Business

Explained: Disinvestment Of Pawan Hans And Why It Was Needed

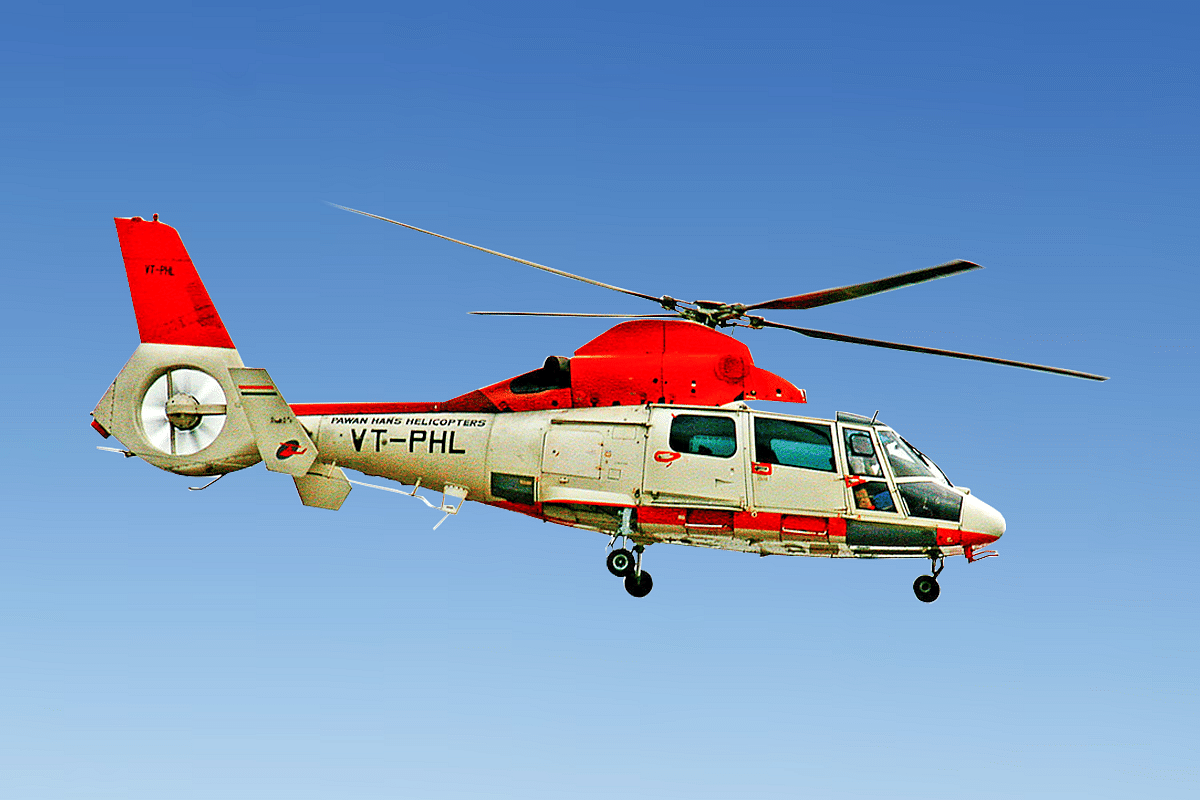

Pawan Hans helicopter

On 29 April, the government accepted Star9 Mobility's bid for its shareholding (51 per cent) in Pawan Hans Limited (PHL) and the transfer of management control.

Context: PHL is a 51:49 joint venture (JV) between the Government of India (GoI) and the state-owned Oil and Natural Gas Corporation (ONGC) providing helicopter and aero mobility services.

ONGC has earlier decided to offer its entire shareholding to the successful bidder identified in the GoI strategic disinvestment transaction, on the same price and terms as GoI.

This is the second successful privatisation in the domestic civil aviation space in the past six months after Air India was sold a subsidiary of Tata Sons in October 2021.

The Bid Story: Three previous divestment attempts starting 2016 were unsuccessful due to poor response from bidders.

The current transaction is the fourth iteration for which Expressions of Interest were invited in December 2020.

The Reserve Price for sale of 51 per cent shareholding of PHL was fixed at Rs 199.92 crore, on the basis of valuation carried out by SBI Capital Markets Ltd. and RBSA Advisors.

Star9 Mobility, a consortium of Big Charter, Maharaja Aviation and Almas Global Opportunity Fund SPC, emerged as the highest bidder quoting Rs 211.14 crore, which was above the reserve price. The other two bids were for Rs 181.05 crore and Rs 153.15 crore.

Big Charter operates regional airline Flybig. Maharaja Aviation runs a helicopter charter services.

Experts have said that the disinvestment of Pawan Hans would help in reinvigorating the industry.

Civil helicopter market in India: Helicopter services are now a vital component of civil aviation in India.

The usage of civil helicopters in India is mostly confined to logistic air support to offshore exploration, non-scheduled passenger service. Only a very small percentage is devoted to roles such as casualty air evacuation, airborne law enforcement etc. vis-à-vis developed nations, where the major helicopter deployment is in such areas.

There are around 239 civil registered helicopters in actual usage in India. Out of the total world civil helicopter population of 41,000, India accounts for less than 1 per cent.

The flagship helicopter service provider of the GoI, Pawan Hans has now evolved into one of Asia’s largest helicopter operators having an operational fleet of 42 helicopters at present with pan India presence.

The Pawan Hans Story: The firm started as Helicopter Corporation of India in 1985 and was renamed as Pawan Hans Limited in 1987.

Since its formation, PHL has logged more than 5.5 lakhs flying hours and over 25 lakhs landings and plans to become a 100 Helicopter company by 2027.

Off-shore operations, connecting inaccessible areas, charter services, search and rescue work, VIP transportation, corporate and special charters, hotline washing of insulators and Heli-pilgrims are some of the major services of Pawan Hans.

PHL has been awarded 13 routes under Regional Connectivity Scheme bidding and has commenced operations on 4 of them in the states of Himachal Pradesh, Uttarakhand and Chandigarh.

The Company is currently under the administrative control of Ministry of Civil Aviation.

Pawan Hans is in a bad shape. The keystone carrier of India’s diminutive civil helicopter industry has been grappling with a series of issues since its inception in 1985.

Amidst ageing fleet and depleting market share, the carrier reported consecutive losses in the last three years (FY-19, FY-20 and FY-21).

The fact that the company’s operations were heavily subsidised often led both central and state government agencies to award them contracts without bids resulting in compromises on price, quality and technical capability.

Ageing fleet: The Company has a fleet of 42 helicopters, of which 41 are owned by the company.

Out of these, five Dauphin N Helicopters which were over 33 years old, have remained grounded since long and approved as ‘impaired assets’. This brings down the effective operational fleet to 37.

The owned helicopters have an average age of over 20 years and three-fourths of them are presently not being manufactured by the original equipment manufacturer.

Due to the old fleet, cost of repair and maintenance has become high.

Losing market share: PHL provides most of its helicopters to institutional customers such as ONGC, other PSUs and state governments on a long term basis. However, the company has failed to maintain competitive position in existing markets, eroding its market share.

The service has been plagued by a plethora of industrial relation problems. This has resulted in business shifting to competitors.

Stipulation by some clients regarding vintage clause due to which the Company may not be able to participate in the tenders.

What they're saying: “Any privatisation is a good move as long as it doesn’t lead to a monopoly or cartelisation. Thus, the privatisation of Pawan Hans is good for the consumer and the country as it will help in expanding the market and increase competition," Captain GR Gopinath, the pioneer of low-cost aviation in India and founder of helicopter charters firm Deccan Aviation, told Business Today.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest