Economy

A ‘Jugaad’ GST Is Okay At This Stage; Modi Government’s Flexible Approach Is Right

- What Arun Jaitley is trying to do is get a reasonable GST regime passed in order to overcome political and economic hurdles.

- So a “compromised” or “jugaad” GST is acceptable at the outset.

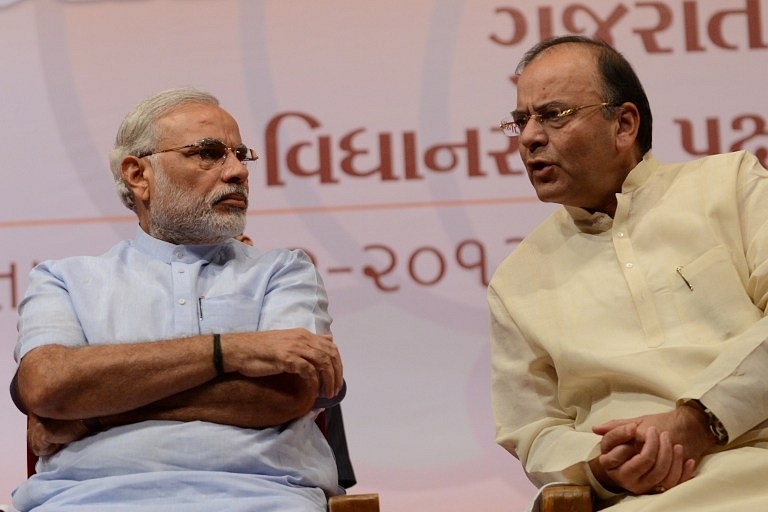

Narendra Modi And Arun Jaitley

The National Democratic Alliance (NDA) government’s flexible and cautious approach to evolving a consensus on the goods and services tax (GST) at a recent meeting of the GST Council is the right one. The meeting, held on 18-19 October, did not immediately lead to agreement on every issue, but it did move ahead, with states seeking time to study the government’s proposals on rates.

The main differences, yet to be bridged, comprise not only tax rates, but the funding pattern for compensation and the division of oversight powers between centre and states, reports Mint newspaper. This is not surprising, for GST effectively moves indirect taxation away from the comfort zones of both the centre and states, the legislation being a voluntary ceding of tax sovereignty by both. To expect any of them to be immediately thrilled about sharing power in the GST Council was unreasonable. One should expect some disagreements to remain even at the next meeting scheduled for 3-4 November.

The centre’s proposals on tax bands involve five rates, including two “standard” rates of 12 per cent and 18 per cent. Below these two “standard rates” are two more rates, a merit rate of six per cent, and a specific rate of four per cent for gold, and a non-merit rate of 26 per cent above the standard rates. Over and above this, there is a proposal to levy a cess on sin goods (tobacco, et al) and ultra-luxury products.

Prima facie, such a cess is a bad idea, because GST is meant to reduce extraneous levies (cess, octroi, entry taxes, et al) and make taxation simpler. But the cess is being justified on the ground that it will be used to compensate states for any loss of revenues after GST is implemented. Presumably, it will remain for the five years in which states have been promised compensation.

The multi-rate GST and the cess have been roundly criticised in many quarters, with one pink newspaper calling this a “compromised GST” and another newspaper a “regressive approach.”

These are valid criticisms, but not the right ones to make at this stage of consensus building. What Arun Jaitley is trying to do is get a reasonable GST regime passed in order to overcome political and economic hurdles. So a “compromised” or “jugaad” GST is not unacceptable at the outset. After gaining some experience with its implementation, it can be steadily improved.

Each one of the compromises can be politically justified, if not economically, and the GST is nothing if not a political process.

First, the decision to have two standard rates is sensible, since it will allow the government to push goods and services currently attracting lower rates to the 12 per cent rate first and then to 18 per cent. Pushing everything to 18 per cent would have been economically disruptive. Adopting two standard rates allows the government to meet the Congress demand for an 18 per cent ceiling on the standard rate, and promise a slightly negative (0.06 per cent) impact on consumer price index (CPI) inflation.

Second, the big uncertainty with GST is that one can never know how revenues will respond to goods or services that enter higher or lower slabs than at present. Since we cannot know the elasticities of demand for thousands of goods and services, trying out multiple rates is one way of finding out. The ideal “standard” rate, and the merit and non-merit rates can only be established after a period of trial-and-error. Based on experience, the rate bands can be narrowed or even eliminated to converge around a single standard rate.

Third, the cess is a bad way of garnering resources for compensation. It would have been far better to have a super-high GST rate of, say, 50 per cent for a small number of sin goods or super luxuries (BMW cars, SUVs, etc). But if one considers the issue from the centre’s point of view, a separate cess makes sense since it safeguards the fiscal roadmap. If there is no additional revenue to take care of contingencies in the short run, the only way to compensate states would have been an increase in the fiscal deficit (or adoption of a standard rate above 18 per cent). When the compensation obligation is one-way – centre to states – surely the centre must have the last word on this. Any other kind of tax would anyway be shared between centre and states.

Perhaps the best compromise would be to keep the cess proposal as an enabling provision, and adopt a 40-50 per cent rate for sin goods, et al. Some leeway on fiscal deficit slippages in the initial two years would also be acceptable. Some slippages in the effective date of implementation to mid-year in 2017 can also be expected. Everyone needs time to adjust, and this is not time wasted.

As we have noted before, GST is a journey, not a destination. When path-breaking reforms are undertaken, it makes no sense to make the best the enemy of what is passable or good enough. Ideal situations can be conceived in a heaven where only economists reside.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest