Economy

Following Boldest Tax Cuts Last Year, Expectations Are Now High On Finance Minister To Deliver A Matching Budget

- The last six months have seen policy interventions by the Finance Minister to rev up growth.

- Expectations are now high that she will present a bold budget.

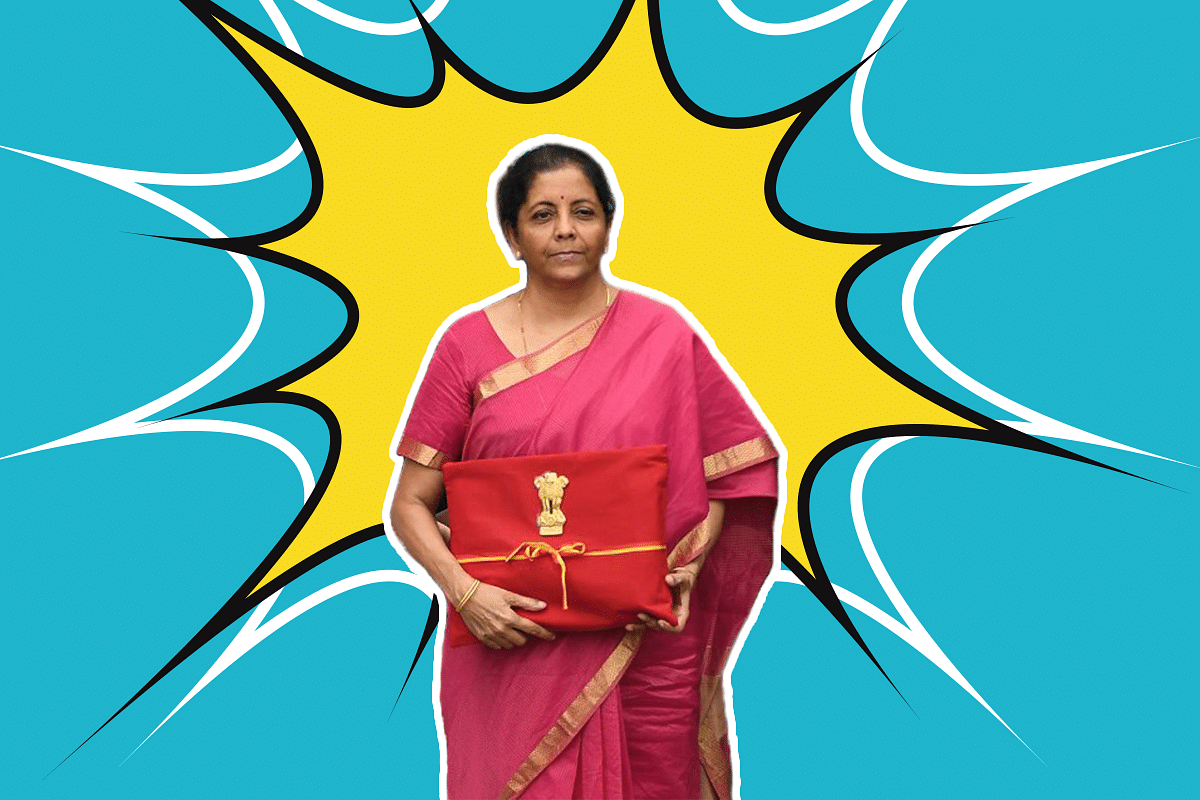

Finance Minister Nirmala Sitharaman.

We are nearly a week away from the Union Budget and are eager to see whether it will tick off our wish-lists. However, a word of caution, a budget is only a means to an end, and the end is of course to revive our economic growth to the trend level for now.

Of course, a permanent increase in our trend rate of growth is also desired and we will perhaps witness such an increase over the next couple of years.

But we must recognise that a budget is just one of the opportunities to present policies that can help us get towards our objective and the best example of this has been the last six months which saw several policy interventions by the Finance Minister from time to time.

The World Economic Outlook was updated by the International Monetary Fund (IMF) and as expected, it revised India’s current growth along with global growth. The reasons for India’s growth revision were primarily due to the shadow banking crisis. This should not come as a surprise as several of us have been talking about the same and the downward revision in growth appears to be slightly more conservative.

Nevertheless, it is not what has happened in the past or what is happening in final months of the current fiscal year that is important but rather, we must focus on what is likely to happen.

In December, I had mentioned how the outlook for global growth looks better now that US-China have signed the ‘phase one’ of their trade deal and Brexit with a deal is likely with conservatives winning a full majority. This has been reiterated by IMF’s Gita Gopinath in a series of interviews as she recognises the impact of these developments on global uncertainty.

The fact that global outlook remains positive is important and worth keeping in mind when we evaluate the policy choices available keeping in mind our external environment.

The statement on using fiscal space wherever possible is an encouraging one as it reverses a long-held hawkish stance on fiscal space. It is even more relevant for countries like India, which continue to have a high cost of borrowing which has resulted in huge divergence in fiscal deficit and primary deficits.

To bridge this, of course, we need more capital, and we can find plenty if we are willing to revisit our position on external debt with reasonable restrictions. One hopes that the idea finds its mention in the coming budget.

A positive global environment will definitely be helpful, but a closer look back home shows the urgent need to take steps to address any risks that may emerge in our financial sector. There are occasional problems that keep surfacing with corporative banks and the way we are handling them should be a cause of concern.

One must be careful and fully aware of the systemic risks in such situations and therefore, the temptation to impose limits on withdrawals must be resisted. This is with reference to the latest corporative bank in Bengaluru that seems to be on Reserve Bank of India’s (RBI’s) radar.

It is ironical that no such limits were put on withdrawals in 2008 during the crisis (and even afterwards) when faith in financial system world over was shaky. Therefore, one wonders why we would want to impose withdrawal limits on corporative banks when there may be other policy choices that could be available.

There are lessons for all of us in the way US Fed and Treasury handled the 2008 crisis and we have used some of them to address the problems in our banking sector. Question is whether we are willing to deal with our cooperative banks in a similar manner?

In many of our minds, there was never a doubt that the severe slowdown was precipitated with the non-banking financial companies (NBFC) crisis and it was always a financial crisis which had implications for the real economy.

This episode of growth slowdown in last six to nine months alone would show the importance of the financial system in India’s growth story and would reveal important lessons for our central bankers.

However, to learn the lessons well, we may have to go back and evaluate the conduct of our monetary policy for the last couple of years.

The upcoming budget should definitely focus on some of these issues in order to ensure that a 7 per cent plus growth can be achieved over the coming financial year. This may appear to be difficult or even impossible.

However, a budget that revives sentiments could be a successful catalyst in accelerating the process of economic recovery. All eyes are now on the Finance Minister who delivered one of India’s boldest tax cuts as we anticipate a budget that could be just as bold, if not more.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest