of the world. The bad loans of listed banks fell from over 10 per cent when Urjit Patel left the scene to just a quarter of that now. Net bad loans are well below one percent today; it was seven-and-a-half times higher in 2018-end, which was more Rajan’s legacy than Patel’s. Today, if there are any economic headwinds, banks are in a position to weather the storm.

On inflation, Das proved to be adroit by keeping the inflation rates within the four per cent band (plus or minus 2 percent) most of the time. He dramatically cut rates to help banks cope with the post-demonetisation shock and equally dramatically raised rates when inflation started rearing its head after the global supply chain disruptions began to raise cost pressures all around. Net result: the policy benchmark repo rate (the rate at which banks borrow overnight money from the central bank) is the same today as it was when Das took over: 6.5 percent.

As growth flags, Das has retained the caution against inflation by not lowering the rate after the recent Monetary Policy Committee meeting. He chose to help the banking system’s liquidity by cutting CRR (cash reserve ratio) by 50 basis points. A CRR cut helps banks more than a rate cut because it frees money, money kept with the RBI without earning interest. CRR is the only non-performing asset on which banks can never hope to earn a return.

Equally adroit was the way in which Das rescued two failing banks (and one massive non-bank financial company, IL&FS) that were about to go under: Yes Bank and Lakshmi Vilas Bank. While the State Bank was asked to rescue the former, DBS Bank was allowed to take over LVB. This suggests that the RBI is no longer ideologically narrow-minded when it comes to keeping the banking system stable. It will use strong public sector banks or foreign banks to rescue failing banks. Today SBI will probably exit Yes Bank with a profit when it disinvests.

Perhaps that most significant success of Das is the massive expansion of the digital payments ecosystem, especially the Unified Payments Interface (UPI), which now accounts for annual transactions worth Rs 200 lakh crore, a compounded annual growth rate of 138 percent from just Rs 1 lakh crore in 2017-18.

Without UPI, and without demonetisation in 2016, the Covid period would have been stressful for the payments industry, but Das’s small tech group in the RBI ensured that throughout the period of aggressive lockdowns and depressed economic activity, money could be paid and received by ordinary Indians for their day-to-day transaction without any hiccup.

Consider what would have happened if all of our daily transactions had to be done in physical currency, which was the case before demonetisation and UPI’s dramatic expansion?

Das, who was in the finance ministry when high-value notes were demonetised in November-December 2016, knew both what was at stake, and what needed to be done to keep the wheels of payments moving despite serious physical disruptions.

Das was not chosen central banker of the year twice in a row by Global Finance without reason. He leaves behind a tough act to follow for his successor Sanjay Malhotra.

Jagannathan is former Editorial Director, Swarajya. He tweets at @TheJaggi.