Economy

Budget 2020: The Nation That Worships Wealth Shouldn’t Demonise Those Creating It

- It is ironical that a country that worships wealth also demonises those who have it.

- The curse of socialism should go, and the idea of collective welfare driven by economic well-being should replace it.

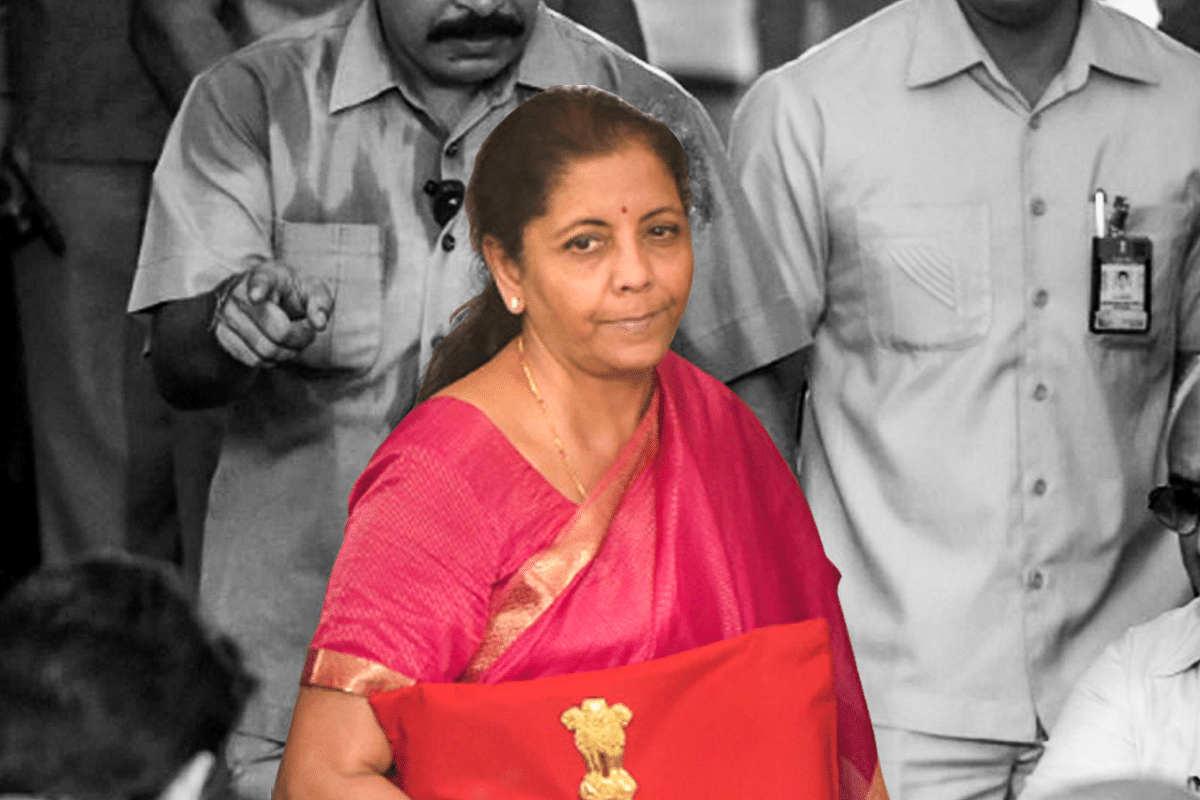

Finance Minister Nirmala Sitharaman outside Parliament before presenting the Budget for 2019-20.

India has always worshipped wealth and the hands that create it, unlike a specific stream of thought that equates poverty to Godliness.

While much was lost in transition due to repeated physical and intangible invasions, it is unfortunate that we chose not to open our trade border; instead, we adopted import substitution.

To make matters worse, socialism emerged as a dominant normal in India’s economic framework, and license Raj, synonymous with controls, flourished. Clearly, the State’s attempt to become an entrepreneur proved catastrophic and eventually in 1990, capitalism was no more a national taboo.

Never talk to me about the word profit; it is a dirty word, Nehru told JRD Tata. This was at a time when Tata did not agree with economic policies of Nehru and had asserted “Jawaharlal, I am talking about the need of the public sector making a profit”.

While economic liberalisation did assuage India from the challenges of a closed economy, it did little to change the pro-poverty sentiment that had already hardened in word and spirit.

It is indeed a moment of reckoning for India as the theme of Economic Survey is Wealth Creation. The document does corroborate with Kautilya, who aptly pointed out that while lack of economic activity leads to distress, it is also a reality check for those who have misled the masses into believing that poverty isn’t bad.

Instruments to create wealth:

1. Entrepreneurs: There has been an aggressive policy push to create ‘job creators’ or entrepreneurs which is reflected in new firms added in formal sector clocking a CAGR of 12.2 per cent (2014-18), the economic significance of these entrepreneurs at grassroot level is put in perspective by noting that 10 per cent increase in registration of new firms in a district yields a 1.8 per cent increase in GDDP.

Our ability to take entrepreneurship from start-up Silicon Metropolitans and spread it across the country also reflects of reducing barriers to entry and secular increase in opportunity.

2. Backward and Forward Integration: For long, China has enjoyed a competitive advantage on the manufacturing sector, primarily due to abundant availability of labour. However, with a change in global relationships, there is a window of opportunity that India can leverage.

India already has stable contracts for assembly of products; with a concerted push, manufacturing of these components that are already being assembled is certainly possible. For any economy, it is obvious to explore possibilities that integrate (forward or backward) with its current capabilities.

While the Economic Survey suggests “reorientation of our trade specialisation towards labour-intensive product lines”, I beg to differ. The disproportionate increase in services compared to merchandise has deglamourised the manufacturing sector, irrespective of the value of product in question, and we need an intervention to be able to shift this perception.

As a nation, it is imperative to win the trust of hands and minds that intend to create wealth by providing them with an adequate climate which will manifest itself in self-belief and assurance that it possible to undertake economically feasible business activities in India.

Now that we have achieved ease of doing business in firms of reasonable scale and size, the next phase for policy intervention needs to be directed towards micro and small enterprises.

Increase in provisions for self-attested submissions, self-audit reports etc are small steps towards communicating trust in the business community. It must be noted that the needs of grassroot businesses are very different from Incorporations.

For example, a grassroot entrepreneur with uninterrupted access to power may not have skilled labour to run the unit throughout the day or an affordable automated warehouse that can improve efficiency.

Posing higher levels of trust and embedding checks in processes should be the strategy for spurring the next level of growth without overloading the system with procedures.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest