Economy

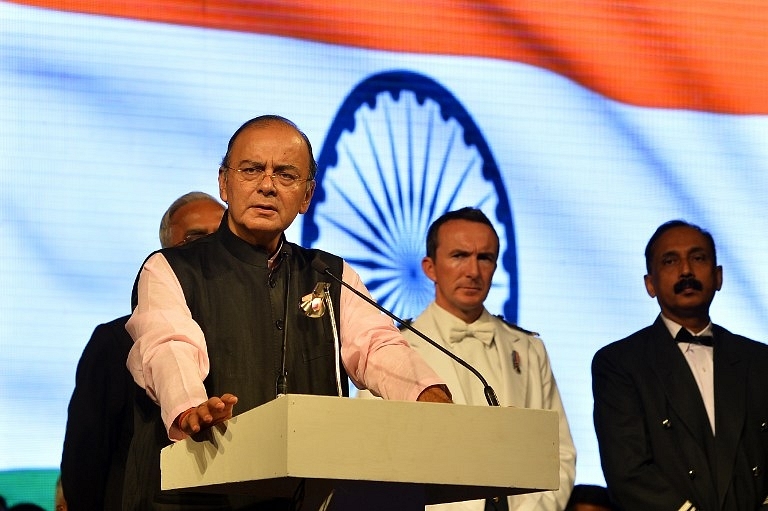

Dear Mr Jaitley, Tackle The Devil In The Details Of GST For A Smooth Rollout

The design and structure of the new tax law seems certain to complicate life for traders and service providers. It may also increase their compliance burden and entangle them in litigation.

The goods and services tax (GST) is meant to unify India into one integrated market but the path to that goal is not going to be an easy one. The design and structure of the new tax law seems certain to complicate life for traders and service providers, increase their compliance burden and entangle them in litigation that would arise from varied interpretations of the law and rules by tax authorities at the Centre and different states. Manufacturing companies too could find life getting a little more complicated under GST, and may need to reorganize their businesses.

Keep it simple, says the traders

The traders are not opposed to the concept of GST, but they are seeking changes in the structure of the tax so as to make it easier to adopt and keep the compliance burden low. One of the most significant demands is that there be a single GST rate across the country, instead of the dual structure that looks set to be implemented. The structure under consideration envisages a central GST (CGST) and a state GST (SGST) component on the supply of all goods and services as well as an integrated GST (IGST) on inter-state transfers of goods and services. This is certain to mean more documentation. Traders also want a single administrative body under which they would file returns and have said that they should not be subject to audits from multiple authorities.

In a memorandum to finance minister Arun Jaitley in early July, the Confederation of All India Traders (CAIT), a traders lobby group, suggested there should be uniformity in the GST law applied by the Centre and every state, as well as in the rules and regulations that will give effect to the tax. CAIT has also sought restraint on individual states independently amending or modifying the GST law and the rates. It has said changes should be made only after consulting all the stakeholders and with the approval of the GST Council – a body of all state finance ministers chaired by the union finance minister. They apprehend the possible diversion of trade from one state to another if there are deviations in the tax rate – a common occurrence under the present value added tax (VAT) regime.

Concerns are justified

The traders have a point. Currently, they have to deal with only the state tax authorities for VAT on the sales of goods and, likewise, service providers only have to deal with the central tax authorities as they pay a service tax. Once the GST law comes into force, goods traders and service providers will have to pay two levels of taxes – the state and central GST for transactions that are within the state where they are based and CGST and IGST for transactions that involve another state (that is, if the buyer of a good or recipient of a service is located in another state).

They will have to file returns with multiple authorities and reconcile statements generated by the GST network to ensure they have got credit for all the taxes paid. A trader will also need to ensure that every supplier from whom he purchases goods or inputs or avails a service has also uploaded the correct data into the system for otherwise he will not be able to avail input tax credits.

What’s more, traders will be subject to audits by multiple authorities – every state where a business is registered and pays tax will seek to audit their books. So if a trader, service provider or any company is registered in six states, each of the six states will seek to audit the business. In addition, there will be an audit by the centre too. CAIT fears all this will lead to inspector raj and increase the burden as well as cost of compliance, with traders being given the run around by tax authorities for refunds and getting involved in settling tax disputes. While manufacturing companies are used to dealing with multiple authorities, service providers and traders will find the increased level of audits bothersome, notes Bipin Sapra, partner, tax and regulatory services, indirect taxes at Ernst & Young.

Keeping track of every transaction

Given the two levels of taxation and the need to distinguish between intra-state and inter-state transaction, keeping records of every transaction becomes critical. Every supplier of goods and service needs to keep track of every transaction in terms of who is the buyer and where that buyer is located. This is something most traders are not used to, but need to do to be compliant in the GST regime, points out Gautam Khattar, partner, indirect tax at consulting firm PwC. The challenge, he adds is to change the mindset of the small traders and get them to use the IT system. The trader or the supplier of a good or service also needs to have the GST registration number of the buyer of the goods or the consumer of a service, if the transaction is a business-to-business deal.

The supplier is also required to be registered with the Centre and all the states where he does business to claim credit for taxes paid. Fortunately, there is likely to be only one registration number, which will be PAN-based, that will apply across the states.

Keeping track of every transaction entails uploading invoice level data of every transaction on the GST network regularly, identifying whether the transaction is business-to-business or business-to-consumer and whether it is an intra-state or an inter-state transaction and providing the registration number of the buyer or receiver of the goods or service along with other usual details such as value of the goods or service and date of transaction. This helps the system identify if the transaction involves SGST or IGST in addition to CGST as well as which state should get the tax collected. This is because GST is a destination-based consumption tax and so all taxes on a good or service will usually go to the state where it is consumed as against the current system where central excise duty and service tax is collected by the centre on manufactured goods and services provided and VAT is collected by the states when a sale is made. Under GST, the state where the consumer is located gets all the tax collected on a product or a service irrespective of where the manufacturer or service provider is located.

Failure to upload all the information leads to breakdown of the value chain and loss of the input credit for the receiver of a good or service. For instance, if the GST registration numbers are not uploaded in the system, a transaction that’s actually B2B in nature will get treated as a B2C one. This would mean that the recipient of a good or service, who may be using that good or service to produce another good or provide another service will not get input credit. That will increase the input costs for that buyer.

This is only one example. There will be multiple problems that would emerge when the tax regime is implemented, particularly, if it is introduced in a hurry without giving due thought to all the problems various stakeholders would face and without giving enough time to the stakeholders to understand the tax law and compliances they have to adhere to.

So, along with political management to ensure that the GST bill does get passed in the Rajya Sabha, Jaitley also needs to get work going to see that these issues are addressed. These are issues of detail and will take time to put in place. There is no time to waste if GST is to roll out in April 2016.

Introducing ElectionsHQ + 50 Ground Reports Project

The 2024 elections might seem easy to guess, but there are some important questions that shouldn't be missed.

Do freebies still sway voters? Do people prioritise infrastructure when voting? How will Punjab vote?

The answers to these questions provide great insights into where we, as a country, are headed in the years to come.

Swarajya is starting a project with an aim to do 50 solid ground stories and a smart commentary service on WhatsApp, a one-of-a-kind. We'd love your support during this election season.

Click below to contribute.

Latest