Economy

IRCTC: Reversal Of Convenience Fee Decision Indicates Shift In Mindset

- The government asked for 50 per cent of IRCTC’s convenience fee revenues.

- The decision was reversed within 19 hours.

- The reversal signals a changing attitude in the government, especially at a time when it is looking to monetise assets.

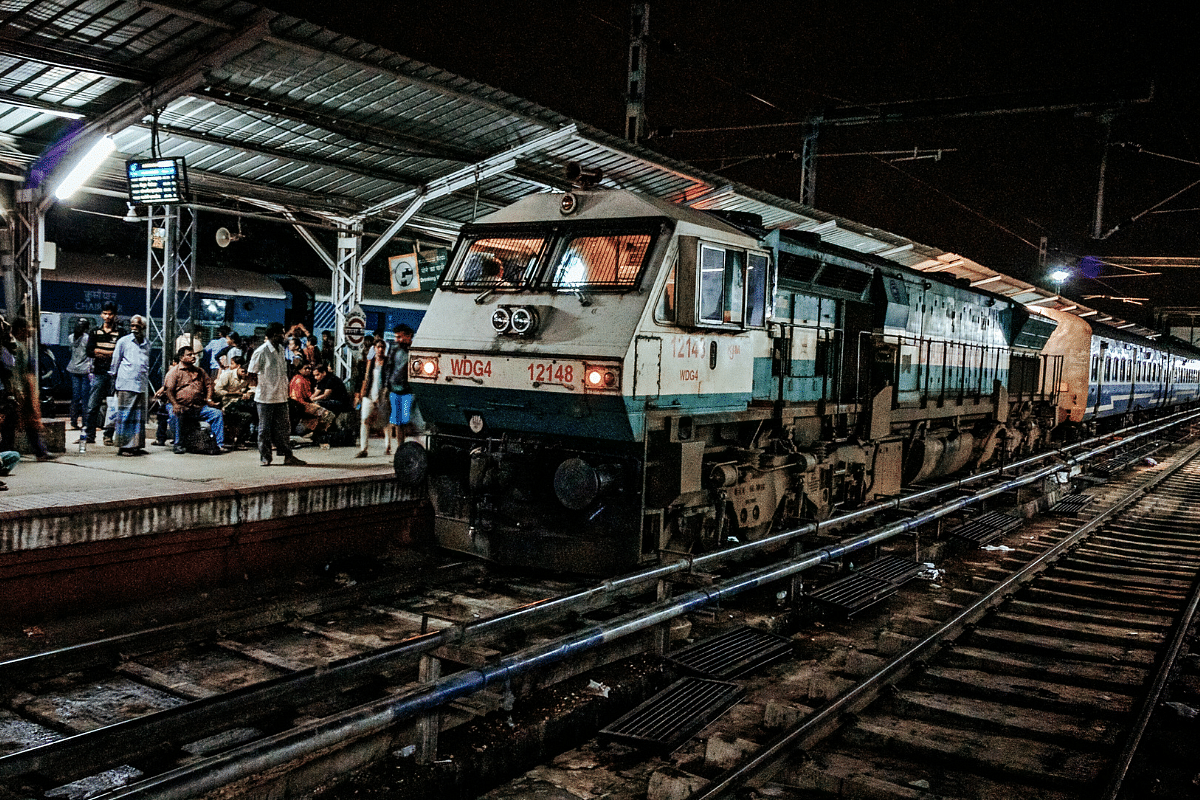

Indian Railways (Photo: Ashwin Kumar/Wikimedia Commons/Flickr)

The Indian Railway Catering and Tourism Corporation (IRCTC) lost close to 25 per cent in the early morning trade after the government asked for 50 per cent of IRCTC’s convenience fee/service charge revenues.

Just after 19 hours, the government reversed its decision.

What Is Convenience Fee?

A passenger pays a convenience fee when they book tickets using IRCTC’s website or mobile application.

Earlier, the government would receive 20 per cent of the convenience fee, but it was changed to 50 per cent of the fee.

Currently, IRCTC charges Rs 30 as the convenience fee for AC coach tickets and Rs 15 for non-AC coach tickets, if made through non-UPI (unified payments interface) modes of payment.

If payment is made through UPI, the convenience fee is Rs 20 for AC coach tickets and Rs 10 for non-AC coach tickets.

IRCTC’s Perspective

Not all revenue is created equal, and for IRCTC, the convenience fee was a highly profitable revenue source. The marginal cost of each transaction is negligible, implying that these revenues generate high margins for the company.

But IRCTC’s convenience fee has a troubled history. In Financial Year (FY) 2016, the convenience fee contributed to almost Rs 552 crore of revenues for IRCTC. But the government pushed for digital payments after demonetisation and asked IRCTC to stop charging a convenience fee.

Cumulatively, the company lost around Rs 1,200 crore worth of revenue between 2016 and 2019 when the regulation was in effect. The government paid a mere Rs 120 crore to IRCTC for covering its costs.

Regulations, A Double-Edged Sword

Government regulations have helped IRCTC in other areas. For instance, in 2017, the government announced that IRCTC would be the caterer for operations across the Indian Railways. The monopoly position in the catering and ticketing segments has allowed IRCTC to become one of the highest valued stocks in the country.

IRCTC currently pays around 20 per cent of the convenience fee to the government. Assuming that the railway passenger volumes return to pre-pandemic levels, it is likely that convenience fees would stand at around Rs 600-700 crore, in accordance with past data. Therefore, the government would earn somewhere to the tune of Rs 200-350 crore a year.

In a bid to earn an extra Rs 350 crore or so, the government has managed to shave off almost Rs 18,000 crore from IRCTC’s market capitalisation.

IRCTC had Rs 1,113 crore in deposits and Rs 345 crore in cash and cash equivalents, according to the FY 21 annual report. The company has strong and consistent cash flows as well, without the need for heavy reinvestment in assets.

Therefore, the government could have asked IRCTC to pay out some money as a dividend, or it could even have sold the highly valued IRCTC stock in small tranches.

If anything, a higher dividend payment would have spurred the stock to greater heights. The current decision has hurt the revenues, profitability, and market capitalisation of the company.

The Curse Of Being A Minority Shareholder

Unfortunately, in the past, governments have rarely, if ever, taken the minority shareholders’ interests into consideration.

There have been several instances when public sector undertakings (PSUs) have been financially hurt by the government. Civil servants have no incentives to make PSU stocks perform well over the long term, but rather are incentivised to destroy shareholder wealth.

For instance, the takeover of Hindustan Petroleum by the Oil and Natural Gas Corporation (ONGC) forced ONGC to take up a large debt right when its core oil production business was floundering. It allowed the government to fill up its coffers and reduce the fiscal gap while the minority shareholders suffered.

Shift In Mindset

In IRCTC’s case, the government reversed the decision within 19 hours. The move signals a changing attitude in the government, especially at a time when it is looking to monetise assets.

Decisions that do not consider the interests of minority shareholders could send the wrong message to investors looking to invest in PSUs.

In addition, with the Initial Public Offering (IPO) of Life Insurance Corporation (LIC) on the books, the government has to be cautious when dealing with publicly listed PSUs.

The Department of Investment and Public Asset Management (DIPAM) is looking to monetise the government’s public assets and bring in private money into different sectors.

According to a report by Moneycontrol, DIPAM Secretary Tuhin Pandey said that the department has been advising other ministries to carefully evaluate policies from minority shareholders’ perspectives.

DIPAM is responsible for the privatisation of Air India. It is currently responsible for monetising Bharat Petroleum, infrastructure assets, and executing the LIC mega-IPO.

“Our clear advice to all the departments has always been that any policy decision with respect to listed PSUs should be taken with the interest of minority shareholders in mind. The railways has evaluated the pros and cons and withdrawn its decision,” Pandey told Moneycontrol.

Despite the fairly good financial performance of PSU stocks, they carry a government ownership discount. The change in attitude, if sustained, could lead to a re-rating of PSU stocks that puts them at par with their private peers.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest