Economy

After Public Outcry, Both EPF And NPS Need To Be Rethought From Tax Angle.

- We need to rethink both the EPF and NPS, not just to avoid tax, but to ensure equity, fairness, and freedom of choice.

- Contributors should be offered choices – to accept EET or TEE or ETE when they start their EPF/NPS contributions.

- They should be allowed to opt out of EPF if they desire.

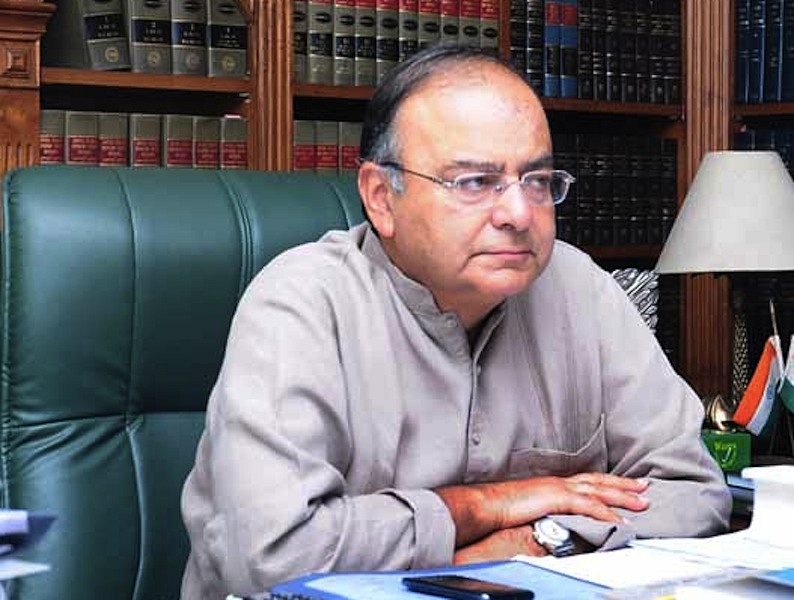

Finance Minister Arun Jaitley

From the kind of angry reception it got for the proposal to tax 60 percent of Employees’ Provident Fund withdrawals (EPF), the NDA government should learn one lesson: don’t spring a nasty surprise on your core support base without thinking through the implications of what you propose and without adequate preparation of the public for it.

That the government was not prepared for the backlash is clear from the bland way in which it made the announcement in the budget speech, and the panicked clarifications it offered when the middle class anger was palpable.

The operative part of the main announcement in Arun Jaitley’s speech was the following: “Pension schemes offer financial protection to senior citizens. I believe that the tax treatment should be uniform for defined benefit and defined contribution pension plans. I propose to make withdrawal up to 40 percent of the corpus at the time of retirement tax exempt in the case of National Pension Scheme (NPS). In case of superannuation funds and recognised provident funds, including EPF, the same norm of 40 percent of corpus to be tax free will apply in respect of corpus created out of contributions made after 1.4.2016.” (For clarity, defined benefit is a reference to the EPF, and defined contribution is about the NPS).

While it is right to make the tax proposal only prospective, the effective decision to tax 60 percent of the corpus at the time of retirement (or even if you exit after five years) militates against the first line in his statement – that “pension schemes offer financial protection to senior citizens.”

How can we assume benign intentions if you are going to be stung by the taxman on retirement, which is when you need the full corpus, not a moth-eaten one?

The clarifications only added to confusion. First, it was said that only interest income on EPF contributions would be taxed; then it was clarified that if 60 percent of withdrawal was re-invested in an annuity, it would be exempt, with only the monthly earnings on those annuities being taxed. Later, the government even said that the taxation will not apply to people earning salaries below Rs 15,000 per month. And, then, it said the EPF was not meant to give undue benefits to richer employees.

Each of these statements is debatable. In a 20-35 year EPF stay, the chances are more than 60 percent of the final corpus will, in fact, be interest, and not contributed money. So to say only interest income will be taxed is pointless, if not deceptive.

To say that only those earning beyond Rs 15,000 a month will be taxed is again confusing. How is the government going to find this out, and will this Rs 15,000 salary apply to people at the start of their careers or the end? Or will the tax plan change as incomes change? Then, where goes the parity with NPS, where the public can invest even if they don’t have salary earnings? The idea of the NPS was to enable all citizens to voluntarily contribute to their retirement corpus and pensions, not to be taxed on it when they need it the most.

To say that EPF is not meant for the rich is fine, assuming the idea is only to deny employers a tax-break for their contributions to EPF, which is now limited to Rs 1.5 lakh. This parallels the 80C tax-exemption limit on employee contributions to EPF, and hence we need not criticise this.

However, the real problem is the government’s pretence that it is shifting to an EET regime (exempt-exempt-taxed), which means contributions and interest are tax exempt, but there is a tax at the time of withdrawal.

Actually, what we actually have is a hybrid TET/TEET regime, assuming the budget proposal is enacted without change.

When there is a limit of Rs 1.5 lakh on 80C deductions (and remember, this limit applies not only to EPF, but also payments of LIC premia, repayments of home loan principal, investment in equity-linked savings scheme, etc), it means any employee contribution above Rs 12,500 a month is tax-paid. So it is not as if the rich get full tax benefits at the start. They are partially exempt, and partially taxed on entry. If they also buy insurance or repay home loans, their exempt status on EPF is even lower than the theoretical limit of Rs 1.5 lakh per annum.

Secondly, citizens subscribing to NPS over and above the EPF (or non-taxpayers who participate) may actually be taking no tax benefit at all. So they are essentially in a TET regime. Since the idea is to tax at only one stage, logically the tax on withdrawal should go. To tax the corpus on which no tax benefit was derived for contributions is unfair. There will be no parity with EPF.

The third problem is lack of choice. NPS allows early-stage entrants to invest half their contributions in equity, which attracts zero tax on long-term gains (if invested directly by the contributor). Even debt funds allow indexation of costs after three years, and are taxed at 20 percent plus cesses – which brings down the effective tax rate below 20 percent. The point is this: if I invest my corpus directly in a long-term equity linked savings scheme (ELSS) or even a normal equity mutual fund, I get both the same contribution benefit and zero-tax on capital gains. I get preferred tax treatment below the top bracket on my investments in debt funds. Why then would I want to invest in an EPF or NPS which taxes me more on withdrawal?

Clearly, the EET proposal is ill-thought-out, and possibly bunged in by a literal copying of schemes relevant to the west. In India, we need to rethink both the EPF and NPS, not just to avoid tax, but to ensure equity, fairness, and freedom of choice.

Here is what needs to be done.

Contributors should be offered choices – to accept EET or TEE or ETE when they start their contributions. Some people may prefer to have an untaxed corpus when they retire and may not mind forgoing a deduction from salary without 80C benefits. NPS contributions made outside the 80C ambit should also be TEE, not EET.

The second idea should be free choice – the right to opt out. If EPF is largely for the less well off, let only those who want to remain in it (or the NPS) opt for it. A minimum – which should be indicated on the basis of annual contribution and not salary, which can change between age 25 and 60 – amount should be EEE (tax-exempt at all stages). The rest of the contributions should be outside 80C and not taxed (TEE). Those who prefer EET can, of course, take what Jaitley has offered in his budget and be happy.

Another choice that should not be made by the nanny state is compulsory investment in annuities. Contributors opting for TEE rather than EET should have the option of either receiving a tax-free lumpsum or buying an annuity. Or both, in some proportion that they decide. The government should not decide that the tax-free corpus going to annuity should be 60 percent (or 40 percent in the case of NPS, as now).

Also remember, you can never know what annuity rate you will get when your retire 20-25-35 years hence. You may exit the scheme when rates are high, or when they are low, and this will impact your annuity income. Since annuity incomes are taxed, it should not matter to the taxman whether one buys an annuity or invests the corpus in a fixed deposit or a designated debt fund, which is also taxed on interest or capital gain, or both.

The third idea should be to avoid complexity and offer transparency at the user end. This means trying to tax interest and not corpus makes little sense, when the quantum of interest can vary from year to year, and calculating interest on interest (after year one) makes the differentiation between contribution and interest difficult. While excel sheets of yearly cash flows can be made available to taxpayers, this makes tax payment unnecessarily complex.

Instead, the EPF Organisation should make tax calculations available on an annual basis with future projections, so that the contributor knows what kind of hit he/she is going to take. Since tax laws and tax rates may change from the time one enters the EPF and when one exits (who knows what the tax rate will be in 2050 or 2035?), switches from TEE to EET should be made available. Every, say, three years. Tax can be collected at source during periods of switching.

For a government that believes in free choice, which is the essence of financial freedom, this is the minimum one can expect. Both EPF and the NPS need to be rethought from the ground up.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest