Business

Explained: Why The World Economy Is Slowing Down

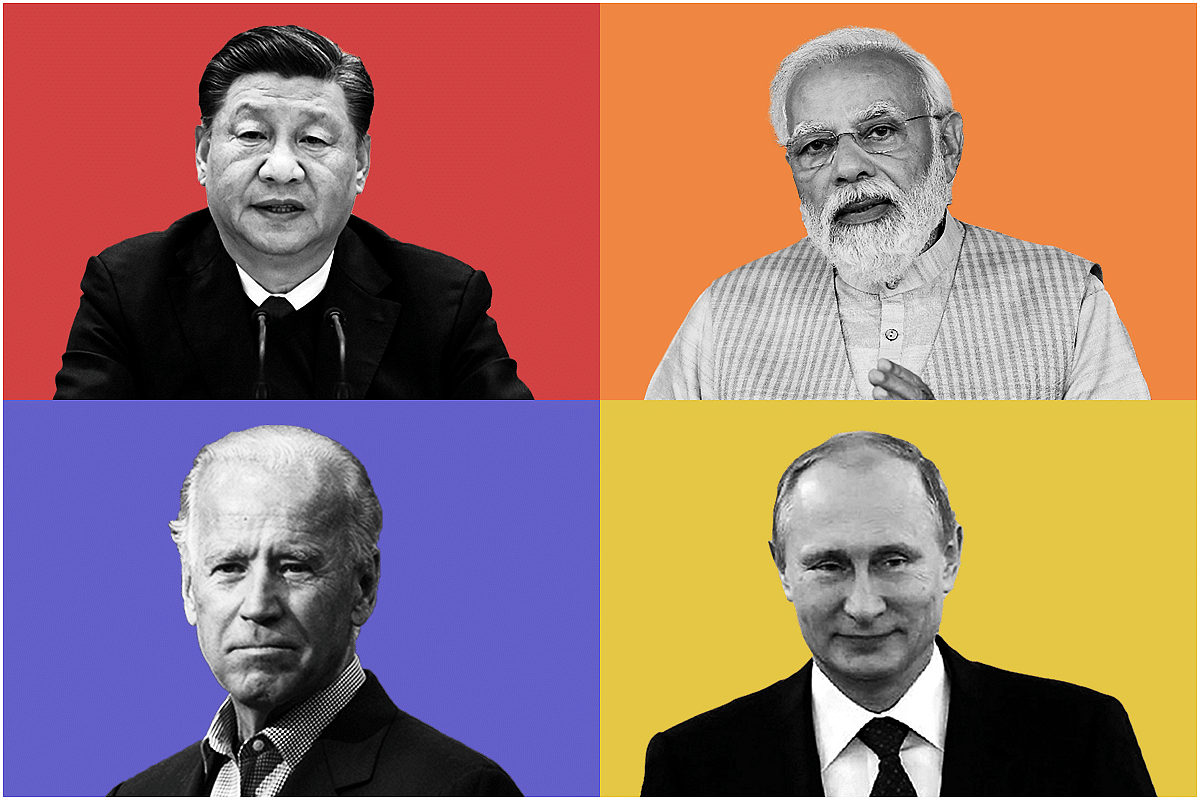

Chinese President Xi Jinping, Indian PM Narendra Modi, US President Joe Biden and Russian President Vladimir Putin

A recent OECD report has projected a subdued global economic growth in 2022.

The organisation projects the global economic growth rate at 3 per cent this year.

Further, the growth for 2023 is also projected to further slow down to 2.2 per cent.

In July, an IMF report had cut the projected world economic growth rate for 2022 to 3.2 per cent, 0.4 percentage points lower than in its previous April report.

Many factors, including the pandemic, Russia's war on Ukraine, rising global interest rates and China's zero-Covid policy, have contributed to the lowering of the global economic growth.

What's ailing the global economy?

The key factor slowing global growth, according to the OECD report, is the generalised tightening of monetary policy, driven by the greater-than-expected overshoot of inflation targets.

Further, Russia's invasion of Ukraine is dragging down growth and putting additional upward pressure on prices, above all for food and energy, as the the impacts of the COVID-19 pandemic still lingers on, as per the OECD report.

Another factor negatively impacting the growth is the slowing of Chinese economy, partly due to Beijing's strict zero COVID-19 policy that has disrupted global supply chains, as well as slump in the property market in China.

These and other factors are creating additional upward pressure on inflation and are weighing on global economic activity.

Rising inflation, falling global economy

The inflation was on an upward trajectory, hovering above central bank targets in most G20 economies, even before Russia's invasion of Ukraine, driven by the initial surge in energy prices as economies reopened after the pandemic.

Other factors adversely impacting the economy were bottlenecks in supply chains, rising freight costs and the shift in the composition of private consumption towards goods.

Following the invasion, the food and energy prices have escalated globally.

Now, the inflationary pressures are broadening out beyond food and energy almost everywhere, with businesses throughout the economy passing through higher energy, transportation and labour costs.

Broader inflationary pressures were already evident in the United States earlier in 2022, and this is now also being seen in the euro area, and to a lesser degree in Japan.

In response to inflation’s alarming rise, central banks worldwide are raising their core bank lending rates.

US Federal Reserve alone has revised the interest rates three times this year since March.

However, rate raises in most countries have not matched the pace of inflation.

Annual inflation to remain above central bank targets globally in near future

According to the OECD, with the global economic cycle turning and monetary tightening by most of the major central banks increasingly taking effect, headline inflation is projected to peak in the current quarter in most major economies, and to decline in the fourth quarter and throughout 2023 in most G20 countries.

Even so, annual inflation in 2023 will remain well above central bank targets almost everywhere.

More than half of the items in the price index show inflation above 4 per cent in the United Kingdom, the United States and the euro area, reflecting a sharp increase compared to a year before and more than doubling their targets.

Jobs, wage growth and inflation

Tight labour market conditions - with unemployment rates at or close to 20-year lows in many countries - are boosting wages and helping to mitigate the loss of purchasing power and growth.

However, this is also contributing to broad-based inflation. Wage growth has strengthened in many countries, particularly the United States, Canada and the United Kingdom, but not yet in the euro area.

With nominal wage growth failing to keep pace with inflation, household real disposable incomes have declined in many OECD economies, curbing private consumption growth.

Anti-Inflationary measures and fall of equity markets

Financial conditions have tightened as central banks have responded increasingly vigorously to above-target inflation, pushing up market-based measures of real interest rates.

Equity markets in much of the world have fallen sharply this year. Meanwhile, the US dollar has appreciated significantly, and the risk appetite of the investors has diminished.

Corporate bond spreads have risen, particularly in Europe, and capital outflows from emerging-market economies have intensified.

How will the world economy grow in upcoming year

The major global economies are expected to see their GDP growth declining this and the next year.

For the United States, annualised growth in 2022 is projected to be around 1.5 per cent, with the country's economy expected to grow at around 0.5 per cent during the latter half of 2022 and through 2023, as per the OECD report.

In Europe, many economies are likely to have at best weak growth in the second half of 2022 and the first quarter of 2023.

In China, policy measures to strengthen infrastructure investment, and a rebound effect from COVID-related restrictions this year, are expected to help growth recover to 4.75 per cent in 2023 after unusually weak growth of 3.2 per cent in 2022.

Indian economy is projected to slowdown from 8.7 per cent annual growth in FY22 to around 7 per cent in FY23, partly due to softer external demand.

However, India's economy still represents a rapid growth in the context of a weak global economy, as per the OECD.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest