Economy

Morgan Stanley: Boosted By Digitisation, GST, India To Be Third-Largest Economy In World By 2027

- Though the country was set for strong long-term growth, the combination of demographics, digitisation and tax reform has only made the India growth story more credible and compelling.

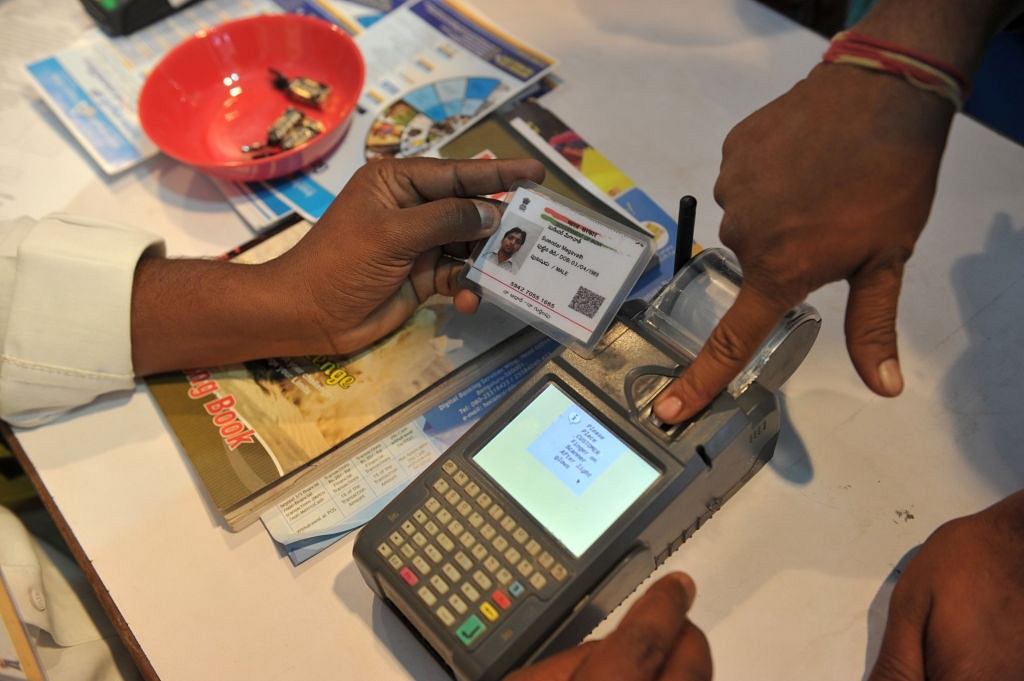

An Indian visitor gives a thumb impression to withdraw money from his bank account with his Aadhaar or Unique Identification (UID) card during a Digi Dhan Mela, held to promote digital payment, in Hyderabad on January 18, 2017. The Digi Dhan mela is a government initiative aimed at digital transformation in the country following the recent demonetization. (NOAH SEELAM/AFP/Getty Images)

Digitisation of India’s cash-bound economy and tax reforms can accelerate expansion and propel the country forward to become one of the world's fastest-growing large economies over the next 10 years, a new report from Morgan Stanley Research has said.

Endorsing the government’s string of bold economic initiatives that are aimed at delivering benefits in the long run, the report said India was already on its way to growing at a brisk pace over the next decade, buoyed by demographics, reforms and globalisation.

“The country was already on a strong trajectory, but digitisation puts India's nominal gross domestic product (GDP) growth on track to compound annually by more than 10 per cent in US dollar terms over the coming decade," says Anil Agarwal, head of Asian Financial Research at Morgan Stanley.

“The result could be a multi-trillion-dollar opportunity.”

Despite the near-term teething issues the country is facing, investors can expect to see visible shifts in economic activity beginning next year.

- $6 Trillion Gross Domestic Product

India's economy is poised to leapfrog from its current seventh-place position to the third-largest economy by 2027 with $6 trillion GDP.

- Advances In Equity Market

India’s equity market could rise to the fifth position from the current tenth in the world with financial services and consumer discretionary stocks leading the way.

- Global Reach

Increase in e-commerce activities consumption growth, financial products and investments can attract global corporations said Agarwal. A successful Indian model can serve as a template for other emerging nations, he added.

- Biometrics And Bank Accounts

The Aadhaar project, which is nearly complete with most of India's 1.3 billion people now registered in the government's digital database, has paved the way for Jan Dhan - India's national mission for financial inclusion aimed at ensuring that every household in India has a bank account and easy access to those accounts. Since the launch of this initiative in 2014, Indians have opened some 285 million bank accounts.

- 800 Million Unique Mobile Users

The report says the surge of mobile phone usage is encouraging Indians to manage their accounts and conduct cashless transactions using their phones. Currently, India has around 800 million unique mobile users, and about 430 million have Internet access — a third of India's population.

“We believe Internet access will double in the next 10 years and we estimate that 915 million Indians will be on the Internet by 2026,” says Ridham Desai, head of India Research.

- Young Work Force Helps Digitisation Drive

Demographics is working in favour of digitisation. India has among the highest numbers of young people entering the work force over the next two decades. “These individuals are not attached to old banking habits and they will have access to mobile phones and smartphones," says Desai.

“We would expect them to adopt digital banking much more quickly than past generations."

- Digital Transaction To Hit 20 Per Cent Of GDP By 2027

As a proportion of total personal consumption expenditures (PCE), digital transactions in India were recently just 8 per cent, well below those of other emerging market countries such as Brazil (30 per cent), South Africa (27 per cent) and Russia (16 per cent). “Given all the changes afoot, in our base case we expect this to increase to about 20 per cent of GDP by 2027, which would take digital transactions as a percentage of PCE to about 36 per cent," says Agarwal.

“Given all the changes afoot, in our base case we expect this to increase to about 20 per cent of GDP by 2027, which would take digital transactions as a percentage of PCE to about 36 per cent,” says Agarwal.

Digital transactions, whether through bank debit cards, credit cards or mobile wallets, is a major catalyst for economic growth, and new modes of digital payments are expected to take over. “We expect new avenues, such as UPI, Mobile Wallets and Rupay Cards — a domestic card payment gateway launched three years ago — to quickly account for two-thirds of the digital payments market by 2027," Desai said.

- GST - The Single Biggest Tax Reforms

India’s new Goods and Services Tax (GST) that was launched in July also has the potential to improve India's overall outlook as the country switched to a unified and completely digital system.

“It will significantly expand India's tax net, a shift that, in our view, will provide a major boost to Indian government finances,” says Derrick Kam, India Economist, adding that it is the country's most important reform since the early 1990s.

Though the country was set for strong long-term growth, the combination of demographics, digitisation and tax reform has only made the India growth story more credible and compelling.

The bottom line: “We expect India to continue to be among the world's best-performing markets, with a potential 24 per cent compound annual growth rate (CAGR) in US-dollar returns over the coming five years,” Kam said.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest