Business

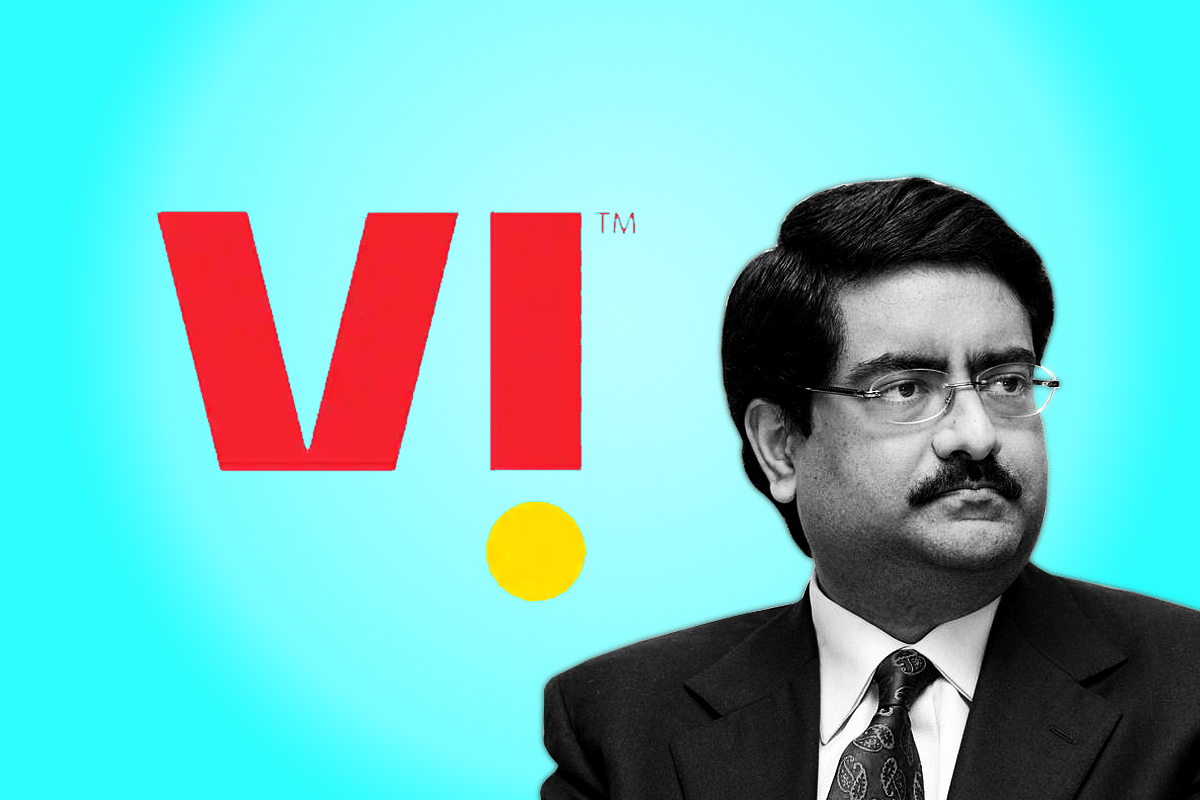

Kumar Mangalam Birla Dials The Wrong Number

- Between Birla's Idea and the foreign entity Vodafone, it seems to be a case of marrying in haste and repenting in leisure.

Kumar Mangalam Birla.

The government has taken the first step forward in smoking the peace pipe with telcos in particular and foreign investors in general by magnanimously withdrawing the retrospective tax amendment to income deemed to arise in India insofar as capital assets are concerned; thus sparing Vodafone of a whopping liability of Rs 22,000 crore.

Kumar Mangalam Birla had thrown in the towel following what he said was the throwing in of the towel by his foreign collaborator Vodafone.

Vodafone UK apparently refused to throw good money after bad in the Indian joint venture Vodafone Idea (VI) in which Birla’s Idea is a junior partner with a 27 per cent stake as opposed to the 44 per cent stake held by Vodafone UK.

It is, however, not clear if he was speaking on behalf of Vodafone as well when he offered the telecom company gratis to the Indian government in order to keep it a going concern.

“India will now become the 26th country where Vodafone has operations, covering across five continents and 40 partner networks with over 200 million customers worldwide”, proclaimed Vodafone in September 2007 on entering India on the back of an acquisition of 67 per cent stake in Hutchison Essar through a convoluted deal — consummating the acquisition of majority stake in a company incorporated in the dubious Camay Islands.

It seems to have been an inauspicious beginning as the Indian government has not taken kindly to its deviousness in protecting its predecessor Hutch from capital gains tax in India.

Hutch thumbed its nose at the Indian taxman and Vodafone played ball by not deducting tax at source. That act of bravado had pitted it against the Indian government in an adversarial relationship.

However, international arbitrators at The Hague had stayed the Indian government’s demand of Rs 22,100 crore, including interest on capital gains vicariously payable by Vodafone on behalf of Hutch. Now as stated in the beginning, that painful chapter is over, and VI can now look forward with greater optimism. Now the ball is in its court, particularly Vodafone’s.

“Vodafone UK has revealed a mammoth £6.6bn annual loss and has cut shareholder dividends for the first time” was the screeching headlines in 2019. Last year, it blamed the pandemic for its dwindling fortunes — thanks to pandemic people have stopped stirring out thereby affecting its roaming charges — it bemoaned. Can a company’s revenue model be so precariously perched?

Back home in India, its tower-added-every-hour campaign in 2019 seems to have fizzled out. It was voted the worst telecom service provider in the UK for the sixth time in a row in 2020. How did Kumar Mangalam Birla merge his Idea Cellular with Vodafone in 2018 when he ought to have dug deep and found out Vodafone’s limitations?

Alas, it has proved to be a case of marrying in haste and repenting in leisure. Vodafone in addition seems to have behaved like a fair weather friend.

Birla should have badgered his foreign collaborator instead of dialling the Indian government with a dramatic request for takeover. Perhaps, his shareholders agreement with Vodafone was weak. At any rate, he should have known that the Indian government is set on the path of privatisation. So, nationalisation of Vodafone-Idea (VI) in such a milieu is hardly on cards.

Moreover, BSNL is caught in a time warp offering 2G services whereas the world has leapfrogged to 5G. Apart from technological incompatibility, cultural, HR, customer orientation and other incompatibilities galore would drive the unwieldy combine into a deeper morass.

His proposal to offer his stakes to the Indian government might be borne of frustration and might even be an indictment of Indian government’s avaricious telecom policy — viewing it as a milch cow, nay, the hen that lays golden eggs by pitching its revenue share as well as spectrum fees high.

In hindsight, the telcos seem to have jumped from the fire into the frying pan when they migrated to the revenue share model from the upfront license fee model in 2001. Little did they know that they would be condemned to stew in their own juices by the Supreme Court when it repeatedly refused to strike down the avaricious DOT definition of adjusted gross revenue (AGR) that took into its fold both telecom related and non-telecom related revenue.

The Supreme Court, which protected the oil majors like GAIL and OIL India from such overreach that otherwise would have resulted in DOT getting a sliver of oil revenue, did not strangely apply the same rationale to the telcos. In the event, as much as 50 per cent of VI’s outstanding revenue share of about Rs 50,000 crore is on account of the warped definition of adjusted gross revenue.

So Birla’s ire is both with the Indian government and his foreign collaborator. A government with no body to be kicked and soul to be damned has always been an easy target for everyone, though admittedly it has to bear a part of the blame for the telecom mess. However, the discerning observers would turn around and say if Airtel and Reliance JIO could survive, why not the much-vaunted VI.

In any case, the government has made some amends to its rigid stand by withdrawing the retrospective amendment that had riled Vodafone no end. The ball is now in Vodafone’s court, though the Indian government can do more by submitting before the SC that the DOT had indeed gone overboard in its interpretation of AGR and the government is prepared to show magnanimity on this front too.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest