Economy

Why New India Needs A Grand Reconstruction Budget Post Covid-19

TV Mohandas Pai and Nisha Holla

Apr 08, 2020, 12:03 PM | Updated 12:01 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The Covid-19 pandemic has morphed into a global economic crisis. All activity is grinding to a halt with unemployment on the rise. Stock market value has declined by more than $27 trillion.

The United Nations predicts that the world economy will go into recession in financial year (FY) 2021 with an anticipated loss of trillions of dollars of global income.

International Monetary Fund (IMF) has announced a negative growth forecast. Oil prices have fallen to historic lows. The world order is in flux.

The government of India (GOI) has taken a bold decision to prioritise the lives of its citizens and face the consequences of the economic fallout. This leadership has undoubtedly helped mitigate the spread of the infection in the country.

Many other countries have delayed this decision with debates on compromising economic activity in the face of higher infection risk.

Regardless, it is evident that all nations will face an unprecedentedly different global economic paradigm than the one merely two months ago.

Most governments are now delivering unprecedented economic relief programmes by raising debt-capital and increasing deficits to provide liquidity and keep citizens going until the pandemic subsides.

The GOI must lose no time in taking decisive steps to protect its citizens from the longer-term effects of the epidemic on our economy. It must view this as a generational opportunity to systematically realign the rails of ‘new India’.

Bold steps taken over the next five years will reshape the country, facilitate the ‘new India’ of our dreams and realign our economic trajectory for the next decade.

Along with a 21-day lockdown, the GOI also announced various economic relief programmes. Hopefully, packages to protect job creators, small businesses and direct-impact industries are assembled soon, as discussed here.

Including distressed situation loans made during this crisis, the ultimate cost of tackling Covid-19 might amount to Rs 10 lakh crore or 5-6 per cent of India's gross domestic product (GDP). This may seem extraordinary, but it is far lower than other large economies.

While the GOI has taken leadership in dealing with the health dimension of this crisis, it must also assume an equally serious stance in the economic dimension.

It is uncertain how much of industry will survive after this lockdown and reduced economic activity, and what the future level of output will be.

What is certain is the gig and informal economies, and micro small and medium enterprises (MSMEs) are deeply wounded due to the discontinuity of income and liquidity. They are directly bearing the costs of the shutdown without relief support.

Direct-impact industries like aviation, travel, tourism, hospitality, airports and entertainment have suffered unmitigable damage.

This fallout will extend as it will take at least 3-9 months for the economy to stabilise, and people will be cautious about spending on non-essentials after lockdown-induced income (and job) losses.

India's FY 2021 growth is expected to be at 2.5-3 per cent.

The agriculture sector may continue at 3 per cent growth if the monsoon is normal. Industry may go down to negative growth as it recovers and rebalances labour.

Services, averaging about 7 per cent real growth for 20 years, might slow down to 3.5 per cent.

An economic analysis shows that only the government sub-sector within services will continue without a blow as taxes and borrowing will finance government spending.

FY 2021 might be resigned to low growth; but if the government does not take bold measures after the March 2020 crisis, FY 2022 may also follow this grim trajectory. Instead, this is a golden opportunity for India to revive economic growth through large scale investments so that FY 2022 through FY 2025 and beyond will see accelerated growth.

As many have opined, this is a one-time opportunity for the GOI to invest and create capacity that will firmly establish India as a sustainable and reliable alternative within global supply chains.

As a nation, we cannot miss this window to take decisive action and aggressively capture our position in a realigning world order.

India needs undaunted action by Prime Minister Narendra Modi at this juncture. We must fearlessly avail 20/30 year long-term loans and bonds raised globally to finance this next decade of growth, with much of it maintained as a special programme outside the budget.

Sticking to the conventional notion of a 3-3.5 per cent fiscal deficit is inadequate to execute this grand vision of ‘new India’. Other nations are already approaching this as a war-time scenario and raising long-term bonds.

Their views are clear – they will spare no efforts to prevent economic disaster and compromise national economic security.

We must also not spare any efforts to protect India’s economic security and realign India to its $5 trillion GDP target.

What action must India take to return to 6.5-7.5 per cent real growth between FY2022-FY2025? The answer is extensive five-year programmes such as:

1. National Infrastructure Pipeline 2.0: A large-scale five-year infrastructure programme is essential to boost the economy, reduce supply chain costs, bolster industry and construction sectors, and increase jobs.

The National Highway Ministry has an investment programme of Rs 15 lakh crore over five years.

The Railway Ministry has a similar programme to improve access and quality, including a part-privatisation strategy.

The Finance Ministry has devised an inspired Rs 102.5 lakh crore National Infrastructure Pipeline (NIP) with allocations to energy, roads, railways, and others, as shown in Table 1.

Finance Minister Nirmala Sitharaman has announced that Rs 42.7 lakh crore (41.6 per cent) worth of projects is under implementation, Rs 32.7 lakh crore (31.9 per cent) under conceptualisation, and the rest under development and classification.

The NIP in its current avatar is not ambitious enough for ‘new India’. Sectors like urban infrastructure and MRTS (Rs 16.3 lakh crore), education (Rs 1.56 lakh crore), health and family welfare (Rs 1.69 lakh crore), industry (Rs 3 lakh crore) and others need bolder investment; the current allocation is inadequate.

Some increased investment opportunities are analysed below to the tune of Rs 33.5 lakh crore.

The fiscal situation of India will be weak in FY2021 with diminished tax collections; new modes of financing for the NIP have to be arranged during FY 2021 so implementation can start in FY2022.

The existing Rs 102.5 lakh crore NIP is a pivotal starting point for the reconstruction of ‘new India’. An NIP 2.0 will actually deliver the results in a post-pandemic economy.

2. Urbanisation: Development and urbanisation go hand-in-hand. Urbanisation concentrates human activity, leading to specialisation, and specialisation to improved productivity; enabling greater availability of goods, services, and job opportunities.

The village-centric model doesn’t work in this new era of specialisation-led growth. India is only 34 per cent urban compared to the world-average at 55 per cent and China at 59 per cent. India must urbanize rapidly and more systematically.

A total of 5,000 census towns can be developed all around India to become the new engines of growth.

Today, 10 large cities are reeling with overpopulation and an inability to cope with immigration, while rural areas provide meagre growth and upliftment opportunities.

India must develop at least 5,000 census towns across the country by proactively building infrastructure connectivity (pt 1), mass transit (pt 4), facilities like water, power and sewage, healthcare (pt 8) and education (pt 7) infrastructure, and industrial clusters (pt 3).

An extensive housing programme for Rs 15 lakh crore (of which the government can subsidise Rs 5 lakh crore through an extension of PM Awas Yojana) can create low-cost housing for three crore low-income families sold at Rs 5 lakh per house in the 5,000 semi-urban centres.

Labour costs will be cheaper in small towns than in large cities, and workers can easily travel from neighbouring villages; thus finding quality employment prospects close to their villages as is happening in Ranchi today with garments industries.

An Rs 15,000 salary in a small town fetches three times what it can in a large city, and many rural workers will opt to stay or commute to work at these industries than migrate to a city as contract labour.

A significant reason for women’s low workforce participation despite higher levels of education is the inability to migrate and work, unlike men. Women are an untapped productive resource in our country and taking employment prospects to their doorsteps with this massive urbanisation plan will unlock this potential.

An investment of Rs 20-50 crore per year is suggested in each of the 5,000 towns averaging Rs 25 crore per year per town or Rs 100 crore over four years. This amounts to a minimum of Rs 5 lakh crore over four years to transform India’s urbanisation.

An additional Rs 15 lakh crore for housing as discussed at a subsidy cost of Rs 5 lakh crore. This investment will pay off handsomely and enable millions to multiply their earning power at the industrial clusters.

The GOI must believe in the inarguable link between urbanisation, higher wage earnings, and the resultant accelerated shift of its citizens out of poverty. This is an opportunity to invest and reap multi-variate benefits that cannot be ignored.

3. Labour-intensive industries are imperative to provide quality mass employment prospects and boost India’s export capabilities.

We can leverage our 137-crore population, just like China did, to establish a comprehensive manufacturing base that caters to global needs.

As the world emerges from this crisis, economies will look to diversify manufacturing and supply chains away from China-centric dependence.

By planning in advance with special economic zones, industrial clusters, high-speed infrastructure connectivity between the clusters and ports, facilities (power, water, sewage and storage) and tax benefits to job creators, India can position itself as a viable alternative to China.

An analysis of China’s top 10 exports in 2018 valued at $ 2.5 trillion (Rs 177 lakh crore) gives us an indication of which industries to set up and cater to global demand, and capture market share:

(Percentage of total exports)

- Electrical machinery and equipment: Rs 47 lakh crore (26.6 per cent)

- Machinery including computers: Rs 30.5 lakh crore (17.2 per cent)

- Furniture, bedding, lighting, signs, prefab buildings: Rs 6.8 lakh crore (3.9 per cent)

- Plastics, plastic articles: Rs 5.7 lakh crore (3.2 per cent)

- Vehicles: Rs 5.3 lakh crore (3 per cent)

- Knit or crochet clothing, accessories: Rs 5.2 lakh crore (2.9 per cent)

- Clothing, accessories (not knit or crochet): Rs 5 lakh crore (2.9 per cent)

- Optical, technical, medical apparatus: Rs 5 lakh crore (2.9 per cent)

- Articles of iron or steel: Rs 4.65 lakh crore (2.6 per cent)

- Organic chemicals: Rs 4.2 lakh crore (2.4 per cent)

India needs at least Rs 5 lakh crore over four years to build export-quality industrial estates. This will yield large-scale job creation and long-term internal sustenance for essential manufacturing.

India can also claim an indisputable hold on a ‘top 5’ ranking in industrial output and exports as a result.

The GOI cannot ignore this opportunity to secure India’s long-term interests along these critically interlinked parameters – it must tolerate no compromise to its national economic security and invest aggressively to empower labour-intensive industries.

4. Increasing Urban Mobility And Fuel Independence: India currently has 53 cities with more than 10 lakh populations, of which approximately seven cities have populations over one crore.

People are increasingly migrating to large cities that are buckling under the strain of insufficient infrastructure. The biggest challenge is urban mobility. People spend three-four hours/day in traffic, causing mental stress, physical drain, and reduced quality of life.

The lockdown has demonstrated that reduced traffic quickly translates to improved quality of air and decreased pollution. This lesson must be operationalised quickly and yield mass transit infrastructure.

It is suggested that metro capacity be rapidly increased to 5,000 km from the total sanctioned 1,400km today. This extra 3,600 km at an average of Rs 300 crore/km will cost about Rs 10.8 lakh crore over four years.

Apart from this, electric buses must be commissioned under the ‘Make In India’ scheme. India needs a minimum of 2 lakh electric buses in our big cities to make urban commute easier at the cost of Rs 1 crore per bus for a total of Rs 2 lakh crore.

The electricity surplus from the grids as well as solar technology can power this, with the added advantage of reduced dependence on fossil fuel imports. This will also spur large-scale battery and electric vehicle (EV) component manufacturing in the country – an inarguably essential supply chain for the future of mobility globally.

Increased urban mobility will require a total of Rs 12.8 lakh crore over four years. The NIP scheme (pt 1) has already allotted base capital towards MRTS and must be expanded.

This is a unique opportunity for the GOI – oil prices are at historic lows and India must build up strategic reserves urgently.

However, prices will bounce back and India must not fall into foreign oil dependence as before. We must use this opportunity to invest in EV mass transit and emerge with lower oil dependence.

This has a double bottom-line effect of also making our urban agglomerates more efficient and productive – large economies do not see such opportunities align very often. The GOI must take full advantage of this convergence and invest aggressively to protect its citizens’ future.

5. Overdependence On Agriculture Must Shift: India's biggest economic challenge is that 43 per cent of the workforce depends on agriculture contributing only 17.6 per cent to nominal gross value added (GVA). About 33.5 per cent of the workforce depends on services providing 55 per cent to GVA, and 23.8 per cent depends on the industry, contributing 27.4 per cent of GVA (Table 2).

An agricultural dependant earns about Rs 55,600 annually compared to Rs 1.55 lakh in industry and Rs 2.21 lakh in services. The income differential is very high at a ratio of 1:3:4. The differential will keep widening as the growth rates for all three sectors are divergent at 3 per cent:5 per cent:7 per cent.

The only sustainable way to address this inequity is to accelerate the shift of workers from agriculture to other sectors. Over the last 20 years, roughly 1 per cent shifted every year – from 60 per cent in 1999 to 43 per cent in 2019, according to the World Bank.

We must accelerate this to at least 2 per cent per year amounting to 10 per cent of Indians shifted by 2025.

Agricultural production can manage and streamline with a lot fewer people, like China.

GOI cannot miss this opportunity to provide its most vulnerable citizens the opportunity to increase their earning power and long-term financial security.

It is critical to invest in NIP 2.0 and accelerate infrastructure development (pt 1), and in labour-intensive manufacturing (pt 3) which are the only two sectors that can absorb crores of low-skilled workers from the transitioning agricultural workforce.

A deliberate strategy for urbanisation in the 5,000 towns (pt 2) is necessary for this to work as villages cannot cater to growing economic needs anymore.

It is clear that investments by the GOI in each of these three strategies – manufacturing, construction and urbanisation – will yield highly beneficial second and third order consequences in jobs and earnings potential.

This is further fuel for the urgency with which the GOI must aggressively pursue large-scale investments that will directly benefit its most vulnerable citizens.

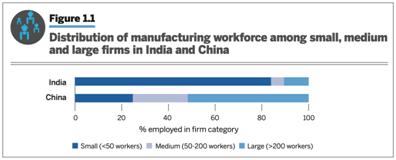

6. Jobs: India’s policy must focus on building massive manufacturing and construction companies. They alone can handle the world’s manufacturing needs (pt 3). As seen in Fig 1, more than 50 per cent of China’s manufacturing workforce is employed by large firms of more than 200 workers.

Small firms employ 25 per cent of the workforce and medium firms under 25 per cent. This is the template India must focus on and replicate – the China model has proven resilience at this population scale.

India currently operates with more than 80 per cent workers in small firms of under 50 workers, and only 10 per cent in large firms like Mahindra or Tata.

GOI has to focus on enabling the building of large firms to leverage the economies of scale and develop global players. Private business alone does not have the reach or means to execute this; GOI has to be main driver.

Similarly, GOI has to invest in infrastructure (pts 1 & 5) to spur construction and help the labour segment earn consistently. The opportunity for wage consistency over five-10 years in a factory or a construction project is a luxury for workers now; let us make this ‘new India’s’ modus operandi.

Apart from investing, GOI’s duty to its citizens, both workers and job creators, is a complete policy overhaul to facilitate large manufacturing and construction. India is buckling under the weight of 70 years’ worth of archaic tax rules and regimes. It is the sovereign duty of government to simplify this for its citizens.

None of these ideas are novel or unprecedented. What matters now is the serious urgency with which decisive action must be demanded from the administration to remove friction to job creation and secure India’s economic interests via bottoms-up and top-down change.

7. Development Of Human Capital: As we set up a reinvigorated manufacturing economy, skills development programsme are required to train the workers shifting over from the agricultural sector (pt 5).

China progressed from labour-intensive industry to light manufacturing, then heavy manufacturing and hi-tech industry.

We foresee India will also follow this trajectory but with the added advantage of an established hi-tech industry network. By planning skills development through this loop, India can accelerate economic growth.

The Union budget currently allocates Rs 3,000 crore annually to skills development. It is suggested the annual budget ramp up to Rs 15,000 crore amounting to Rs 60,000 crore over four years.

In parallel, higher education needs focused investment to design world-class universities. Our report on Human Capital Development in India (November 2019) demonstrates that India has built the soon-to-be largest education system in the world.

Rapid brownfield expansion to improve quality, access and affordability is the need of the hour. We currently produce 40,800 PhDs a year and must ramp up by an additional 50,000 high-quality PhDs annually.

To develop human capital on par with the US and China, India needs to invest in state-of-the-art laboratories, specialised PhD programmes in keeping with future requirements, and developing world-class curricula to train our young population for a technology-first future.

This investment has the added advantage of retaining more students who are today going abroad in search of better opportunities.

Federation of Indian Chambers of Commerce and Industry (FICCI) estimates that an investment of Rs 8 lakh crore is required by 2030 to improve quality and increase gross enrolment ratio to 50 (from 26.3 today).

The NIP includes about Rs 1.18 lakh crore (pt 1). Another Rs 3 lakh crore is needed by 2025, and a further Rs 4 lakh crore by 2030.

At this time of crisis, the GOI must re-establish its commitment to its citizens and take their long-term resilience seriously. Such investment is a strong signal that the administration can deliver upon its duty to strengthen our collective capacity and prepare the next generation to be stronger than the last.

8. Healthcare infrastructure: In India needs reinforcement, as the pandemic has demonstrated. Of 718 districts, at least 500 require a large 500-bed multidisciplinary hospital that can cater to the needs of the community.

These hi-tech facilities will also attract doctors and medical staff to work in small towns instead of moving to large cities in search of good hospitals. Building these hospitals at the cost of Rs 50 lakh per bed for (500x500 beds) could cost Rs 1.25 lakh crore over the next four years.

Today, India graduates about 51,000 MBBS, 14,000 post-graduate (PG) specialists and 70,000 nurses a year.

The number of MBBS seats has increased to almost 80,000 and PG seats to 36,000. The World Health Organization (WHO) estimates there is a deficit of 6 lakh doctors and 20 lakh nurses in India – which can be remedied with focused investment over four-five years. Rapid brownfield expansion of existing colleges can double the graduates to reduce the shortfall.

Medical colleges over 20 years old with a proven track record can be provisioned to increase capacity by 50 per cent over the next five years with government assistance. They have facilities and human capital to produce high-quality medical staff.

Similarly, the training capacity for health technicians in radiology, pathology, anaesthesiology, and other critical functions must increase. Doctors in India perform many small tasks that can be handed over to other staff to optimise the utilisation of doctors for specific specialised tasks.

We also need primary health centres in every taluk/tehsil. Today, rural citizens travel needlessly for tens of kilometres to access basic healthcare. Primary facilities can cater to 60-70 per cent of their needs. An investment of Rs 1 crore per year for each of the 5,650 taluks amounts to a total of Rs 22,600 crore over four years.

Unfortunately for India’s citizens, the country’s best medical students are continuously poached to fill shortfalls in medical staff of more mature economies. This is an intolerable brain- and talent-drain of essential skills that compromises the country’s ability to react to crises such as this.

Unless there is a coordinated shift in how we build our health infrastructure, the GOI will leave its citizens susceptible to future epidemics and continue to suffer trained staff shortages.

The administration can make India the best place to work for her doctors, nurses, and trained medical staff by prioritising such investments and fortifying its systematic response capacity in the interests of its citizens.

9. Startups To Leverage The Knowledge Economy: With 40,000 startups and more than 33 unicorns, India is home to the third-largest startup ecosystem, behind only the US and China. They have created a combined value of Rs 11.4 lakh crore and employ 7.5 lakh people collectively.

Projections indicate that by 2025, India may well have more than 100,000 startups, employ 32.5 lakh people, and produce more than 100 unicorns, with a total market value north of Rs 35.5 lakh crore.

The rise of startups in India in 2014 was accelerated by Prime Minister Modi’s strong push to build the world’s most sophisticated digital banking and payments system.

Now a second push for urbanisation, industrialisation, high-quality infrastructure, and tax regime simplification will enable the next wave.

As India emerges as a gravitational centre of a burgeoning knowledge economy, it is unfortunate that only 10 per cent of total investments in Indian startups is by Indian capital – a dangerous position. With 90 per cent capital coming in from countries like the US, China, Japan and Singapore, India is on track to becoming a captive digital colony.

If we are to command our digital destiny, more Indian capital is required. To accelerate investment into this sector, we suggest that the government increase allocation to Rs 50,000 crore via the SIDBI Fund-of-Funds and funds run by banks like SBI, HDFC and ICICI.

The 2019 National Democratic Alliance (NDA) election manifesto included a promise of Rs 20,000 crore seed capital for startups.

In the light of the coronavirus pandemic and the unconditional support lent to the government by many startups during this trying time, we recognise the value of enhancing allocation to Rs 50,000 crore. This should enable investment into at least 500 funds; if each fund invests in 25 companies, this will create capacity for 12,500 new startups.

Once the world recovers from the pandemic, it will realise the digital era that we have irreversibly shifted into during the lockdown. People who have been locked in the world over have used digital infrastructure for their every need – payments, food and grocery delivery, communication, health and medicine delivery, teleconsultations, education, entertainment, and more.

This has transformed people’s habits and will accelerate immigration to the digital dimension. India has the basic building blocks in place to now turbocharge into this new digital reality, fuelled by this Rs 50,000 crore investment.

10. Poverty Eradication: The development and digital push by NDA-I have undoubtedly empowered the poor to weather this crisis, as discussed here.

The recent outflow of migrant labour from Delhi has also demonstrated that people migrate long distances in search of work. Staying power and liquidity in hand is low; they live day-to-day. India's poor require minimum income support to sustain themselves in times of crisis.

It is evident India needs a new approach to eliminate poverty and increase purchasing power by 2025. While the government has many schemes for the poor, the system is unsustainable in times of crisis.

The JAM (Jan Dhan, Aadhaar and mobile) trinity, which has enabled many productivity improvements including direct benefit transfer (DBT) in India, can be leveraged further and that requires a separate analysis.

With these spend items over NIP's Rs 102.5 lakh crore, an additional Rs 33.5 lakh crore ($470 billion) is required. This Rs 136 lakh crore is India's grand reconstruction budget for FY 2022 through FY 2025.

Financing India's Grand Reconstruction Budget

India’s grand reconstruction budget, above the current budget, will elevate India to a ‘Top 3’ economy. It is suggested that India borrow $500 billion globally for this purpose.

Internal savings in India is inadequate to fund India's reconstruction. Financial savings through households is only 11 per cent and 7-8 per cent from the corporate sector.

Adhering to the 3-3.5 per cent ceiling on fiscal deficit may have served India well in a high-inflation environment.

Over the last five years, however, the Modi government has kept inflation below 4 per cent.

In this low-inflation environment, the government can afford to boldly invest more and maintain additional borrowing as a special situation development-linked line item.

India must now tap global capital markets to raise long-term debt of $500 billion.

With India's stellar reputation as a financial stalwart that doesn't default on loans, overseas markets will engage with the opportunity to lend long-term 20/30 year loans to us.

If the government is uncomfortable raising debt directly, capital can be raised through parastatals like the National Highway Authority of India, Indian Railway Finance Corporation, National Housing Bank, NABARD, Power Finance Corporation, Higher Education Finance Corporation and others for the respective sectors, and Indian commercial banks for on-lending to infrastructure.

These parastatals have raised money in the past and must now avail 20/30 year loans.

Long term debt is optimum, so there is no repayment pressure on the principal for 20 years by which time India might grow to a $15-20 trillion economy with the ability to repay these loans with ease.

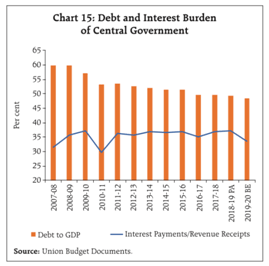

In the meantime, interest can be easily serviced. India’s debt-to-GDP ratio has steadily decreased from 60 per cent in FY2008 to 48 per cent in FY2020, aggressively pursued by the Modi government since FY 2015, as seen in Fig 2.

Undoubtedly, India is in an optimum position to take on long-term debt.

Moreover, the Finance Ministry estimates India’s FY2025 GDP at Rs 365.5 lakh crore or $5 trillion. The $500 billion borrowed is an additional 10 per cent of our projected FY2025 GDP – very respectable for special development debt.

Suggestions On Where To Raise Capital

- About 20/30 year long-term loans from multilateral institutions like World Bank, Asian Development Bank, Asian Infrastructure Investment Bank, New Development Bank, and others.

- Raising global bonds outside India is better than inviting foreign capital to invest in local bonds. Global bonds will have to be redeemed only on maturity 20 or 30 years down the line. In contrast, foreign-owned domestic bonds can be sold at any time and dollar proceeds redeemed immediately, making them a vastly riskier proposition.

- Foreign markets with surplus capital like Tokyo. The Japanese have significant capital reserves but not enough high-growth investment opportunities within Japan. The bond market in Japan is predicted to generate negative returns. They are exploring beyond their borders for better opportunities. For example, in March 2020, Japan's Government Pension Investment Fund increased portfolio allocation to foreign bonds to 25 per cent from 15 per cent (with total AUM of $1.45 trillion). Capturing a share of that 10 per cent of $ 1.45 trillion is an excellent opportunity for India.

- Float 20/30 year bonds in the Indian market with tax-exemption regimes so citizens with savings can partly fund their country's development at 6.5 per cent interest per annum.

- Pension funds and endowments manage over $ 15 trillion worldwide. The GOI must build a concerted engagement plan with these asset allocators, hold investor summits, and incentivise long-term allocations over the 20/30 year view.

A very bold vision is required to remake India after this crisis. The ‘new India’ that Prime Minister Modi aims to usher in will have world-class infrastructure with extensive investments in human capital, no poverty, and a very highly skilled productive workforce assembled in a short time frame.

This calls for an enhanced strategy and large-scale investment for five years.

The additional spending suggested above has to be maintained outside the budget as a special development programme over the next four-five years to remake India. This investment will increase jobs, decrease poverty to near-zero by 2025, create significant opportunities for young Indians to rewrite their future and make India a $5 trillion economy by 2025 on the way to a $10 trillion economy by 2030.

This article first appeared on the Sunday Guardian, and has been republished here with permission.

TV Mohandas Pai is Chairman, 3one4 Capital, and Nisha Holla is Research Fellow, 3one4 Capital