Analysis

Germany Blocks Chinese Stake In 2 Semiconductor Chip Firms Days After Xi Urged Scholz To Resist Grip Of Ideology On Bilateral Ties

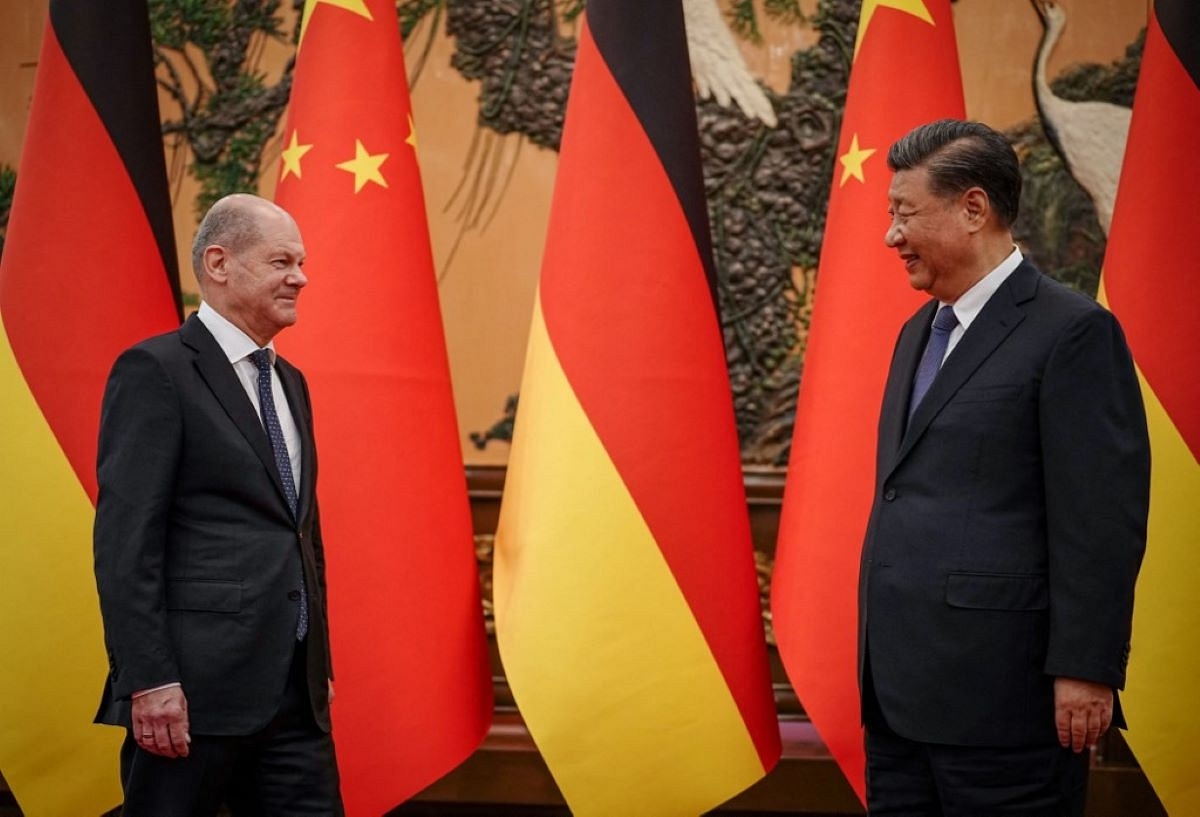

Chinese President Xi Jinping and Chancellor Olaf Scholz

Citing concerns over national security and the flow of sensitive technological know-how to Beijing, the German government on Wednesday (November 9) blocked prospective Chinese investment in two domestic semiconductor chip companies.

The move by the German government days after Chinese President Xi Jinping urged Chancellor Olaf Scholz that Berlin should not be influenced by "bloc confrontations" and "attempts to see everything through the prism of ideology".

Germany's economic ministry said in a statement that it had prohibited Dortmund-based Elmos Semiconductor, which makes chips for the automotive industry, from selling its factory to Silex, a Swedish subsidiary of China's Sai Microelectronics.

The decision had been taken "because the acquisition would have endangered the public order and safety of Germany," the ministry said in a statement.

Silex announced in December that it had signed an agreement with Elmos to buy the factory for €85 million ($85.4 million).

Quoting sources privy to the development, Reuters reported that Berlin has also blocked a potential investment by a Chinese private equity firm in ERS Electronic, based in Bavaria's southern state.

"We have to take a close look at company acquisitions when important infrastructure is involved or when there is a risk of technology flowing to acquirers from non-EU countries," German economy minister Robert Habeck said while addressing a press conference.

He added that the semiconductor industry in Europe, in particular, needed to guard its "technological and economic sovereignty."

"Germany is and will remain an open investment location", he said but added that it was not "naive".

Berlin's moves to restrict Chinese firms in the semiconductor industry comes a month after the United States introduced stringent controls on chip exports to China, a move designed to protect its national security and bolster its domestic semiconductor industry.

In October 2022, the U.S. Commerce Department published an expansive plan to deprive China of access to semiconductor chips made anywhere in the world using U.S. equipment to curtail Beijing's technological and military advances.

The Biden administration announced that it would impose restrictions on 31 Chinese companies, research institutions and related groups effective October 21, effectively blocking their ability to obtain core U.S. technologies.

The U.S. claimed that the latest export control moves were intended to halt shipments of chips and chip-making technology of potential use to China in its military build-up and bid to dominate key industries.

Scholz's China Visit

Last week, Chancellor Scholz visited China. He was the first G7 and western European leader to visit Beijing since the Covid-19 pandemic began and the first since the changing of the guard in China's leadership after last month's congress.

The visit took place in the backdrop of deteriorating relations between Beijing and Berlin and growing calls from within Europe to reduce overreliance on China.

A delegation of top industry CEOs, including the bosses of Volkswagen, Siemens and chemicals giant BASF, travelled as a part of Scholz's entourage to Beijing to meet with Chinese business executives.

China has been Germany's largest trading partner for the past six years and, by volume, accounts for almost 30 per cent of the total trade between China and the European Union (EU).

Germany also accounts for the EU's biggest foreign direct investment (FDI) flows into China, contributing an average of 43 per cent of total investment in the past four years.

Around 6,000 German companies operate in China, mainly in the chemical, electrical and transport manufacturing sectors.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest