Economy

This Is Modi 3.0: Buckle Up For More Big Bang Reforms; Disinvestment Next Target

- The decisions on retrospective tax and telecom are no isolated cases. They are in continuation with 'Modi 3.0' that started in the pandemic year of 2020 and got its shape in 2021.

The hallmark of this phase is a string of policy decisions, also referred to as second-generation reforms.

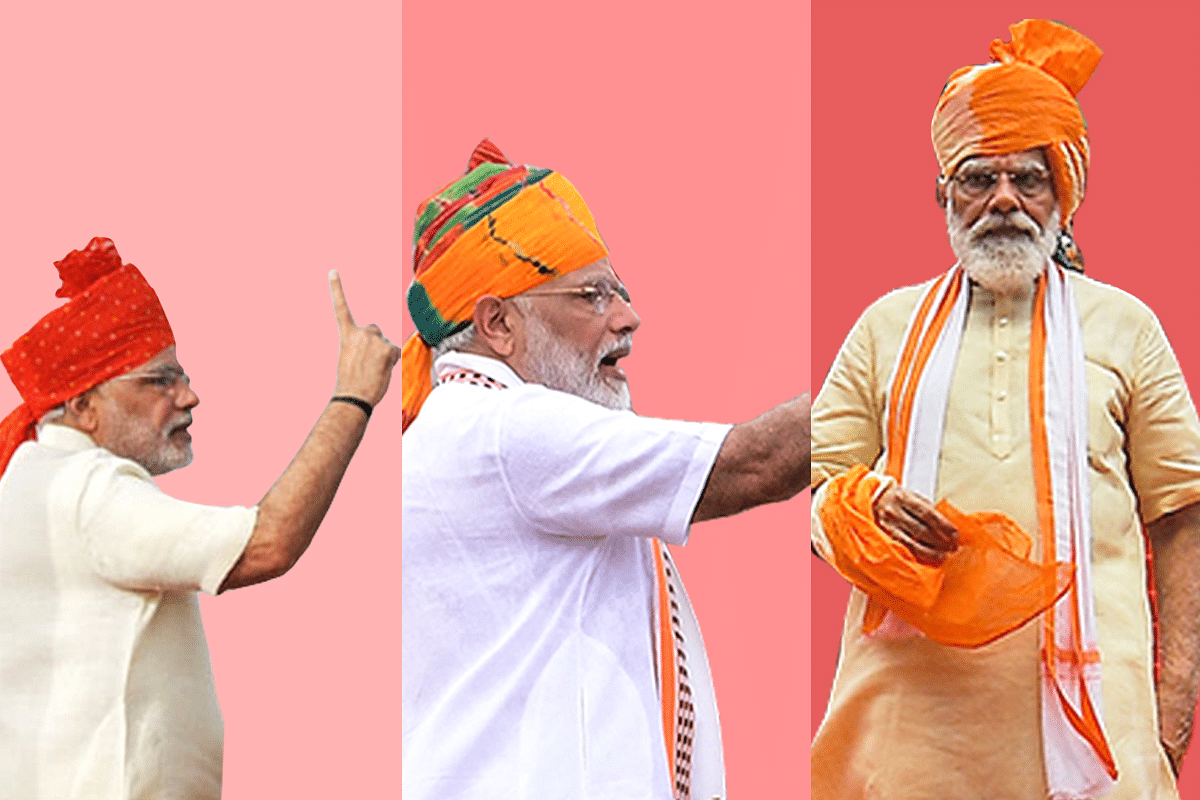

In the news media, Prime Minister Narendra Modi’s second term in office is referred to as ‘Modi 2.0’. To borrow that terminology (but not sticking on to the definition); India has stepped into Modi 3.0.

The hallmark of this phase is a string of policy decisions, also referred to as second-generation reforms - including the scrapping of the retrospective tax and bringing about long-pending reforms in the telecom sector – that will push India high on investors’ priority and promote growth and employment generation.

The reforms are not over. If Modi has his way, India will soon see big bang disinvestments—where the government will leave control to the private sector—which were practically stopped after the Vajpayee-era. And, there is no reason why a determined, charismatic leader shouldn’t do what most others were afraid of.

Not Afraid To Reform

Let’s face it, if reforms are unpopular across the world, second-generation reforms face even greater resistance. But that was not enough to deter Modi. Here is a rare mass leader, who can keep voters charmed, despite taking difficult decisions normally avoided by politicians fearing loss of popularity.

GST, coal denationalisation, bankruptcy code – each one of these could have been potential landmines and were avoided by politicians for decades. Modi addressed all these and more (demonetisation and Rafale). Moreover, he dared to take such calls under an adverse economic situation.

The Manmohan Singh-led UPA assumed power when the economy was on a high-growth trajectory. Path-breaking connectivity projects initiated by the Atal Bihari Vajpayee government were fueling consumption, subprime in the USA and the Chinese growth engine were keeping sentiments buoyant.

All these proved short-lived. The meltdown in 2008 left the global economy tattered. China never grew at the same pace again. In India, every key sector - highway construction, telecom, coal, power, oil and gas, banking - was marred with controversies. The economy was at a hopeless stage beginning 2010.

Investment is as much a factor of perception as fundamentals. India suffered from both ends. Tens of thousands of megawatt worth of newly installed power capacities were idling, banks were loaded with bad debts and practically stopped lending. An ill-designed land acquisition act (2013) that gave in to populist demands, added to the misery.

As the new government came in, it faced an unprecedented event – the deallocation of captive mines. Investments in mine, end-use plants and the downstream industries - made since liberalisation - became vulnerable overnight. Very few countries witnessed such tectonic policy reversals in recent history.

There were not many fools to invest in India at that juncture. Many went bankrupt or closed some lines of business. It was the job of the new government to work on both fundamentals and sentiments. And, they haven’t done as bad either.

Despite song and dance about high growth, the UPA government failed to attract much FDI. According to ITC, between 2006 and 2013, the inward FDI hovered between $9 billion and $23 billion. The inflow peaked in 2011 and declined to $16 billion in 2013.

Even Indian investors were looking for other destinations. Outward FDI exceeded the inflow beginning 2010 ($40 billion) and was as high as $29 billion in 2013.

The trend was reversed in 2015 when inward inflow exceeded outflow. From $24 billion in 2014, inward FDI grew consistently and outward flow declined sharply. The inflow suffered temporarily during the pandemic before reaching a historic high. Between August 2020 and July 2021, India received $72 billion in FDI.

Leaving It To Courts Is Dangerous

FDI is a measure of investor confidence, which has been rising due to stable and strong leadership, and sustained initiatives to improve ease of doing business and reduce logistical inefficiencies. But that was surely not enough to take the economy to the next level of growth.

According to World Bank data, India’s GDP numbers have been range-bound between 1991 and 2019. The peak (8.8 percent) was achieved in 1999 and the lowest (3 percent) in 2008. The longest stay at the top was for five years, between 2003 and 2007.

This was due to the slow pace of reforms. Vajpayee started giving space to competition by disinvesting non-strategic PSUs. UPA converted the initiative into a revenue-generation exercise. Coal India was listed but the state retained a monopoly in commercial mining.

Global politics and the economy do not follow a static pattern. To make the most of it, reforms are to be backed by more reforms. China did that by taking its railways to the cleaners in the last decade. We didn’t.

Mistakes are part of policymaking. The wise correct it at the earliest. UPA introduced ‘retrospective tax’ in 2012, allegedly to prevent tax avoidance in two complicated big-ticket acquisition deals (Vodafone and Cairn). It ended up earning India disrepute. Investors were scared about policy uncertainty.

In August this year, India scrapped that law after Cairn won the international arbitration and took legal measures to attach Indian national assets overseas – including that of Air India, which is up for sale. On the brighter side, India acted fast since the arbitration award, and reportedly worked out an out-of-court settlement with Cairn.

It would have been better if India acted earlier. Apparently, the Prime Minister was keen but his finance ministry didn’t want to risk public scrutiny for notional loss. Some say they didn’t want to embarrass then President Pranab Mukherjee, who introduced the law as finance minister.

Leaving it on the court to take a call is dangerous, as was further proved with the September 2020 Supreme Court verdict concerning adjusted gross revenue (AGR) dues from three telecom majors.

This is also a legacy problem. Everyone knew it was unreasonable to demand a share of non-telecom revenues. Compounding the woes of an industry that is facing pressure on revenue—both due to change in technology as well as competition—by imposing hefty penalties and interest for delayed payment of license fee was also ill-advised.

The puzzle is too complex for an accountant to solve. Over the last decade, data and voice charges in India came down to rock bottom. This distorted initial revenue calculations. However, it helped the spread of the digital economy, widening the scope for employment and investment, manifold.

Vodafone suffered from retrospective tax issues. They are also facing the biggest AGR dues. The government wanted companies to pay in 20 years. The judiciary went a step ahead in asking them to comply in 10 years, which was impossible for a loss-making company facing a huge debt burden. The finance ministry held a conservative view in this case too.

Left to itself, Vodafone would have died, sending shockwaves to lenders and the investor community. To make matters worse, the telecom market in India would have become a duopoly, bereft of competition.

In a decision on 15 September, the government rationalised the fee and revenue-sharing structure progressively and offered easy terms to pay some of the past dues. This is unlikely to solve Vodafone’s mounting financial woes entirely. But the improved outlook may help the industry get new investments. That is in India’s interest.

Welcome To Modi 3.0

The decisions on retrospective tax and telecom are no isolated cases. They are in continuation with Modi 3.0 that started in the pandemic year of 2020 and got its shape in 2021.

For most, 2020 would have been disastrous. But Modi used the pandemic to start afresh. Over the last year, he built a completely new team and took decisions, often described by critics as outrageous, ignoring widespread criticism.

In the end, he laughed the last laugh. His stress on vaccine manufacturing has been vindicated. India has already jabbed over 65 percent of the adult (eligible) population with at least one-dose of the domestically manufactured vaccine and is set to resume exports from October. It is the only major country after China that didn’t go for Pfizers and Modernas.

While critics laughed at the ambitious Atmanirbhar Bharat programme, Modi went ahead with his production-linked incentive (PLI) schemes to shore up domestic manufacturing and exports in select sectors. And, it started working.

The government has been putting pressure on domestic handset manufacturing for some time. That PLI helped attract top-notch brands. The share of domestically manufactured iPhones in the market in India, increased from 17 percent in 2018 to 76 percent in 2021; exports reached 5 percent from nil.

To the dismay of critics, who expected India to suffer following a record 24 percent GDP contraction in the lockdown-hit April-June 2020 quarter, India staged a V-shaped recovery. Even a deadly second-wave failed to stop this growth march.

Exports, electricity demands are at an all-time high. PMI (purchasing managers index) in both manufacturing and services are positive. Employment in the organized sector is rising. Over 14 lakh new members were added to the employees’ provident fund (EPF) list in July.

All problems are not over though. It cannot be so. The pandemic has ravaged the world economy. China is staring at a huge bank default. The problem came to light in bits and pieces last year. Now, things have reached a dramatic stage.

What is important is this. All indications suggest that the growth impetus in India will NOT be short-lived. A fundamental change is taking place in the economy and Modi is in a hurry to give it a shape. Rest assured disinvestment will now be his focus area.

The government announced an exit from all non-strategic businesses last year. Let's hope it succeeds. We have been dragging our feet to reform, for too long.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest