Economy

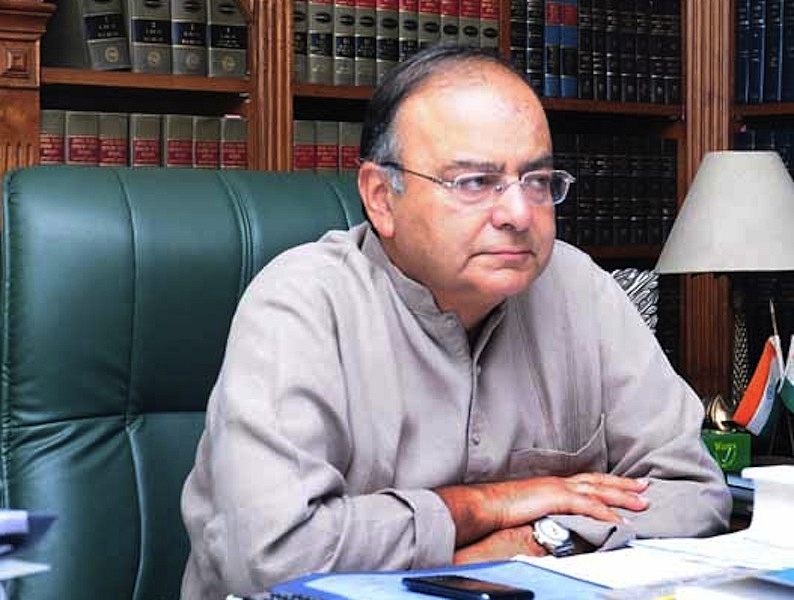

Here's Where Jaitley's Tax Axe Could Fall When He Rationalises India Inc's Sops

Arun Jaitley had said that he would cut corporate taxes and compensate for the loss by rationalising and removing various tax exemptions. Thus, which sectors are likely to lose the privileges of exemption in Budget 2016-17?

With Budget 2016-17 less than eight weeks away (it will probably be presented on Monday, 29 February, this being a leap year), India Inc will be wondering where Finance Minister Arun Jaitley’s axe will fall.

This is not to suggest that the budget is about taxing companies more, not by a long chalk, but Jaitley had promised in his last budget that he will cut corporate taxes by 1.25 percent this year, and compensate the revenue loss by “the rationalisation and removal of various kinds of tax exemptions and incentives for corporate taxpayers, which incidentally account for a large number of tax disputes.”

This means that while tax-paying companies as a whole will gain, there could be several sectoral losers as some tax sops are yanked away.

So where will the axe fall?

There are three major areas where revenues are forgone by the exchequer in order to promote investment or to protect or promote domestic industry. According to estimates of revenue forgone in 2014-15, as given in the budget for 2015-16, customs, excise and direct tax concessions are where most revenues are lost.

Estimates for 2014-15 show that nothing much will be gained by withdrawing direct tax sops, where revenue forgone was estimated at Rs 62,398 crore. In this total, the bulk of the losses were due to tax exemptions on profits earned in special economic zones (Rs 18,394 crore), accelerated depreciation (Rs 37,010 crore) and deduction of profits for power companies (Rs 10,607 crore). Barring accelerated depreciation, where some tweaks are possible, it is difficult to see Jaitley cutting sops to power units (still staggering under losses) or to exports (which is what SEZs are for). Most export sops will remain, and some could even be enhanced.

The bulk of the revenue concessions to be closed are in the indirect taxes arena, where excise loses the government Rs 1,84,784 crore, and customs Rs 3,01,688 crore.

Since this is a year of low exports, cheap oil and weak industrial revival, the focus of Jaitley’s revenue gains will probably be in customs.

Oil, where customs concessions are the biggest at Rs 72,180 crore, is likely to face some duty increments. If duties can’t be raised when oil prices are low, they can never be raised.

Diamond trade gets the highest sops worth Rs 75,592 crore, but since diamonds are the cutting edge in our export thrust after software, these sops are unlikely to be tinkered with substantially.

Edible oil imports, which got concessions worth Rs 57,511 crore in 2014-15, will not be touched either, since these impact the aam aadmi and food inflation. Political sensitivities rule that out.

Machinery, which gets the next big tax-break worth Rs 31,664 crore, could see some tweaks, but in a year where domestic demand is weak, one doubts whether these will be touched substantially. However, duty increases will have the effect of protecting domestic industry, so that could provide some justification for higher customs duties on some pieces of machinery.

Primary metals, chemicals, and textiles get Rs 15,000-18,000 crore worth of customs tax breaks each, and some changes here are not unthinkable.

Our best guess: the axe will fall on depreciation, since this will be neutralised by corporation tax cuts, and on oil and machinery imports to some degree. Anything to do with exports or food prices will probably not be touched.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest