Infrastructure

Tata-Tesla Deal: A Game-Changer For India's Semiconductor Ambitions

V Bhagya Subhashini

Apr 17, 2024, 11:06 AM | Updated 11:06 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Recently, Tesla has reportedly entered into a strategic agreement with Tata Electronics to source semiconductor chips for its worldwide activities.

Tata Group is also in collaboration with Taiwan's Powerchip Semiconductor Manufacturing Corporation (PSMC) to establish a cutting-edge plant in Gujarat's Dholera. PSMC's chairman, Frank Huang, has confirmed that the inaugural semiconductor chip from this partnership will be ready by the end of 2026.

Supported by substantial funding from both central and state governments, which will cover up to 70 per cent of the project's cost, the Dholera facility is on track to become India's first commercial semiconductor fabrication unit.

Ahead of the Dholera plant's operational launch, the landmark deal secured by Tata Group elevates India's standing in the global semiconductor arena, reports Mint.

With Indian-manufactured chips set to power Tesla's vehicles worldwide, India demonstrates its maturity and capability in the semiconductor industry. Traditionally dominated by Taiwan, China, and South Korea, India is poised to join this league, gaining strategic importance with such deals.

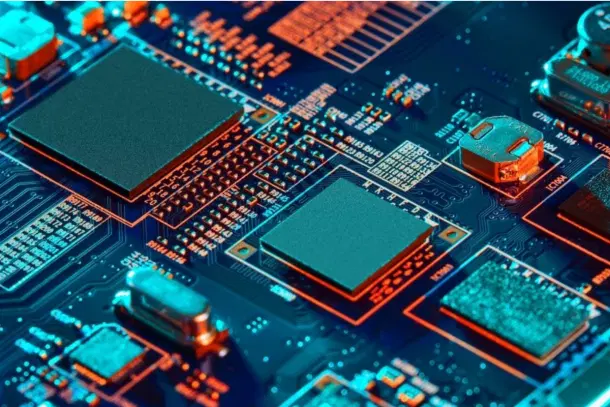

Significance of semiconductor chips

The strategic significance of semiconductor chips has become increasingly apparent, especially in the wake of global events. The 2022 semiconductor shortages, exacerbated by pandemic-induced supply chain disruptions, highlighted the vulnerability of countries reliant on chip imports.

For instance, during the Russia-Ukraine conflict, the US faced challenges in supplying weapons to Ukraine due to semiconductor shortages. Commerce Secretary Gina Raimondo emphasised the critical role of chips in defence systems, indicating the US' strategic dependence on chip-producing countries like Taiwan, China, and South Korea.

Recognising this vulnerability, the US pledged $52 billion to bolster domestic semiconductor manufacturing. Following suit, India announced a $10 billion incentive for semiconductor manufacturing, leading to Tata's chip plants in Gujarat and Assam under the Production-Linked Incentive (PLI) scheme.

The global chip race

Countries worldwide are ramping up efforts to bolster domestic semiconductor manufacturing to ensure digital sovereignty and reduce dependence on global supply chains. Japan is revitalising its semiconductor industry, attracting Taiwanese chip companies to support its endeavours.

In the US, the government is investing billions to expand domestic chip production. The Department of Commerce announced grants for Samsung and TSMC's American unit, aiming to reclaim a significant share of global semiconductor manufacturing.

South Korea's President Yoon Suk Yeol has committed to investing $6.94 billion in artificial intelligence by 2027, underscoring the country's determination to maintain its leadership in cutting-edge semiconductor chips.

India's legacy chip strategy

While advanced chip manufacturing is a priority for countries like the US, South Korea, and Japan, India is strategically focusing on legacy chips. These chips, produced with 28-nanometer (nm) technology or larger, account for nearly 95 per cent of global semiconductor consumption, driving everyday applications from weapon systems to smartphones.

India's emphasis on legacy chips offers a path to self-reliance and positions the country as a reliable supplier for larger nations focusing on advanced chips. The reported Tata-Tesla deal exemplifies this strategy, potentially opening doors for Indian firms to supply legacy chips to other top Western manufacturers.

Anku Jain, managing director of MediaTek's India arm, commended India's approach, stating that starting with mature nodes is less complex and a prudent strategy.

While India may take time to manufacture cutting-edge chips, focusing on legacy chips can quickly integrate it into the global chip value chain.

V Bhagya Subhashini is a staff writer at Swarajya. She tracks infrastructure developments.