Business

IUC: Should TRAI Listen More To Jio Or The Incumbents? Probably The Latter

- The incumbents need to be shown some indulgence so that competition does not reduce further due to huge bleeds on the balance-sheets.

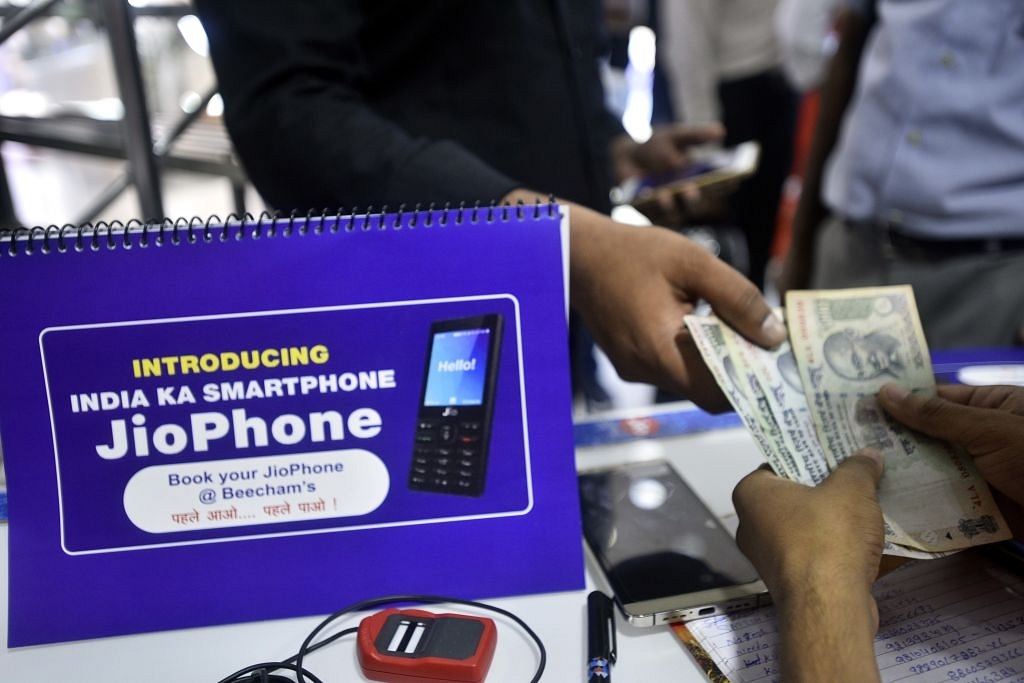

A customer at Reliance store for Jio phone pre-booking at Connaught Place in New Delhi. (Arun Sharma/Hindustan Times via GettyImages)

The battle between challenger Reliance Jio and the incumbents, Vodafone-Idea and Airtel primarily, is reaching a crucial stage, with regulator Telecom Regulatory Authority of India (TRAI) about to decide on whether or not to cut the interconnect usage charge (IUC). The chatter is that the rate will be cut.

The IUC charge is the money paid by the network where a call originates to the network where it terminates, and the rate per call is currently 14 paise.

The incumbents say this is below cost, while Jio claims that, on the contrary, the big boys have been making easy money when call volumes have gone through the roof. The incumbents are, in fact, collecting “excess charges”.

In a presentation made to TRAI some weeks ago, Jio said that IUC charges have risen from 10 per cent of voice charges to 45 per cent now, but this is more a function of the denominator: as voice call charges have fallen, it is logical that IUC as a percentage of total charges will rise. Jio’s calculation is that Airtel and Idea between them got excess recoveries of Rs 73,385 crore and Rs 45,940 crore so far.

The counter-point has been made by Vodafone in a submission to the telecom ministry. It warns that if IUC is cut, many rural telecom sites will have to be shut since they will become uneconomic. Business Standard quotes Vodafone Group chief executive office Vittorio Colao as saying: “The existing rate of 14 paise is already below cost. This damages the economic case for connecting rural areas because traffic is largely from urban to rural, with little call origination revenue in rural areas. Even at the present MTC (mobile termination charge) level, 15-20 per cent of our sites run at a loss. Any reduction in MTC risks large-scale site shut down of already unprofitable sites in rural India and this would greatly diminish the population coverage of mobile telephony.”

However, the truth may lie somewhere in-between. It makes commercial sense for both Jio and the incumbents to take maximalist positions – one for abolition and the other for retention of the existing rate – so that the final decision can be somewhere in-between.

TRAI will be pilloried as being on Jio’s side if it opts for zero IUC, but if it retains the charge at the current level, it will be seen as anti-consumer, though consumers are not complaining when it is raining freebies and tariff cuts due to the entry of Jio.

But there are some broader considerations that should guide the regulator’s decision.

One, with the incumbents on the ropes, it does not make sense to allow them to bleed even more, since Jio seems to have more resources than them for the moment. Already, there are only five serious players left – Airtel, Vodafone-Idea, Reliance Communications, Jio and BSNL. Tatas are looking to sell if they get a good deal. Reducing competition by forcing even more mergers means two years down the line there will be an oligopoly ruling the telecom market. Not a good situation to be in.

Two, while the balance-sheets of the incumbents are visible and can clearly show the extent of the bleeding, Jio’s profit-and-loss account is opaque, hidden in a sea of equity pumped in by parent Reliance Industries. In fact, since accounting rules allow a company to capitalise its operational expenses till a project is deemed complete, it means we don’t know how much of Jio’s tariffs are related to the actual costs of providing the service. The right time to take a full call on IUC is when you know whether Jio’s tariffs flow from genuine competitive edge, or merely high subsidies from its other businesses.

Three, at some point, once market shares settle, IUC should be decided not by the regulator, but through commercial arrangements between all operators. The regulator should step in only if the big boys try to create an oligopoly or try to kill competition by restrictive practices.

For now, the bottomline is this: the incumbents need to be shown some indulgence so that competition does not reduce further due to huge bleeds on the balance-sheets.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest