Commentary

Looking at Liquor Policies in India

The recent bunching up of hooch tragedies brought to attention liquor policies in India. There was an article in The Hindu on AP liquor situation and some brief discussions in Twitter before the Kushwaha issue got pushed as the burning national issue. Moral and possible Gandhian considerations have consistently pushed this component of public policy debate to the edges.

Many prefer to ignore or pretend that this issue does not exist (because it affects only the wicked?). Policy making falls between two stools of morality and revenue maximisation, ending up compromising both.

If anything drinking is on the increase, and, estimates of tax evasion are huge! Total central excise collection for all goods in 2009-10 was just over Rs 100000 crores. As against this excise collected on liquor by states is estimated at well over Rs 30000 crores. But the level of deliberation and discussion in such an important consumption item is shrouded – in the mist of Gandhian morality?

Interestingly, this does not seem to have been the case historically!

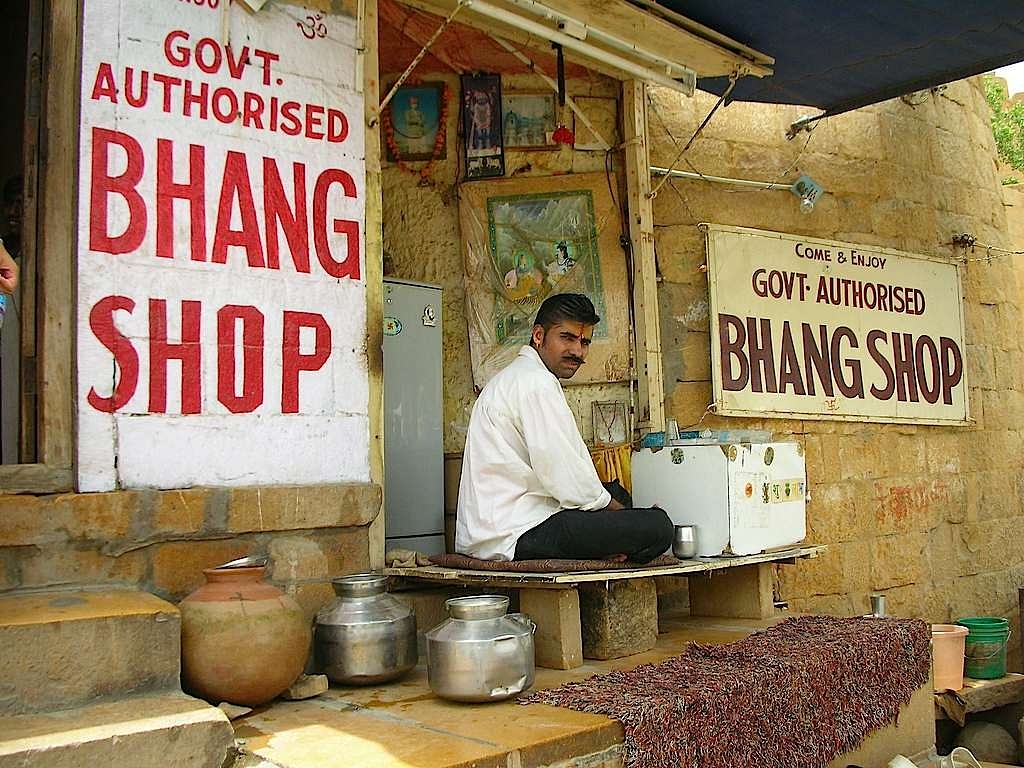

Alcohol use does not seem to have posed a significant health or social problem in ancient or medieval India (an interesting link from the Asia Pacific Alcohol Policy Alliance) From what the author in that linked document states, ancient India knew where to draw the line! Modern day Governments certainly do not! Under the guise of revenue maximisation, Tamil Nadu Government runs liquor shops. In essence the marketing arm of the government company constantly seeks ways and means of promoting its wares! It prevents people from tapping toddy from coconut palms and arresting those who have done this for generations.

At the other extreme is the government in Gujarat implementing its version of promoting temperance – forget moderation, one has to get a medical permit, effectively demeaning oneself certifying that he / she is an alcoholic to legally access alcoholic drinks of any strength. From the relevant rules:

“If any person in the State for the maintenance of his health needs the use of foreign liquor, he has to get the application form from the District Prohibition and Excise Officer by paying Rs. ISO/- and has to go to the concerned Area Medical Board (Civil Surgeon) for Medical check up.” (link).

The possible objectives of both revenue maximisation and temperance are being thus met!Indiasurely deserves better! Policy issues involved should be debated, and not just when there is a liquor tragedy.

First of all the State should explicitly rework its objective as Temperance and not Prohibition. Article47 inthe Directive Principles enjoins the State to bring about “prohibition of the consumption except for medicinal purposes of intoxicating drinks and of drugs which are injurious to health.” Ideally this should be redefined or the ‘injurious to health’ part clarified. In the current milieu, this still need not be a constraint – let us remember that Directive Principles also call for implementation of a Uniform Civil Code.

Second, the objective of revenue maximisation should be replaced with systematically plugging revenue leakages. Having decided this, it should focus on collecting the same as efficiently as possible and not strive to a) take over whole supply chains, or b) auction revenues (where a dealer bids to provide a certain revenue amount, and the highest bidder wins the right to sell liquor in a particular area / vend.) The former places the state as a liquor seller. If it becomes the policy of the government to take over all businesses where revenue leakages occur, then we will find it running many more businesses! The latter’s implications are worse. The auction amounts are so high that it is often impossible to run the business legally. Prices are inflated or spurious liquor is sold to recover costs.

The State is certainly not obliged to make available cheap liquor for those who want it, but it should also make the category suffer a rate of taxation appropriate say to an occasional indulgence, rather than savage rates of 400%! (Source: The Hindu news item referred earlier).

Third, free the sector from over-politicisation. Everything in this sector from production to retail is directly linked to political connections. The situation suits everyone except the Consumer and the honest taxpayer – ironically the two stakeholders that keep the business going! In today’s milieu it may be naïve to expect zero linkage between business and politics, but shall we call for a situation where this sector is just as bad or as good as any other business? Exact scope of this will of course vary from state to state, depending on where the starting point is.

The State should focus instead on – a) product standardisation and compliance, b) plugging revenue loopholes, and c) promoting temperance campaigns including coming down on public (drunken) behaviour, drunken driving.

Clarity in policy can also lead to intelligent management of the objectives. For instance everything from light beer to country arrack is treated with the same policy stick. Instead, how about keeping beer with less than 3.5 % alcohol content outside the purview of strict prohibition rules (i.e. treating it like a normal beverage) in exchange for a higher rate of taxation?

Conflating moral issues with fiscal possibilities by the State can lead to dangerous policy decisions. For now liquor policy has just resulted in the State doing what it can to get its subjects drunk. The moral dimension clouds the challenging of this by the general public – possibly as the negative effect of policy is expected to affect only the wicked.

If this is acceptable and fiscal possibilities alone determine policy as long as the affected are perceived as only the wicked, why should the State then not enter prostitution, gambling, and drugs? The funds generated can be ploughed into ‘anti poverty programs’?

Policy corrections are necessary!

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest