Analysis

Intel Plans A $20bn Fab Factory In Europe As EU Aims To Produce 20% Of World’s Semiconductors by 2030

- US chip manufacturing behemoth Intel has indicated that investment in its planned European $20 billion semiconductor factory could be spread across several EU member states.

- European Union aims to double the production of chips on its territory in order to increase its global share to 20%.

- If Europe wants to build a mega, cutting-edge factory, or "fab," it needs to attract at least one of the world's top three manufacturers — TSMC, the U.S.'s Intel or South Korea's Samsung — to invest roughly €20 billion in a new foundry.

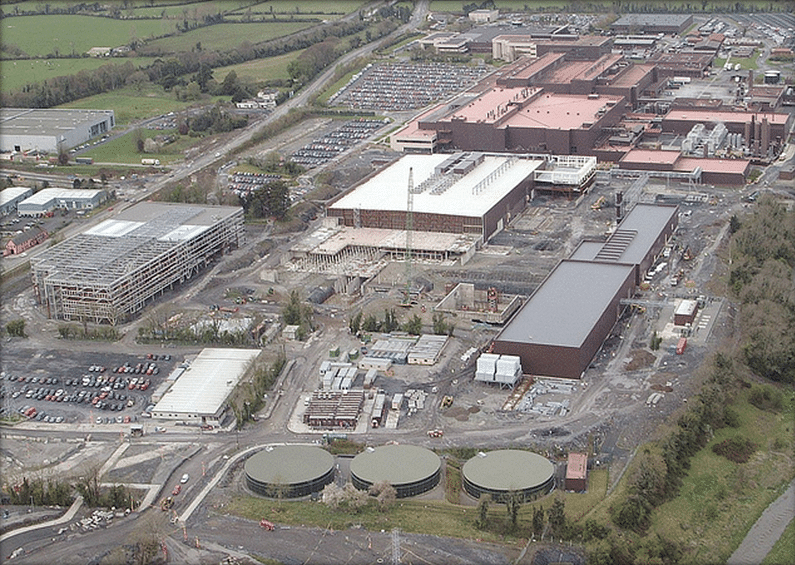

INTEL, IRELAND

US chip manufacturing behemoth Intel has indicated that investment in its planned European $20 billion semiconductor factory could be spread across several EU member states, Financial Times reported.

Much of the world is currently dependent on Taiwan and its dominant chip manufacturing giant, TSMC, to supply chips. But the island nation faces supply chain shocks and growing geopolitical concerns about China's expansionist designs — concerns that have accelerated U.S. plans to get TSMC and competitors to set up shop on U.S. soil too.

Intel also already announced expansion of the company’s semiconductor manufacturing capacity through two new fabrication factories in Arizona, U.S that will be set up at a cost of $20bn.

The new factories will commence production in 2024 and Intel’s foundry will offer a United States (US) and Europe-based alternative to Asian fab factories.

Intel currently operates four factories, called “wafer fabs,” in the United States. In addition to its site in Arizona, which is being expanded, it also has fabs in Massachusetts, New Mexico and Oregon. It also makes chips in Ireland, Israel and has a single fab in China.

Europe's Fab Factory Ambitions

Europe too is planning to reshore part of the manufacturing, including in a cutting-edge factory, or "fab," on the Continent.

If Europe wants to build a mega, cutting-edge factory, or "fab," it needs to attract at least one of the world's top three manufacturers — TSMC, the U.S.'s Intel or South Korea's Samsung — to invest roughly €20 billion in a new foundry.

EU Commissioner Thierry Breton is putting together a multibillion-euro plan for the semiconductor industry.

Breton has an expansive vision that aims to catapult Europe to 'technological sovereignty' in semiconductor domain by creating capability to manufacture ultra-sophisticated chips for smartphones, cloud computing and artificial intelligence.

"Europe must have this ambition," Bretton said, referring to plans to produce 2-nanometer chips — the industry's most advanced target — by 2030.

European Union aims to double the production of chips on its territory in order to increase its global share to 20%.

In April, Bretton met Intel’s Chief Executive Officer Pat Gelsinger to discuss the idea.

EU wants to mobilise a public-private funding to tune of €20 billion-30 billion to operationalise its semiconductor manufacturing ambitions

Gelsinger recently met French president Emmanuel Macron and Italian prime minister Mario Draghi to discuss the impact of global chip shortage.

"What we are asking from the American and European governments is to allow it (the project) to be competitive for us here compared to Asia, ” Gelsinger said in an interview with the Politico Europe.

Intel is reportedly seeking at least $9.7 billion in public subsidies towards building a semiconductor factory in Europe.

According to Financial Times, Intel is looking for a site in Europe with at least 1000 acres of land that can support up to eight chip fabrication facilities (popularly known as fabs) and provide access to talent pool.

Gelsigner had previously hinted that Germany might be a good location for a foundry.

“Geopolitically, if you’re in Europe, you want to be in continental Europe,” Gelsinger said during a press conference. “We think of Germany as a good candidate — not the only, but a good candidate — for where we might build our fabrication capabilities.”

Belgium, Luxembourg, and the Netherlands are also said to be candidate countries.

The EU is also said to be considering creating a semiconductor alliance including STMicroelectronics, NXP, Infineon and ASML to cut dependence on foreign chipmakers amid a global supply chain crunch.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest