Economy

Budget 2015: Understated But Far-Reaching

What stands out in this budget is a broad vision, painstaking attention to details and “promise less, deliver more” attitude

“Politics is a strong and slow boring of hard boards. It requires both passion and perspective.”

–Max Weber

Critics of Narendra Modi government often accuse it of misplaced flamboyance. Ironically the most substantive policy statements to have come from this govt till date, economic survey and union budget 2015/16, have been presented in an understated manner.

Dr. Manmohan Singh most famously ended his 1991 budget speech with the triumphant invocation of Victor Hugo: no power on earth can stop an idea whose time has come. By contrast, economic survey this year has chosen to quote the scholarly Max Weber. Unlike his predecessors, Finance Minister didn’t try to revive the fortunes of Indian economy with the usual mix of inspirational speeches and pep talk. If anything, the survey consciously downplayed the recent growth performance as sign of a “recovering, not yet surging economy”.

This unanticipated reticence, together with somewhat tepid market response, misled the pundits into believing that budget delivery was somehow below par. Clueless anchors duly pronounced the budget as lacking in “big bang reforms” (whatever that means).

But after carefully reading the budget and survey documents, a very different picture emerges altogether. Make no mistake, we have witnessed a very consequential and meticulously crafted budget, of the kind that will remain relevant even a decade later. From investment to infrastructure, from social security architecture to macroeconomic framework, it breaks fresh grounds in almost every area.

Next time you come across someone religiously chanting “no big bang reforms” mantra, do remind them that this budget is every bit reformist, but with following caveats:

– “Checklist” approach to reform doesn’t work. Economic survey reminds us that there is a difference between what is “important” and what is “urgent”. Not all reforms deliver equal outcomes, even if their net effect is eventually positive. Sequencing, speed and timing matters.

– Economics operates in a political context, almost always. Saying that ‘X’ is a good ‘economics’ but bad ‘politics’ is neither here nor there. All leaders have finite political capital and job of technocrats is to deliver biggest bang for the given buck. In a democracy, pace and sequencing of reforms will be politically calibrated, except in extraordinary circumstances.

That of course doesn’t preclude either the possibility or desirability of reforms, just a reminder that we’re playing a test match, not a 20-20 game. Tenacity and not mindless aggression is the name of the game.

What are the most urgent priorities of this government? There are two of them: reviving capital expenditure cycle and, putting in place a smart social security architecture. That is where entire budget is focused. Once capex cycle revives, growth will accelerate, rising tax base and inherent buoyancy of Indian economy will provide the government with lot more room to manoeuvre. Similarly, any rationalization and pruning of expenditure, to be politically feasible, must be preceded by smart targetting, reduction in inefficiencies and plugging of leakages. You just can not put the cart before the horse.

Other macroeconomic parameters like inflation, current account deficit, fiscal deficit etc are at manageable levels right now and any reform that operates via improvement in those parameters will yield negligible returns, at least for now. Now investment can either come from the public sector or private sector. Let us take them one by one.

Public investment in infrastructure: expect a boom

There is an impeccable logic for ratcheting up public investment infrastructure. It can kill many birds with a single shot. One, as private investment remains lukewarm, public investment can fill the gap and maintain the growth momentum. Two thanks to years of underinvestment, infrastructure facilities in India are awful. While this is bad, the flip side is that there is plenty of scope for improvement. Even small investment will fetch large and tangible returns.

Economic survey devotes an entire chapter on Indian Railways and makes a compelling case for the establishment of dedicated freight corridors paralleling golden quadrilateral and associated industrial corridors. Using an econometric exercise, it reports large and steady multipliers. In particular, it shows that one rupee of investment in railways increases manufacturing and aggregate output by 1.2 and 7.2 rupees respectively (within three years). This is extraordinarily high social return.

Three, because infrastructure raises returns to private investment, it would “crowd in” private capital expenditure.

Four, electoral promises of ruling party mainly revolved around creating world class infrastructure and they have to find a way to implement their promises: budget after all is the fulfillment of a political covenant.

For funding the infrastructure projects, budget exploits the fiscal space created by falling petroleum prices and corresponding reduction in fuel subsidies. It sets up National Infrastructure and Investment Fund with the initial corpus of INR 20,000 crore. Reading carefully, we realize how the conflicting objectives of fiscal consolidation and infrastructure funding are going to be reconciled.

On the other hand, plans of auctioning off “plug and play” projects shows that government has finally figured out the crucial conceptual distinction between infrastructure projects (subject to regulatory risk, difficult to sell) and infrastructure utilities (plain vanilla cash flow, will sell like hot cake). It is more or less a safe bet now that in years to come, we will witness an infrastructure boom, particularly a transformation of Indian Railways.

Private investment: work in progress

Public investment can only be a temporary short term fix. For economy to really take off ultimately private investment must increase. A small part of private investment has been held back by a number of fixable reasons: lack of regulatory clearances, coal linkages etc and will respond immediately to policy action. Low interest rate regime and infrastructure spending will induce further investment.

These low-lying fruits are far and few. Unfortunately as economic survey notes, weak balance sheets and debt overhang remains a major reason for stalled projects and lack of private investment take-off. These are not very easy problems to resolve. Effectively we need a way to release resources from commercially unviable projects and adjudicate competing claims swiftly and effectively. That requires new bankruptcy laws and procedures. Admittedly it will be time-consuming process. By proposing a comprehensive bankruptcy code and ending dysfunctional SICA and BIFR, budget makes initial moves in the right direction.

JAM trinity: social security architecture for the 21st century

There is a universal consensus among the Indian politicians and development practitioners that the level of poverty in India is unconscionably high and must be eliminated. There are sharp disagreements on how exactly to accomplish it. Survey reminds us that Indian state (both center and state combined) spends about INR 3,78,000 crore on subsidies. This is enough to bring poor household to the income level of 35th percentile (roughly 21.5% of population is below poverty line).

In other words, the main reason why poverty persists is not lack of resource availability but state’s capacity to identify beneficiaries and effect transfers. Budget plans to tackle it with a unique combination of Jan-Dhan Yojna (financial inclusion), Aadhar (biometric identification) and by leveraging mobile and post office networks. While this year’s budget marks a modest beginning, it is obvious that ultimately this architecture will revolutionize governance at the bottom of the pyramid. In fact the prospect of ending mass structural poverty in a decade or so is so heady that survey calls it “Nirvana” or ultimate bliss!

Institutional Reforms

This budget is understandably focused on reviving growth, building state capacity and creating employment in the short run. That doesn’t imply that it is unmindful of institutional challenges that hobble Indian economy. Consider recent auctions of coal blocks. In India, discretionary allocation of natural resources has been the single biggest source of cronyism (both capitalist and socialist varieties). It is not a coincidence that our resource-rich eastern belt, from Orissa to Jharkhand, is also one of the poorest regions in India. Resource curse is not a fact of nature, it is a tell-tale signature of the persistence of extractive institutions.

Auction of coal blocks reverses it. Rent which was earlier accruing to a select few will now flow to some of the most impoverished regions in our country. Welfare gains will be enormous. This is institutional reform in every sense of the term, though not of the kind that pink papers (and stock markets for that matter) will celebrate.

Some exciting changes are taking place in monetary policy framework. It appears, on 20th of February, government has signed an agreement with RBI formally accepting Inflation Targeting framework with an annual inflation target of 4% (CPI;+-2% band). Budget announces separation of public debt management function from central bank, promises amendment in RBI Act to formalize central bank autonomy and set up Monetary Policy Committee. These steps once and for all clear any lingering doubt about the credibility, predictability and continuity of our monetary policy regime. Resulting price and financial stability will create more conducive environment for businesses to flourish and encourage savings and capital inflows.

Similarly, the Forward Market Commission, one of the our weakest regulators, has been merged with SEBI, foreclosing the possibility of regulatory arbitrage and “funny market practices”. One wonders why this small reform, reportedly first mooted in 2004, was left hanging for so many years. Proposed comprehensive bankruptcy code and contract resolution and settlement law will improve the ease of doing business ranking and add value. Cumulatively these seemingly small reforms will add up to a large outcome.

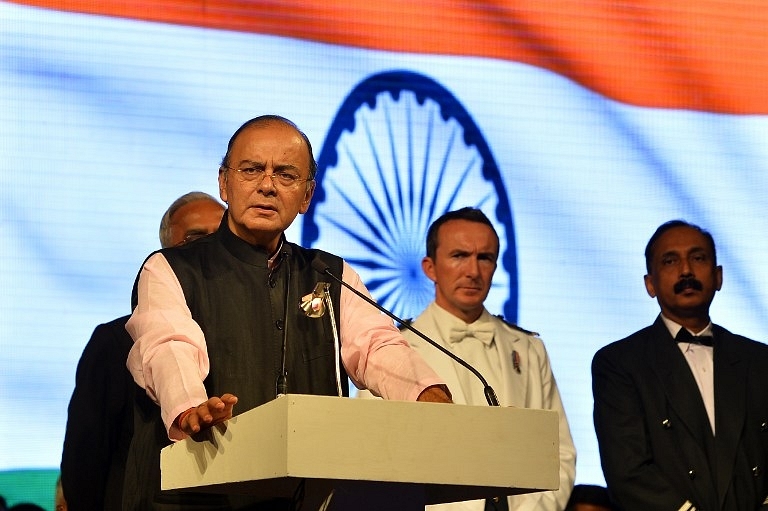

After the budget the finance minister said that he was not interested in headlines. He could easily have added that he was interested in small print. What stands out in this budget is a broad vision, painstaking attention to details and “promise less, deliver more” attitude. We can objectively congratulate the finance minister and his team for having delivered a landmark budget.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest