Economy

Adani-Hindenburg: Why Supreme Court Committee Is The Right Idea

- Not only does the formation of an expert committee promise a thorough investigation into the Adani-Hindenburg matter, it also sets the stage for potential reforms that could fortify India's financial markets against future attacks

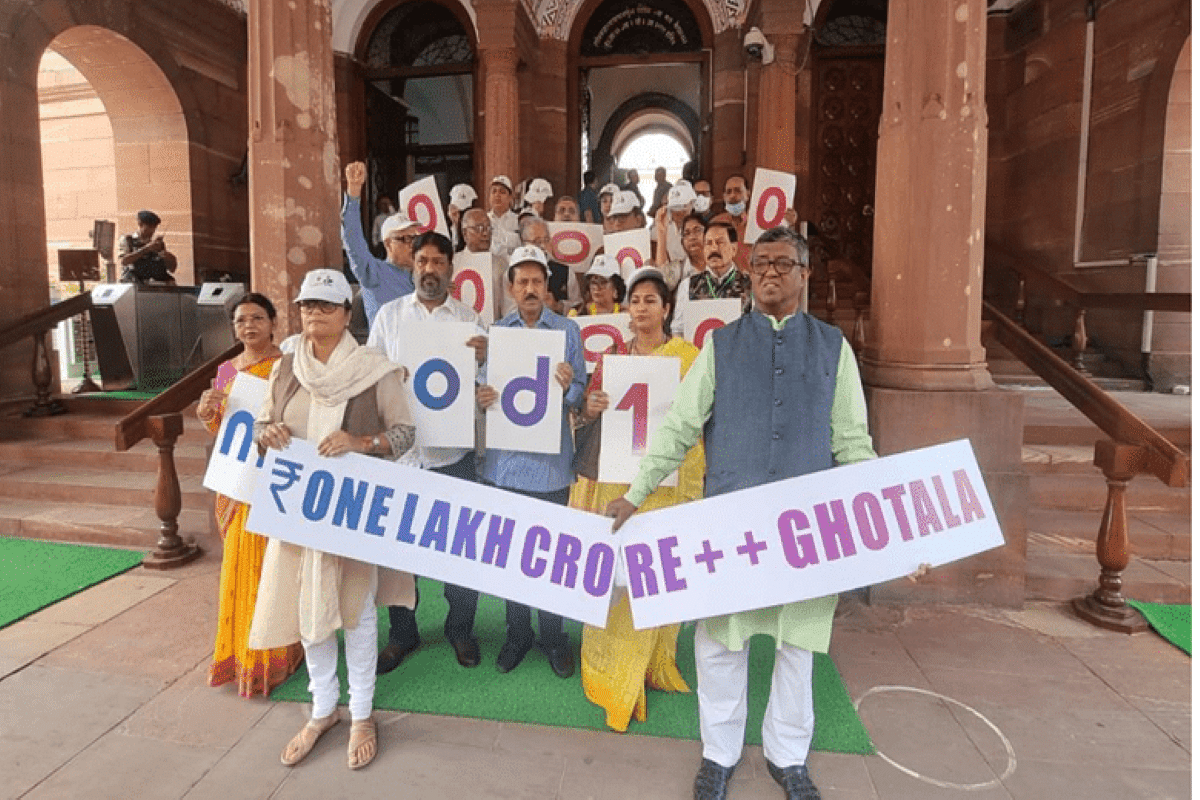

Trinamool Congress members protest outside the Parliament, demanding Adani's arrest. (Twitter).

The Indian financial landscape has been rocked by the recent controversy involving Adani Group and Hindenburg Research, a U.S.-based short-seller.

The spat, one of the most contentious in recent memory, sent shockwaves through the Indian investment community, leading to volatile swings in the market and significantly impacting investor sentiment. Hindenburg Research, known for its aggressive short-selling and damning investigative reports, published a report on January 24, alleging financial irregularities within the Adani Group. This report led to a severe dip in Adani's shares, causing significant losses for investors.

Short selling is a common practice in the stock market, where traders bet against a company's stock, predicting that the price will fall.

In this case, the short-seller borrows shares and sells them in the open market, planning to buy them back once the price falls. If the stock's price does fall, they can buy back the shares at a lower price, return the borrowed shares, and pocket the difference. However, this strategy can cause panic among small investors who may lack the resources or the understanding to weather such financial storms.

In the case of Adani and Hindenburg, the latter's report caused just such a panic, leading to a sharp drop in Adani’s share prices.

Short sellers, including Hindenburg, profited immensely from this plunge, while small investors bore the brunt of the losses. The role of foreign research firms in manipulating market sentiments for personal gains raises ethical and regulatory concerns.

Supreme Court and such controversies:

The Supreme Court of India has time and again stepped in and resolved issues in the right direction in a lot of matters in the past.

In response to the market turmoil and the potential regulatory implications of the situation, the Supreme Court of India took a proactive stance. Recognizing the need for a comprehensive, expert-driven investigation, the Court set up a high-profile committee.

The committee comprises an illustrious group of professionals, each an expert in their respective field, and is tasked with examining the allegations and the existing regulatory framework.

The committee is headed by former Supreme Court judge Justice AM Sapre, a seasoned legal professional with a rich history in the Indian judiciary. He is supported by OP Bhatt, former chairman of the State Bank of India; Nandan Nilekani, co-founder of Infosys; KV Kamath, former chief of the New Development Bank of BRICS countries; Justice JP Devadhar, retired Judge of the Bombay High Court; and Somasekhar Sundaresan, a prominent lawyer with expertise in regulatory issues.

Each of these committee members brings with them a wealth of knowledge and experience. For instance, Nilekani has played a pivotal role in transforming Infosys into a global leader in the technology industry and was the driving force behind the implementation of Aadhaar, India's unique identification project.

Kamath, on the other hand, brings a deep understanding of banking and infrastructure financing, having led the National Bank of Financing Infrastructure and Development (NaBFID) and the New Development Bank of BRICS countries.

Despite the stellar credentials of the committee members, they have come under attack from certain quarters.

Critics have questioned the independence of the committee and its ability to deliver an unbiased verdict. This is unfortunate, as it undermines the credibility of the committee even before its report is submitted to the Supreme Court.

It is worth noting that the Supreme Court's decision to form an expert committee, (instead of a Joint Parliamentary Committee (JPC) demand from the opposition), is a step in the right direction.

The primary advantage of an expert committee over a JPC is the former’s relative insulation from political influences. While a JPC comprises members of Parliament and thus may carry the risk of partisan influence, an expert committee is formed purely on the basis of the professional competence of its members. This allows for a more objective, knowledge-based examination of the issues at hand.

It's this very aspect of neutrality and expertise that makes such committees a preferred choice in handling complex, technical matters that require a deep understanding of the subject. The Supreme Court's choice of an independent expert committee also demonstrates a commitment to ensure an unbiased and thorough investigation. By putting the matter in the hands of experts from diverse backgrounds, the Court has ensured that the investigation will be comprehensive, leaving no stone unturned.

Furthermore, history has shown that expert committees have been instrumental in shaping financial markets and market regulation in India, protecting investors, and maintaining the integrity of the financial ecosystem. One such example is the Narasimham Committee on Banking Sector Reforms. The recommendations of this committee in the 1990s played a crucial role in reshaping India's banking sector, bringing in much-needed transparency, accountability, and efficiency.

Similarly, the Raghuram Rajan Committee on Financial Sector Reforms (2008) proposed far-reaching reforms to enhance financial inclusion and protect consumers. Its recommendations on financial literacy and consumer protection have had a profound impact on investor awareness and protection in India.

The Supreme Court has stood the test of time when it comes to maintaining and building credibility of its own. It is one of the most credible organisations in India today.

The SC was the one which dealt with the 2G Scam, Coal scam and even unravelled the truth of the so called “Rafale Scam”. The Supreme Court of India has upheld the law of the land.

In my opinion, if these “scams” would have been taken up by say a Joint Parliamentary Committee, the truth would have never seen the light of the day. It would have gotten buried under heaps of documents in some corner government office which would catch “fire” one fine day. It is indeed sad to see people attacking our institutions day in and day out to get back at their political opponents.

Mandate of the Committee

In the current scenario, the committee set up by the Supreme Court has a broad mandate. Its terms of reference include providing an overall assessment of the situation, suggesting measures to strengthen investor awareness, investigating potential regulatory failures, and recommending ways to bolster the statutory and regulatory framework for investor protection.

Despite the task's complexity, the committee's members are equipped with the requisite skills and expertise to navigate the labyrinthine world of financial regulation. Each member brings a unique perspective to the table – from understanding the nuances of banking operations to dissecting the intricacies of corporate law and dissecting the dynamics of technological innovation in the financial world.

The committee's work is especially critical in the current context, as it concerns not just the fate of one corporate group or the findings of a foreign research firm, but the larger issue of investor confidence in India's financial markets. Its findings could potentially set the tone for future regulatory norms and establish a precedent for how allegations of this nature are handled in the future.

While the Adani-Hindenburg controversy has indeed cast a shadow over the Indian financial landscape, it's important to remember that it has also provided an opportunity – an opportunity to strengthen the regulatory framework and protect the interests of investors.

It has exposed potential vulnerabilities in the system and highlighted the need for vigilance and robust checks and balances.

Attacks by such foreign institutions profiting from small investor misery needs to be tackled that too just on the basis of a document which were just allegations. Such manipulative reports which make one seem guilty until proven innocent cause havoc in the markets.

In the world of finance, where investor confidence is paramount, it is crucial to maintain faith in institutions. The rise of 'activism' – whether it be shareholder activism or investigative activism – is a reality of our times. But when such activism descends into the realm of creating chaos and exploiting the system for personal gain, it's time to draw the line.

What the Indian financial markets need at this juncture is not unfounded allegations or scaremongering, but a fair and objective examination of the facts. The Supreme Court committee, with its illustrious members and comprehensive mandate, is a step in that direction. It represents the triumph of expertise over partisanship, of objectivity over bias, and of investor protection over market manipulation.

Detractors may attempt to discredit this committee or undermine its work, but it's crucial to remember that such tactics only serve to erode trust in institutions.

In the long run, this is harmful to the very fabric of our financial markets. The need of the hour is to stand behind our institutions, allowing them the space and the autonomy to do their work, and to trust in the power of expertise and objectivity.

Rise of Fake Activism and Attack on Our Institutions

In the final analysis, it's clear that the formation of the expert committee is a positive move. Not only does it promise a thorough investigation into the Adani-Hindenburg matter, but it also sets the stage for potential reforms that could fortify India's financial markets against future attacks and shocks. It is a testament to the robustness of India's democratic institutions and their ability to respond to challenges with wisdom and agility.

In a world where financial markets are increasingly interconnected and complex, the role of regulatory bodies and expert committees cannot be overstated. They serve as gatekeepers, ensuring that the rules of the game are fair, transparent, and uphold the interests of all stakeholders, especially small investors who might not have the wherewithal to understand the complexities of the market.

The Adani-Hindenburg controversy, while unfortunate, has shone a spotlight on some critical aspects of market regulation and investor protection. It has also highlighted the need for robust mechanisms to guard against market manipulation and the exploitation of small investors.

The formation of the expert committee is a reassuring signal that India's judiciary and regulatory bodies are committed to upholding the integrity of the country's financial markets. It's a demonstration of their resolve to ensure that the interests of investors are protected, and that any allegations of financial irregularities are investigated thoroughly and impartially.

Critics may question the independence or the effectiveness of the committee. Still, it's important to remember that the members of this committee are professionals of the highest integrity and competence, with a proven track record in their respective fields. Their collective wisdom and experience will be invaluable in shedding light on the Adani-Hindenburg matter and in making recommendations that strengthen the regulatory framework.

This new age 'activism', often bereft of accountability, carries the risk of causing long-term damage. It's high time we discern the fine line between genuine activism, which aims at bringing positive change, and these malicious practices, which are essentially self-serving agendas under the guise of public interest.

In the long run, it's not just corporations or individuals who bear the brunt, but the entire nation's progress and reputation are at stake. It's critical that we, as a society, remain vigilant against the rise of 'fake activism'.

We need to support our institutions, like the Supreme Court and its expert committee in this case, in their pursuit of truth and justice. Only then can we hope to protect our financial markets, our investors, and our national interests from the ill effects of such underhanded tactics.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest