Business

Why Is IRCTC A Big Hit Among Investors, Despite It Being A PSU?

- The company had listed in October 2019 with an initial public offering price of around Rs 315 per share.

- Since then, the stock has multiplied 20 times within two years.

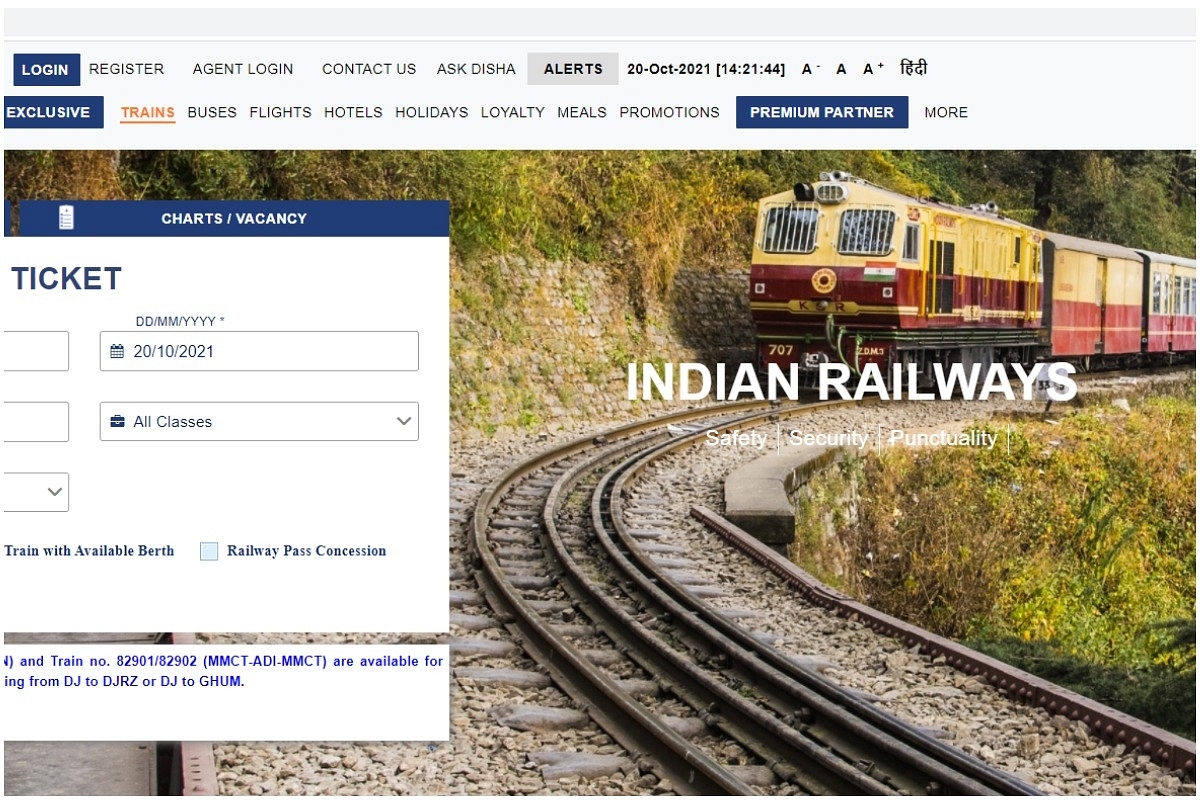

The new IRCTC website

Exactly within two years of its listing, Indian Railway Catering and Tourism Corporation’s (IRCTC) market capitalisation hit the Rs 1 lakh crore mark, before hitting the 15 per cent lower circuit.

The company had listed in October 2019 with an initial public offering price of around Rs 315 per share. Since then, the stock has multiplied 20 times within two years.

Other public sector companies that have crossed the 1 lakh crore market cap milestone include behemoths like State Bank of India, Power Grid, Indian Oil, Bharat Petroleum, National Thermal Power Corporation, SBI Cards, and Bharat Petroleum Corporation Limited.

In contrast to the price rise, IRCTC’s business is still struggling with the effects of the pandemic. So far, the company has reported quarterly revenues that stand at 30-40 per cent of the pre-pandemic levels.

Its revenues stood at Rs 2,353 crore for the financial year 2020, putting its current valuations around 42 times its pre-pandemic sales and at 170 times the pre-tax earnings for the same period.

The investor optimism around IRCTC appears to be a function of the optimism around Indian technology companies, especially businesses that operate a platform.

Technology businesses, as a group, have seen their valuations rise rapidly in both public and private markets. India has seen a stream of start-ups turn into unicorns, and almost all of them are unprofitable.

In contrast, IRCTC’s main businesses — online ticketing platform and catering — are highly profitable monopolies.

In addition, IRCTC might also be given additional power as the government looks to rationalise operations and shut/merge government bodies. Principal economic advisor, Sanjeev Sanyal, has recommended that IRCTC be responsible for activities such as ticketing, freight invoicing, train operations, management of train crew, and management of fixed/rolling assets.

IRCTC had also emerged as the only bidder for some areas for the private train operations. Its experience in operating private trains allowed it to gain an advantage over other competitors.

Nevertheless, investors should keep in mind that IRCTC has not created a natural monopoly, and that its market position is the result of the government’s regulations.

Natural monopolies include gas distribution companies, electricity grid companies, marketplaces and other specific areas where monopolies come up organically without government intervention.

IRCTC’s monopoly remains a double-edged sword as it must follow the government’s mandates, irrespective of the effects on the business. Unlike other monopolies, IRCTC cannot extract more money out of customers due to constraints put on it by the government.

In the past, the company had seen its revenues being affected by the government’s actions.

For instance, in 2016, the government abolished service charges to promote digital payments. The service charges were Rs 40 for air-conditioned coaches and Rs 20 for non-air-conditioned coaches.

For IRCTC, abolishment of service charge meant letting go of around 26 per cent of its revenues. Again in 2019, the government brought back service charges, though at a lower rate of Rs 30 for AC and Rs 15 for non-AC coaches.

To be fair, the government did reimburse a part of its expenses during the period, but that did not improve its position by much.

In addition to the Catering Policy 2017, the government had granted IRCTC the monopoly to run catering establishments on railways stations and inside trains.

The consolidation allowed the catering revenues to go from 25 per cent of total revenues to 54 per cent of total revenues within a period of two years.

The company took over restaurants, food courts, kitchens and other catering establishments in the Indian Railways ecosystem. The high growth rate in recent years is quite possibly a result of the positive policy action, rather than any organic initiatives.

Other PSUs trade at a discount to the general markets due to the governmental ownership. In the past, the government has used PSU coffers to overcome fiscal deficits. In IRCTC’s case, the government is directly responsible for setting prices and other activities, yet it continues trading at a high premium.

The dependence of the governmental policies on the company’s revenues is clearly visible. Luckily for IRCTC investors, the government has not introduced any adverse policy so far since the company’s listing. By most metrics of valuation, the stock appears to be priced to perfection, if not overpriced.

The market expects IRCTC to grow at a rapid pace over the next few years. But if an unfavourable government policy or any other roadblock hits it, the stock might underperform. IRCTC has been a favourite of retail investors, and any devaluation could adversely affect them.

IRCTC’s valuation indicates the government’s inability to price an IPO correctly. The government left too much money on the table during the IPO. The government could divest its stake in the company, and exit with a handsome return.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest