Business

Why We Must Stop Obsessing About The Daily Wealth Of Ambani And Adani

- We have needlessly made Ambani and Adani bywords for excess wealth, and thus targets of political grand-standing.

- The media needs to stop obsessing about stock market wealth calculated on a minute-by-minute basis. It distorts reality.

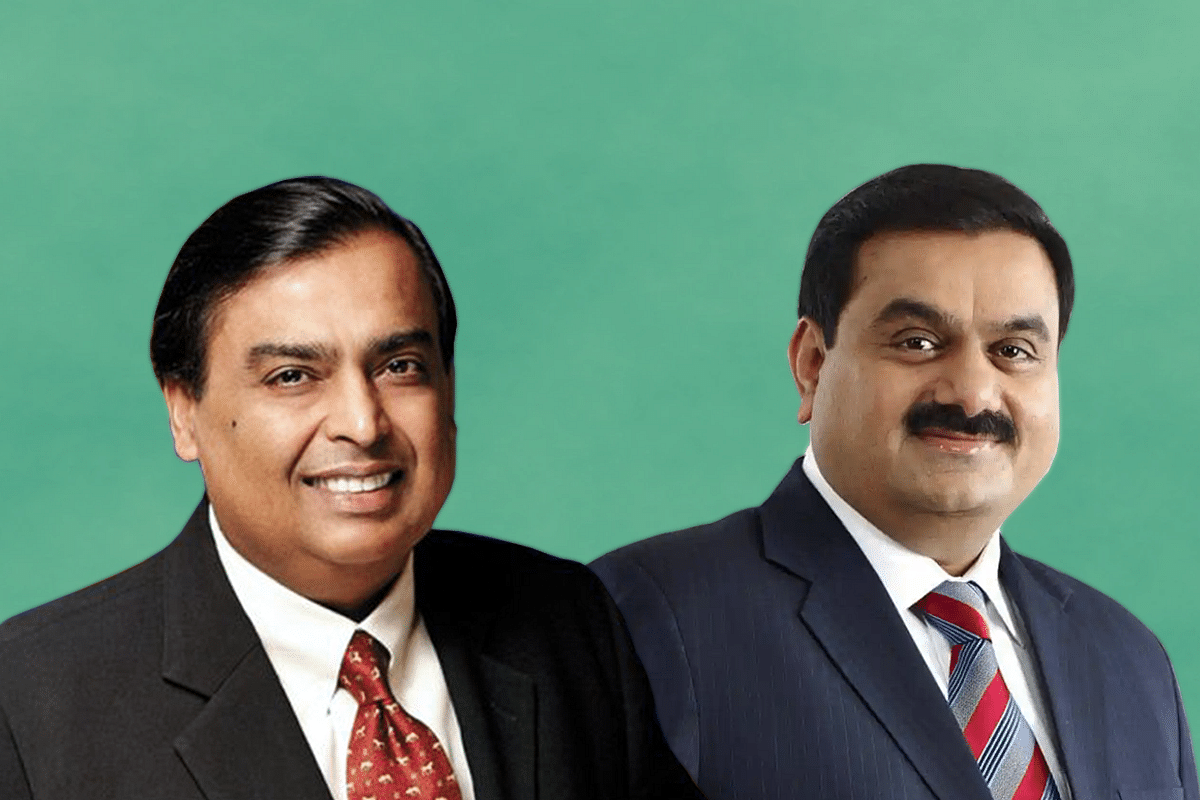

Mukesh Ambani and Gautam Adani.

A few days ago, newspapers headlined a fleeting reality: that Gautam Adani had overtaken Bill Gates to become the fourth richest man in the world. His wealth was calculated at $116 billion by Forbes magazine. This may make for a great clickbait headline, but is nowhere close to reality.

Forbes calculates a billionaire’s net worth based on stock market prices in real time, every five minutes when the relevant markets are open. It is as likely that Adani will lose multiple billions if his stock prices fall by 10 per cent during a bearish month, or rise by similar amounts when the bulls are going crazy.

Let this sink in: the market price of a share is not only decided by a company’s underlying profitability, but by the level of liquidity chasing shares and other assets. If the US Fed, or the Reserve Bank of India, for that matter, were to open the liquidity taps for whatever reason (a major recession, or a drastic fall in employment), Adani’s wealth could soar again. It takes only a recession or two to raise stock market prices, as we have seen continuously since the 2008 global financial crisis. In short, this kind of wealth is directly related to central bank policies.

But that’s not all.

When personal wealth is calculated largely based on stock market valuations, it may disguise the underlying negatives, including the amount of debt raised by a company, or lack of free cash flows. In the digital age, where valuations are often determined by expectations of future profitability based on (wild, often flawed) assessments about how fast 'free' customers can become paying ones, this way of calculating wealth is problematic. Zomato, a food delivery chain, saw its share fall all the way from a high of Rs 169 to Rs 43 today (27 July), a 75 per cent drop. Its IPO happened in July 2021.

Secondly, not all shares held by a businessman can easily be converted to cash. Two reasons why: one, if a businessman or his family are seen selling their shares, investors will panic and make the share crash in no time; and two, a lot of these shares are held for reasons of control of a company.

Mukesh Ambani may hold more than 50 per cent in Reliance, whose current market capitalisation is over Rs 16 lakh crore. Half of that would be Rs 8 lakh crore, which is part of Ambani’s 'net worth' in this one company alone. But Ambani will not sell these shares, unless he is exiting all his businesses or dividing it among his inheritors for some reason. In short, a large portion of this wealth is paper wealth, unrealisable in most cases for genuine businessmen who want to own and run their businesses their way. At most he can pledge his shares to raise loans from banks.

The last and final reason why we should not obsess about our market billionaires has nothing to do with what happens to their wealth. The more we talk about wealth of mind-boggling proportions, the more it leads to public envy and bad taxation policies. There will be loud cries about taxing this wealth and using it to feed the poor or addressing inequality. If this is done, the wealth will diminish automatically, for underlying these valuations are assumptions about the innate profitability of these companies.

We have needlessly made Ambani and Adani bywords for excess wealth, and thus targets of political grand-standing. Wealth and job creators should not be targeted this way in any economy that wants to raise its people to middle income status.

What we should do is encourage the wealthy to leave the bulk of their wealth for charity once they pass away. Gautam Adani has pledged to spend $7.7 billion of family wealth for social causes. Three years ago, Azim Premji pledged $21 billion for charity. As Indian businessmen become richer, more of them will automatically do so.

That, and an inheritance tax with generous exemptions, is the way forward. The media needs to stop obsessing about stock market wealth calculated on a minute-by-minute basis. It distorts reality.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest