Economy

Union Budget: How Bold It Can Be Amidst Limitations And Expectations

- One of the key things that the budget can do is adopt a different approach towards the economy.

- A lot of our focus over the years has been on creation of non-farm employment and promoting manufacturing industries.

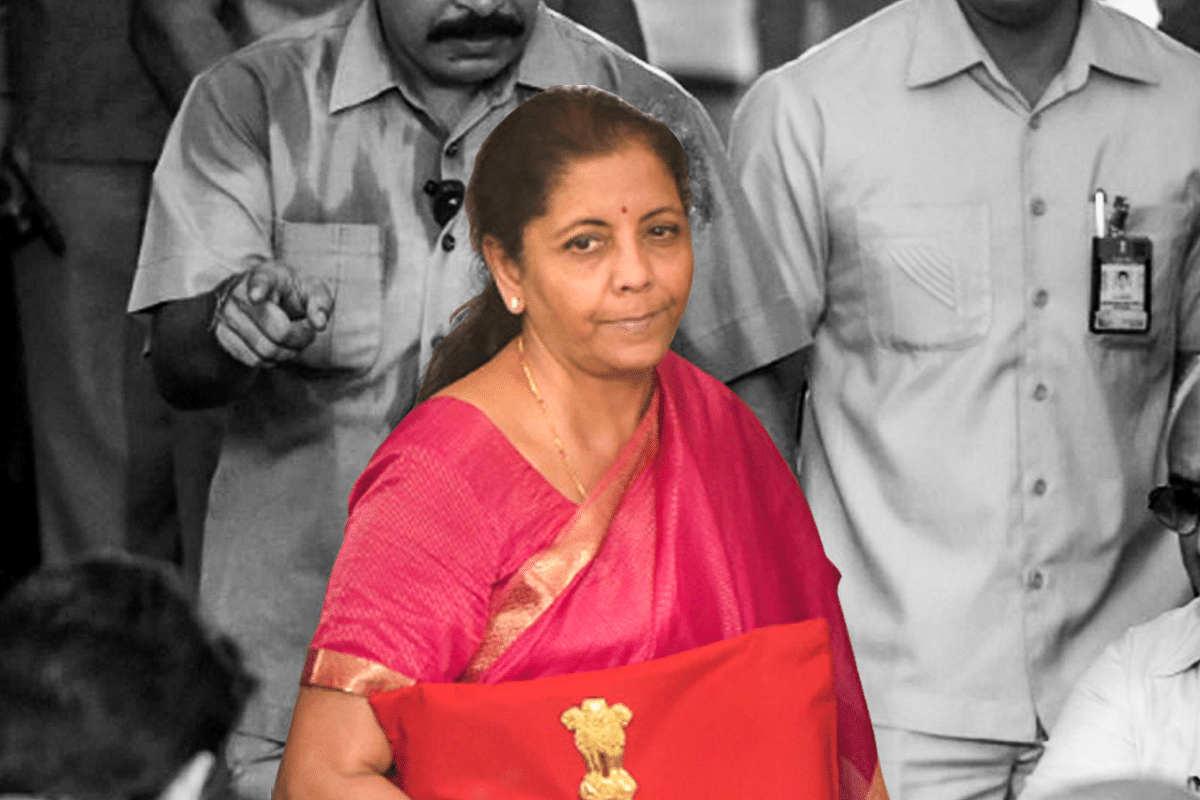

Finance Minister Nirmala Sitharaman outside Parliament before presenting the Budget for 2019-20.

There isn’t much time left for a budget that has the potential to unshackle our productivity. However, there is a need to recalibrate our expectations in order to ensure that we are not being overtly aggressive.

This is important as we have witnessed a significant amount of bold decisions being taken by the government over the last couple of months and it is only natural to expect some of these decisions on the economic front too.

The key question is not of whether the government will take those bold steps or not — but it is a question of when. Do note that we did manage to eventually get rid of our Nehruvian era economic policies even if it happened after nearly four decades with those wonky policies.

This time, it may not take four decades but only a single decade between 2014 and 2024 which can perhaps get rid of the last bits of those policies.

A key thing worth discussing is the degree of boldness that one can anticipate in the budget and we surely expect this budget to be bold. But, there will be limitations to just how bold it can be.

For starters, the budget is just one part of the economic policies of the government. Even though many believe it to be significant — which it is, but, a lot of the structural reforms that many keep talking about such as land and labour would not be a part of the budget as a money bill.

Even the issue of indirect taxation and some tweaks in goods and services (GST) procedures, filings etc are not in the purview of the Finance Ministry. Therefore, we must acknowledge the true extent of limitations before our expectations get unrealistic.

One of the key things that the budget can do is adopt a different approach towards the Indian economy. A lot of our focus over the years has been on creation of non-farm employment and promoting manufacturing industries.

This is essential to shift surplus labour from agriculture but we are witnessing a trend where people are aspiring for better-paying and high-value addition jobs. These jobs are largely concentrated in the services industry, and therefore, we must recognise our competitive advantage is not just limited to goods but also in services.

One such area is financial services — an industry that can develop as one of India’s biggest export sector by its value in a really small amount of time. This in turn will create good-quality high-value adding jobs in the economy.

The question thus is why it has not happened and the answer to this lies in a combination of the ease of doing business and our taxation policies. Our taxation policies and regulatory regime has indeed outsourced a bulk of the industry to other countries.

An aggressive resolution of some of the regulatory mess combined with taxation reforms would definitely be tax positive and therefore, we have every incentive to undertake such policy decisions.

But these high-value jobs do not solve the problem of surplus labour in agricultural sector which requires a different kind of policy intervention. The approach on manufacturing jobs in the past failed due to multiple reasons.

First is our labour laws and government are indeed working to simplify them as new labour codes are likely to be introduced soon. The other was land acquisition and in some cases even the cost of land.

It is, however, interesting that several states have a policy to partially refund the investment on land through tax breaks and utility subsidies.

Perhaps, more states should consider such an approach in order to focus on achieving a higher growth. The other two issues have been the high cost of capital and high tax rates. Government has fixed the latter while for the former, we would have to wait to see what the budgeted deficit is and whether government will bite the bullet on the sovereign bond or not.

The encouraging experience of Greece in raising funds at cheap rates should make those against it reconsider their position. The availability of surplus liquidity at historic low levels is a reason enough for India to consider the possibility of a sovereign bond which can help reduce the cost of borrowings and bring down our fiscal deficits — or simultaneously expand our primary deficit.

While growth may have been lower, but we do see several signs of an imminent economic revival as tax collections improve. This would also imply that the tax revenue shortfall may in fact be lower than what was expected a few months ago.

Our overtly cautious approach results in frequent instances of us not taking bold decisions that have the potential to provide rich dividends. This seems to have changed in Modi 2.0, thanks to the 303 and this makes one optimistic regarding India’s economic prospects.

However, we do need to inculcate a culture of growth not just amongst our politicians but also amongst the people.

The severe economic slump until the last quarter has perhaps made a big impact as everyone now is interested to talk about growth. One hopes that such discussions also happen when we hit 7 per cent so that we can start chalking out opportunities in order to grow and sustain a growth rate well beyond 8 per cent.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest