Economy

Growing Debt Distress: FM Nirmala Sitharaman Sends Veiled Message To Beijing

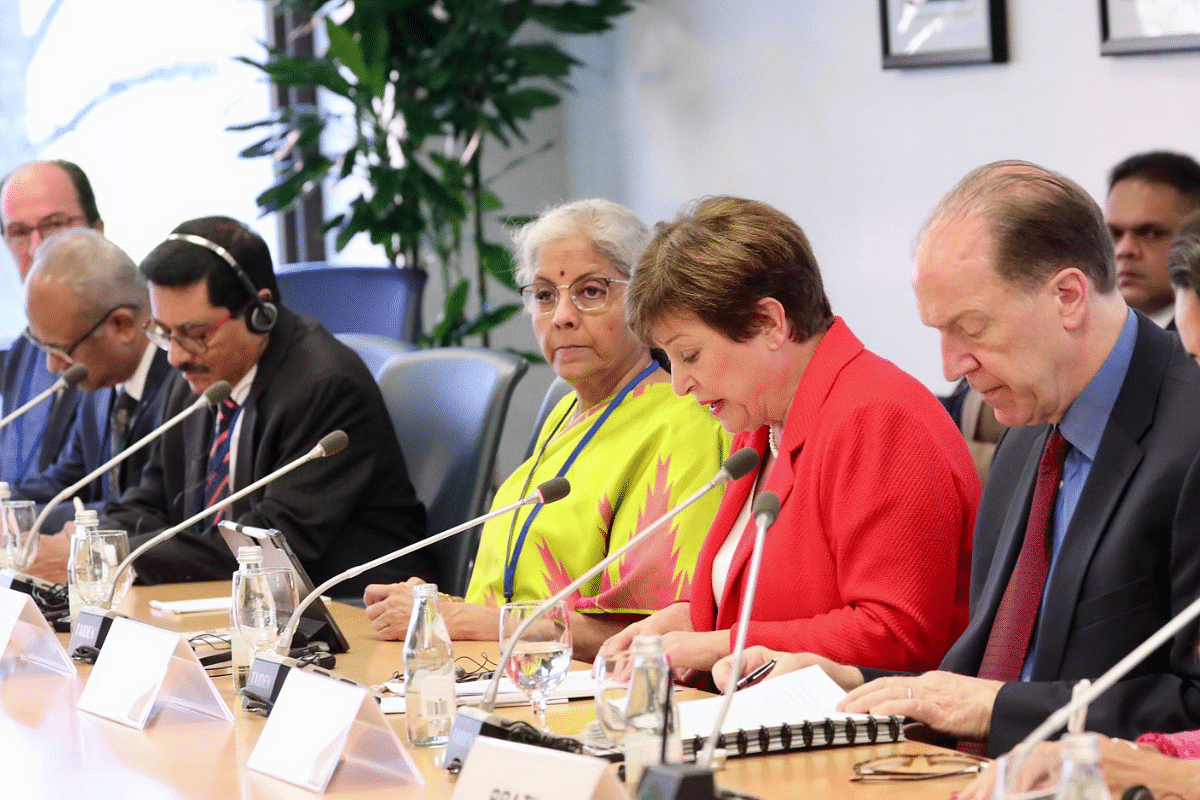

India Finance Minister Nirmala Sitharaman participated in the Global Sovereign Debt Roundtable meeting in Washington, DC. (Photo: Ministry of Finance/Twitter)

India's focus on debt distress during the term of its G20 presidency was reiterated by Finance Minister Nirmala Sitharaman.

She emphasised that debt transparency, information sharing, comparability of treatment, predictability, and timely restructuring processes were critical principles that should govern the process, Prashant Jha reported for Hindustan Times.

China is seen as obstructing efforts to aid countries in distress. Sitharaman's comments, including the principles outlined, appeared to send a message to Beijing.

Co-chairing a meeting of the global sovereign debt roundtable, Sitharaman joined the heads of the International Monetary Fund (IMF) and World Bank at the second G20 finance minister and central bank governors meeting in Washington, DC, on Wednesday (12 April).

The meeting took place amid a deepening debt crisis, with 21 countries in default or seeking restructuring. IMF's Kristalina Georgieva revealed that 15 per cent of low-income countries are in debt distress, 45 per cent are vulnerable, and a quarter of emerging economies face high risk.

The debt roundtable grouping, comprising official creditors, private creditors, and borrowing countries, was established to address the differences that exist between advanced western economies and multilateral development banks on one side, and China on the other.

The members aim to achieve a better common understanding of the debt restructuring process through a focus on the process and standards.

The major issue in the debt restructuring process is the involvement of China, which has lent huge amounts of money to several countries now grappling with debt.

The obscurity of the lending process and refusal to write down loans, among other factors, amount to China impeding debt relief and restructuring efforts.

Beijing wants multilateral development banks to reduce loans, but this goes against their safeguards.

Reuters reported that China may be willing to drop this demand, which would be a positive step. However, there has been no official confirmation yet.

The concern among economies is that if debt relief is given to countries without China's participation, it could lead to the repayment of Chinese loans and promote impunity for Beijing's behaviour.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest