Economy

What India Can Learn From UK’s PFI Experience

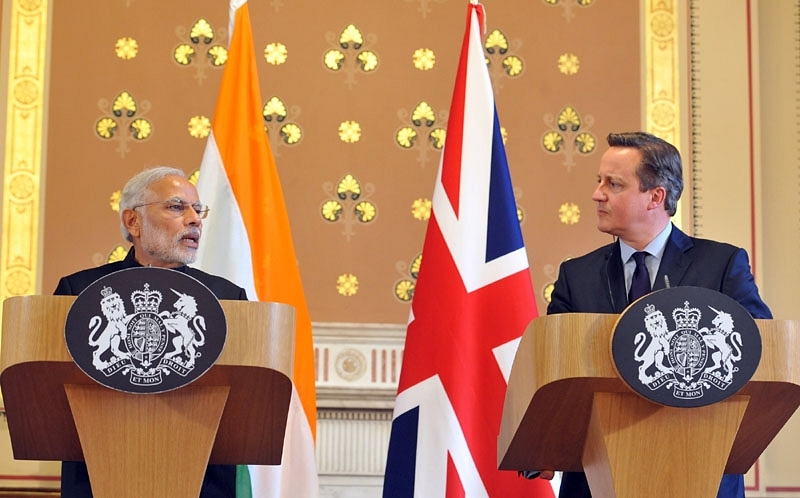

During a recent address to business leaders in London, the Prime Minister of India expressed an opinion that India is keen to learn from the United Kingdom’s experience in “structuring and implementing PPP projects”. This and earlier indications by the Government of India suggest that it is considering an expansion of the outcome-oriented public-private-partnership (PPP) method of project implementation to the social services sector, especially in education, health, and sanitation sectors.

The PPP method (sometimes called contract or procurement) for delivery of services in India is not new. Successive governments in India have engaged in PPP projects since the late 1990s. Most of these projects have been in physical infrastructure including highways, railways, ports, airports, telecommunications and power. The enthusiasm for such collaborations led to the formation of a ‘PPP Sub-Group on Social Sector’ in 2004 at the then Planning Commission of Government of India, which recommended greater use of PPPs for the social sector in areas including education, health, environment & forests, drinking water supply, rural developments, and urban development.

Recent data from the NITI (National Institution for Transforming India) Aayog, which has replaced the Planning Commission, suggests that since January 2006, an overwhelming, 264 out of a total of 281 PPP projects (94 per cent), which had been approved by the PPP Appraisal Committee of the Government of India, were for roads or ports. NITI Aayog has noted that PPPs have not taken off in social sectors and that “there is a need to enhance private investment and coverage in untapped sectors, particularly in the “social sectors”; and specifically suggested that new PPP models be evolved to attract private investments to various sectors including the social sector.

The United Kingdom (UK) exhibits a history of more than two decades of PPP method or procurement in the social sector, through its Private Finance Initiative (PFI). Based on this experience, Indian government organisations, at both the Union and the State levels, can draw context specific, nuanced insights in designing, implementing and assessing social sector PPPs.

The PFI Model

PFI, introduced in UK in 1992, attempted to use methods and practices of project finance for public sector infrastructure projects, specifically for the social sector. A typical PFI contract, or agreement, is for about 25 to 30 years, and is signed between the public sector department and a Special Purpose Vehicle (SPV), which is owned by a private sector consortium. The SPV takes on tasks of designing, building, financing and managing (sometimes, maintaining) a capital project.

The SPV subcontracts various components of the PFI project including construction and operation activities. It raises the finance for the project, in the form of debt and equity: with debt constituting the higher share, often around 90 per cent. Consequently, the financing structure of each PFI project is unique. A majority of finance for PFI projects has come from “senior debt” – a kind of debt provided by banks, which would be paid off first, in case of project failure. In addition, bonds have also been used to finance PFI projects.

Once the construction is completed and the services commence for a PFI project, the public sector department makes regular payments called “unitary charges” to the private sector consortium. These charges are linked to the performance and deductions are made, in case the services are not according to contractual requirements. Upon expiry of the contract, assets created are owned by public sector.

Apart from the duration, purpose and financing structure, other features of a typical PFI contract also distinguish it from a conventional public procurement. While contract specifications are usually input-based in case of the latter, in a PFI contract, they are output-based, enabling the private contractor to innovate during the designing and construction stages of the project. In a PFI contract, risks associated with construction delays and cost overruns are transferred to the private sector, in turn, encouraging delivery within the time and budget agreed upon in the contract.

UK’s PFI Experience

By 31 March 2012, according to data of the Treasury of the UK Government, 717 PFI projects were either under construction or in operation across the various departments of the UK Government, with a total capital cost of GBP 54.7 billion. A little over 550 of these projects were running in England and overall, 21 departments of the UK Government were using the PFI project route. The largest number of PFI projects (166 in number) were active in the Department for Education; whereas the PFI projects of the Department of Health had the largest share of capital costs at GBP 11.6 billion across 118 PFI projects (the second largest number of projects). Total repayments (as unitary charges) in nominal, undiscounted terms, for the PFI projects amounted to GBP 301.3 billion until the financial year 2049-50, peaking at GBP 10.1 billion in 2017-18.

UK’s PFI projects were intended to reap benefits from private sector’s project management skills, and from its innovation and risk management expertise. By 2001, according to UK’s National Audit Organisation, public sector departments were also observed to have shifted their focus from inputs to outputs, especially in defining performance levels and financial penalties; and had developed internal governance arrangements, including processes for monitoring and problem resolution, to manage the relationship between themselves and the private sector partners.

The performance, however, fell short due to several unsatisfactory aspects of the PFI.

PFI contracts, once signed, were very rigid and the involved parties found themselves locked into complex bundled contracts involving design, construction, finance and management for nearly three decades. There was also insufficient transparency on future liabilities created by PFI projects since until 2012, about 85 per cent of PFI projects had been classified as being “off” the public sector balance sheet – effectively meaning that the associated liabilities were neither estimated nor reported. This was pertinent as there were implicit government guarantees in PFI projects; though there was no estimate of the contingent liabilities that would fall upon the government, in case of failure. Due to inadequate accounting of PFI related financial commitments, public sector departments were biased in favour of PFI leading to incorrect use of public sector comparators during decision-making.

Concerns were also raised about the ways in which risks were allocated between the private and public sectors. Ideally, PFI projects should transfer only those risks such as risks relating to quality of design, construction and maintenance, to the private sector where the private consortium can influence the outcome. However, evidence, such as that in case of PFI contracts for roads projects found that risks relating to demand i.e. the volume of traffic had been transferred to the private sector. Due to inappropriate risks being transferred to the private sector, higher risk premiums were charged to the public sector.

Deficit of skills in public sector departments was one of the root causes for increased negotiation periods and bidding costs in case of PFI projects. Due to poor project management and contract management skills in the public sector, advisors from the private sector had to be employed – which, in turn, contributed to increased costs.

In December 2012, a host of reforms through the Private Finance – 2 (or PF2) initiative were introduced in England (since, by then, capital spending on public infrastructure had become a devolved matter) to tackle the shortcomings of the PFI model.

Main reform areas included measures towards increasing transparency by the publishing of Whole of Government Accounts (WGA), which captured the PFI-related financials; restructuring the equity component of PFI projects by encouraging PFI projects to adopt lower debt to equity ratios (of 8:2 or 7.5:2.5), requiring the government to act as a minority equity investor in each project by providing capital and loans equal to 25 to 49 per cent of the total equity quantum; improving public sector procurement capability by strengthening the mandate of Infrastructure UK (a unit within UK Government’s Treasury that works on long term infrastructure priorities and secures private sector investment) and extending its support to centralised procurement units in each of UK Government’s departments; increasing flexibility in service provision by giving discretion to procuring authorities on inclusion of minor maintenance activities at the project outset, and the flexibility to add or remove certain elective services once a contract became operational; and improving risk allocation by requiring that the public sector manage a greater amount of risks, especially risks associated with unforeseeable changes in law, cost of utilities, site contamination and insurance. These addressed some of the limitations of PFI, but challenges of renegotiating and managing earlier PFI contracts remain.

Lessons for India

Main lessons that India can draw from UK’s PFI experience include the following.

First, relevant Indian government agencies and departments must equip themselves with project management and contract negotiation and monitoring abilities. Further, the staff would also need to understand how to carry out a comparative analysis of full economic costs for the life of the project involving conventional procurement and various PPP route(s) (as many forms of PPPs may be considered).

Second, once all the PPP-linked liabilities have been estimated, they must be reported clearly in budgetary and accounting statements of public sector departments. The experience of PFI shows that there has been a constant budgetary and fiscal incentive for public sector departments to encourage the use of PFIs since liabilities created did not contribute to the calculation of the national debt statistics. This has, in many cases, led to inappropriate decision making in the UK since decisions did not involve all relevant information, including future fiscal risks. Indian organisations can learn by avoiding these aspects of UK’s PFI experience.

Third, during the formulation of a PPP contract, processes such as whole-life costing need to be carried out by experts in a strategic unit. Whole-life costing can be especially challenging in case of social sector projects as they heavily depend on demographics, which might undergo changes. In India, this can be carried out at the Union government level by the PPP Cell at the Ministry of Finance, Government of India, or other designated agencies. With regard to social sector PPP projects, sector-specific knowledge would need to be housed in expert PPP divisions at the ministries of Human Resource Development and Health at Government of India. NITI Aayog has also suggested that every Ministry engaged in PPPs should create a dedicated division for monitoring of PPPs with full time staff and budgets to hire appropriate experts. Given India’s federal structure and since education and health are State subjects, PPP divisions may also need to be created at education and health departments of State governments.

Fourth, the PFI experience shows that if inappropriate risks are transferred to the private sector, large fiscal risks and contingent liabilities arise. Hence, risk sharing between the public and private sectors needs to be carefully contemplated and appropriate pricing of PPP contracts carried out. ‘Bundling’ of services, as has been done in case of many PFI projects in the social sector in the UK, may enable a reduction in transaction costs but ‘bundling’ creates complex contracts, which might reduce accountability and may be difficult to renegotiate. It is essential that private and public sector players, who are involved in a PPP contract, agree on a common agenda and a balance is struck between ‘bundling’ of services and transaction costs.

Fifth, the common financial structure of PFIs in the UK has been debt heavy but with PF2, efforts have been made to involve more institutional investors in the debt component of these projects. In India, long-term funds, such pension funds, funds of the Life Insurance Corporation (LIC) and provident funds of the Employees State Insurance Corporation (ESIC) are routed towards buying central government securities. It debt heavy financing structures are to be adopted by PPPs in India, directed efforts, such as developing specialised financial instruments, will have to be made to engage these institutional investors. Feasibility of “Masala bonds”, Indian rupee denominated bonds issued in USD in overseas markets, particularly London, in which hedging risk is borne by the lender, not the borrower, could also be explored.

Sixth, information and data systems for performance monitoring as well as for benchmarking would need specific attention, when a PPP project is implemented. Data would also need to be periodically analysed to give feedback to the private and public sector stakeholders involved in the PPP, through the life of the project. For this data to be used effectively, clauses should be inserted in PPP contracts which allow for renegotiation, as well as changes in case savings are identified in certain components of the contract.

The ability and willingness of policymakers in the UK to acknowledge certain challenges in PFI projects, and to reform some central aspects of the initiative, has been commendable. This is especially relevant for India, as there is scope to reform for many existing public project arrangements that have not been fundamentally altered for a long period.

PPP contracts are complex, and have high transaction costs. These should be more than offset by greater operational efficiencies to obtain desired benefits by using the PPP route for the social sector.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest