Economy

Clouds Of Uncertainty Over India’s Growth Story Unlikely To Disappear Anytime Soon

- Research by State Bank Of India (SBI) published in its Ecowrap report shows that Food prices alone have pushed up inflation by 151 basis points (bps), GST has pushed it up by 12 bps and petroleum prices by 18 bps.

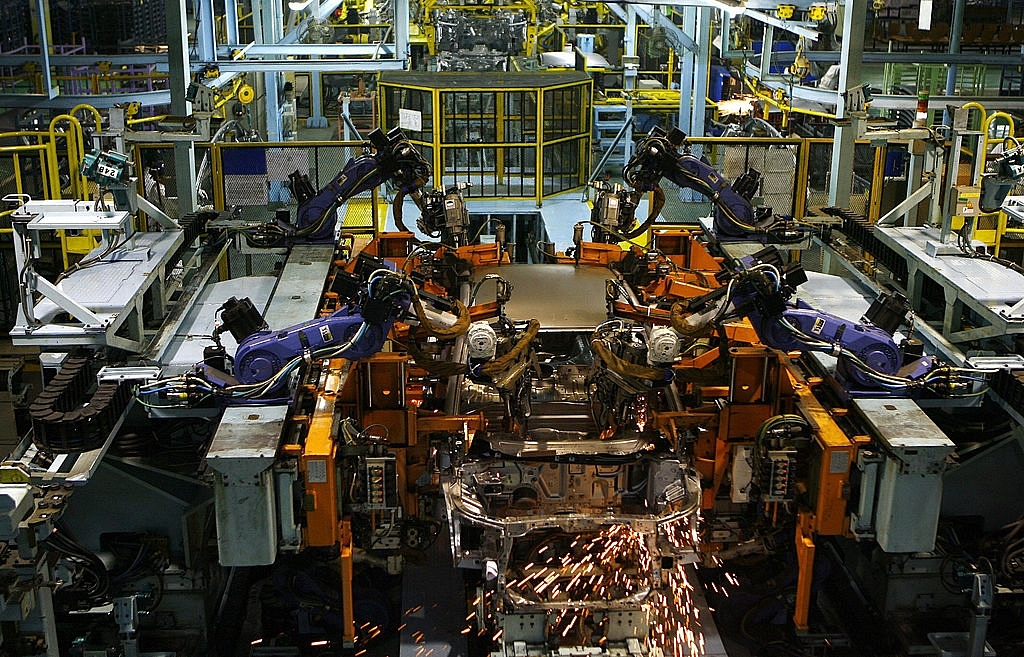

An Indian factory. Photo credit: MANPREET ROMANA/AFP/Getty Images

The economic environment is looking quite bleak at the moment. The Gross Domestic Product (GDP) growth decelerated to 5.7 per cent in the first quarter of the current fiscal year thanks in part due to massive destocking operations carried out by companies ahead of Goods and Services tax (GST) roll out from 1 July. Demonetisation’s lag effects could be seen on the numbers but it should no longer be a factor in subsequent quarter numbers.

The question on everyone’s minds currently is how long before the economic growth revives?

The bad news is that the clouds of uncertainty over India’s growth story are unlikely to disappear anytime soon.

Consumer Price Index (CPI) inflation touched a five month high of 3.36 per cent in August, compared to 2.17 per cent in the month before and 2.47 per cent in August last year whereas core CPI increased to 4.50 per cent in August compared to 3.96 per cent in July.

Research by State Bank Of India (SBI) published in its Ecowrap report shows that Food prices alone have pushed up inflation by 151 basis points (bps), GST has pushed it up by 12 bps and petroleum prices by 18 bps.

In the coming months, food inflation is likely to go up, given deficit monsoon rainfall recorded in areas such as Uttar Pradesh (29 per cent less than normal rains), Madhya Pradesh (26 per cent less than normal), Haryana (-27 per cent), Punjab (-17 per cent) and so on. These states have a share of 32 per cent in total sowing. Hence, we may see cereal prices going up due to less-than-expected production.

Barring 10 months, CPI in rural areas has outpaced CPI in urban areas since January 2012. Average rural inflation stood 89 bps higher than urban inflation in these last five and a half years. SBI’s report says this may be largely due to fuel inflation difference between them which is now changing and we are witnessing a convergence in inflation in rural and urban India.

With inflation rate on the rise, we can probably kiss any rate cut from central bank goodbye. The twin balance sheet problem has been allowed to fester for too long. While the deep surgery is currently underway, things are unlikely to show considerable improvement at least till the end of this fiscal. Without a big fat check from the government capitalising the banks, they won’t be able to restart lending to companies thus giving no room for private investment to pickup. Hence, growth rate is likely to be below 6.5 per cent for the next two quarters.

The Index of Industrial Production (IIP) showed hints of revival clocking 1.2 per cent growth in July, compared to a contraction of 0.2 per cent in May. However, this is still lower than the 4.5 per cent growth registered in July last year. Manufacturing and construction are coming out of the black after these sectors got badly hit by demonetisation which means that the impact is now almost over. However, overall statistics are still highly discouraging. The SBI report notes that out of 23 industry groups, 15 were in negative territory in July, notable ones being tobacco products (-43.4 per cent), electrical equipment (-11.1 per cent), printing and reproduction of recorded media (-8.8 per cent), etc.

Despite all this, the government doesn’t seem to be in any mood to cut taxes on oil which may spur consumption in short term. Nor is it willing to let the banks off the hook easily by capitalising them or drastically increase spending thus giving up its fiscal consolidation plans. Under these circumstances, it is increasingly becoming clear that we will have to slog through this difficult phase. Growth is indeed looking distant.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest