Economy

Leveraging District-Level Economic Activities For Post-Covid recovery

L Somasundaram

Oct 10, 2020, 05:56 PM | Updated 05:56 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The year 2020 has been devastating on global economy and livelihood. Covid-19 has impacted how businesses are conducted and how governments respond to crises.

Several researchers have put forward suggestions on the scale of the macroeconomic recovery package that each nation should implement. A common theme in these opinions has been the need to be wary of an inflationary impact due to fiscal and monetary expansion. Yet, the immediate necessity in the economy is to address demand creation.

The question therefore is whether the government’s economic management at the Central, state and monetary policy levels can have a boost on domestic demand.

At this juncture, it is opportune to evaluate available data at the disaggregated level in India.

The Reserve Bank of India recently released data on deposits and credit for the districts of India, for the quarter ending June 2020.

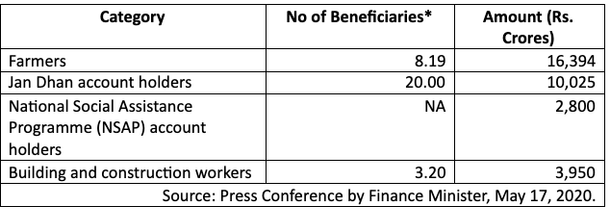

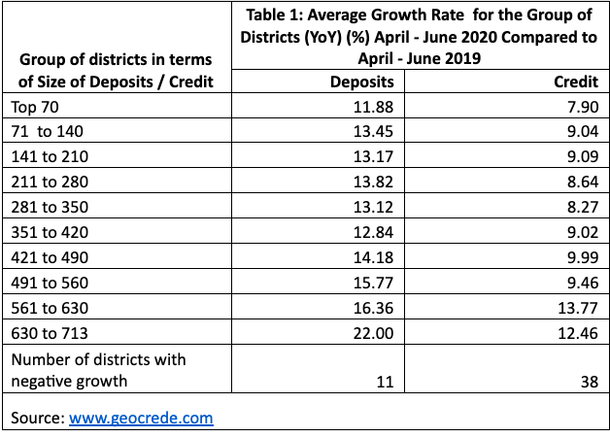

We see that across states, most districts have registered reasonable growth both in terms of credit and deposit. This could be the result of the credit enhancement programme initiated by the Central government and the increased transfer of funds to Jan Dhan accounts and other beneficiary accounts (table 1).

Table 2 below presents the average growth rate of deposits and credit for the quarter April-June 2020 compared to the same period, previous year.

The districts have been grouped in terms of the size of credit and deposit.

Average growth is presented for sets of 70 districts each to arrive at 10 sets of districts in terms of size of credit and deposit.

Upon closer look, it can be observed that districts with lower economic base have had stronger growth rate (refer cohorts 561 to 630 and 630 to 713 in the table above).

We do not have data in terms of classification of credit by occupation for the latest quarter. In any case, credit growth has an important bearing on purchasing power of a district.

Given this background, it is logical to expect that the economic activity base at the level of districts must be leveraged for economic revival.

A starting point could be the inherent diversity of economic activities in India. This could be an important factor in ensuring that a post-Covid recovery plan could achieve demand creation, particularly for local produce.

Here, the constraint is the low economic base or the low value-added achieved in most districts through economic activities.

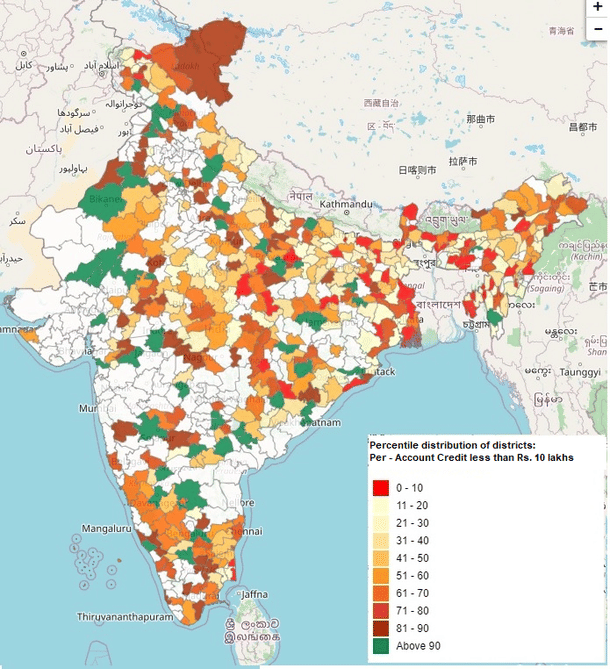

Of India’s 705 districts, 475, nearly 70 per cent have a per-account credit in manufacturing sector of less than Rs. 10 lakhs (Snapshot map 1).

These districts have manufacturing activities that produce goods in the lower end of the value chain of industry. Typically, districts with economic activities in the higher end of value chain (for instance, Pune in automobile sector), or hosting the entire value chain of the sector (for instance, Tiruppur in hosiery sector) have larger per-account credit off-take.

Some outliers that can be observed are the districts that have higher household incomes (such as those in Tamil Nadu and Karnataka, as can be seen from the map) also have a per-account credit off-take in manufacturing sector of less than Rs. 10 lakhs.

Availability of diverse economic activities in the district, and in the contiguous districts, is the differentiating factor for the higher household income in these districts.

This brings us to the context of “act local”.

Given that economic activities – the prime driver of incomes and thus demand – are largely in the lower value-added group in most districts, a closer look at this data is imperative to put in place a strategy to “act local” – as outlined by the Prime Minister in his speech on 12 May, 2020, where he announced a Rs. 20 lakh crore recovery package.

Acting local

“Local” could mean different things in the context of Indian economy depending upon the scale and type of operations.

We have seen a “local” bakery, catering to not more than a few wards of a town, being successfully run over decades; traders who cater to towns and villages within a district; aggregators in the agri-based sectors (dairy, meat) buying products from various states for urban markets in India.

A dying unit in Tiruppur or a leather processor in Agra work for “local” manufacturers – who in turn operate in a globally networked market.

All these activities impact local purchasing power and the capacity of the local governments to invest and maintain the cities.

Given that economic activities could be relevant for global, national and regional markets, “local” and “self-reliant”, the buzzwords that the Prime Minister’s speech referred to, cannot imply a market limited to the local areas.

A case in point is the recent emphasis on reducing the impact of middlemen in agricultural value chain. Here, market reach is an imperative for sustainability of rural and small-town incomes. Acting local, in this context, would mean that markets, and thus opportunities, reach the last mile of producers.

Case for a Targeted Intervention

The series of measures announced so far under the aegis of Covid-19 relief and post-Covid recovery relate to temporary relief (moratorium on loans) and reforms. These measures could ease the economic environment at different levels.

Yet, these may not directly have a positive impact on demand generation.

A closer analysis of district-level economic data enables policy makers to answer which are the districts to focus on.

Apart from the top industrial districts, the rest are largely agrarian. Moreover, the stronger ones among these agrarian districts are those with some manufacturing.

We see from RBI's data on credit off-take, occupation-wise, at the district level, that agriculture is evolving to be a bankable business in industrially stronger districts.

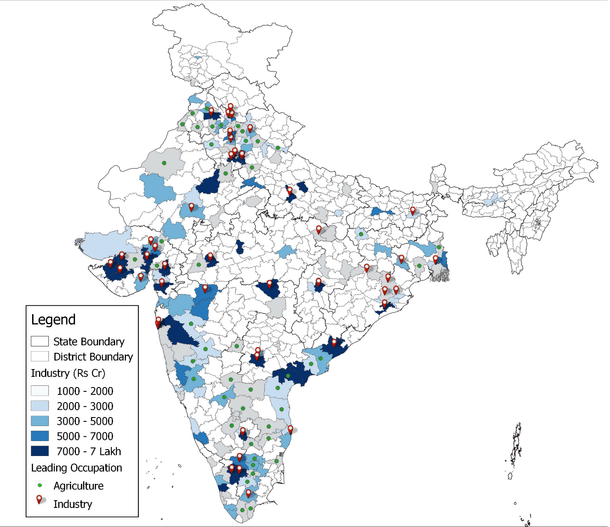

The snapshot presented below is the map of districts with more than Rs. 1,000 crore credit (in terms of amount outstanding as on March 2019) to industry sector – a set of 167 districts.

Of these, agriculture is the leading economic activity in 47 districts, and is larger than industry.

With industrial growth at a micro-geographic level come benefits of demand, deeper markets, and lesser number of dependents on agriculture.

This makes agriculture a bankable business. This evidence could be a starting point to target districts with agriculture base and moderate to high levels of industry and other activities for interventions.

Recent reforms could be leveraged for district level revival focusing on creating value-adding linkages.

Formation of farmer producer organisations to market standardised produce to manufacturers with targeted credit from banks could be an immediate action taken by state interventions.

NABARD is one institution which could drive this effort, with its district-level presence and documenting of various economic activities and its potential at each block/taluk of India. NABARD’s sectoral coverage is very wide – from food-processing and handloom to renewable energy in manufacturing, agri-clinics to schools in services and social infrastructure, and housing loans to educational loans in financial inclusion.

Such an approach enables targeting the interventions at the right location and the right beneficiaries, easing the process and convergence of schemes through institutions. Data is the key and it is readily available with institutions such as RBI and NABARD and needs to be put to use for increasing the scope for the private sector.