Economy

Forget 8 Per Cent For Now, Says A Sobering & Realistic Economic Survey

- The only consolation the government can take is from the fact that the Survey says India “stands out as a haven of macroeconomic stability, resilience and optimism”

- India is so entwined with the world economy, Subramaniam pointed out, that it will not be able to insulate itself entirely.

- The Survey seems to be relying on domestic consumption, propelled by the Seventh Pay Commission award and a likely rebound on the monsoon front.

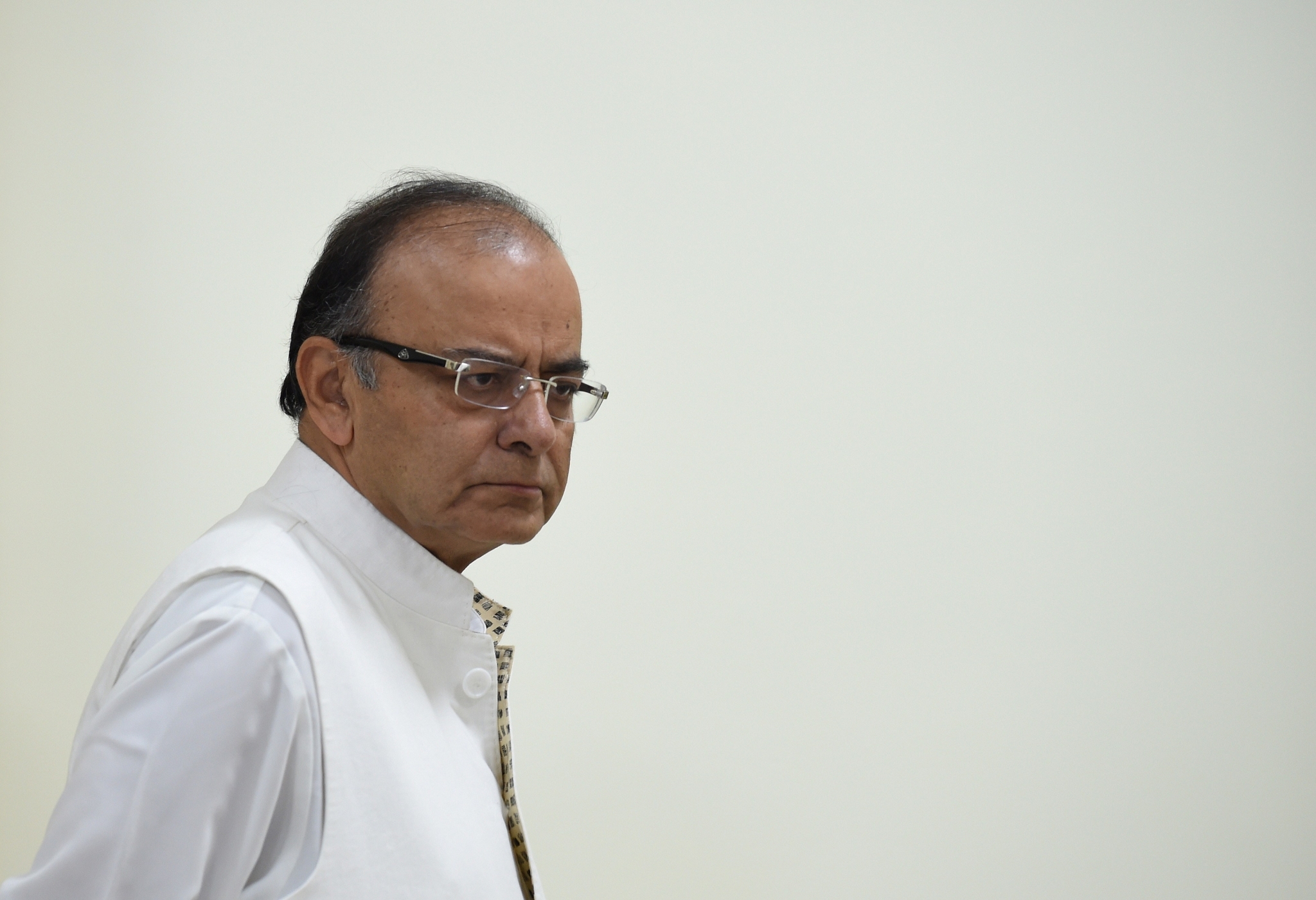

Arun Jaitley

Towards the end of his press conference on the Economic Survey 2015-16 today, chief economic adviser Arvind Subramaniam was interrupted by a phone call. He then had to cut the presser shot and rush out.

Speculation got rife immediately – the only reason he would have to rush out must be a summons from the Prime Minister. Perhaps Narendra Modi was not too pleased by the Survey pushing the tantalising 8 per cent growth target a little further out of reach?

The Survey, tabled today in Parliament, pegs growth this year at 7.6 per cent. But it does not expect growth next year to be very much higher – it will be in the range of 7-7.75 per cent. The 8 per cent mark is expected to be reached in the medium term. What is the medium term? “Well, not this year,” was Subramaniam’s cryptic remark when asked about this at a press conference.

By that time the government’s term may well have ended. The Survey even seeks a recalibration of growth expectations. This will not be something that Prime Minister Narendra Modi may find palatable – after all, he came to power mocking the previous government’s economic record and promised to put India on a much higher growth trajectory. And after the Mid-Year Economic Analysis 2015-16 had projected a similar growth rate in December, Jaitley had said that next year would see the economy touching 8 per cent growth. The only consolation the government can take is from the fact that the Survey says India “stands out as a haven of macroeconomic stability, resilience and optimism”.

The political bosses may be disappointed but the Survey does paint a more realistic picture. It is high time that expectations are not stoked up high, leading to a lot of disappointment later. The strong dose of realism in the Survey needs to be appreciated.

After all the challenges facing the economy are quite formidable. There is, above all, “an unusually challenging and weak external environment”. Major financial crises are occurring more frequently and there is major currency re-adjustment in Asia following that of China. Right now the oil prices are still subdued but if these also start to rise, that could be a triple whammy (along with global slowdown and extreme financial events), the Survey warns. India is so entwined with the world economy, Subramaniam pointed out, that it will not be able to insulate itself entirely. The Survey points out that the correlation of India’s growth rate with that of the world has risen from 0.2 in the 1991-2002 period to 0.42 in the post 2002 period. That means every 1 percentage point decrease in world growth pulls down growth in India by 0.42 percentage points.

“Foreign demand,” the survey says, “is likely to be weak, forcing India – in the short run – to find and activate domestic sources of demand to prevent the growth momentum from weakening.”

So what domestic factors could boost growth? The Survey seems to be relying on domestic consumption, propelled by the Seventh Pay Commission award and a likely rebound on the monsoon front (which could improve rural incomes this year). If oil prices continue to remain soft, that could be a further boost. But if they start hardening, then that could take away the gains from the first two boosters. The survey also cautions that Indian monetary and fiscal policy should not add to the deflationary impulses from abroad.

The Survey does not expect inflation to be a huge downside risk. Discounting apprehensions of this risk arising from the Seventh Pay Commission award, the Survey says the expected wage bill will go up 52 per cent against 70 per cent in the case of the Sixth Pay Commission. It gives three reasons for the lack of an inflationary impact – pay awards are only a small part of aggregate demand and will not create huge demand-supply mismatches; the public sector wage increase is unlikely to spill over into private sector wages; and the increase in the housing component of the consumer price index will be one-off and modest. So the CPI inflation will remain in the 4.5-5 per cent range. The Survey thinks this warrants an easier monetary policy. But whether Reserve Bank of India governor gets the message and cuts interest rates remains to be seen.

The Survey has several suggestions on boosting growth and sustaining it. The government should give serious thoughts to what this sagacious document says. Jumping to 8 per cent without addressing structural issues would be foolhardy.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest