Ideas

Rajiv Bajaj Is Stumbling On The EV Front Too As His Pet Project Bajaj Chetak Electric Fails To Make A Mark

- While launching Chetak electric in 2019, Rajiv Bajaj had taken potshots at existing EV players including startups effectively hinting that every Tom, Dick and Harry had entered into the market.

- One and a half years later, Chetak is placed at ninth position in sales, far behind the competition he had mocked.

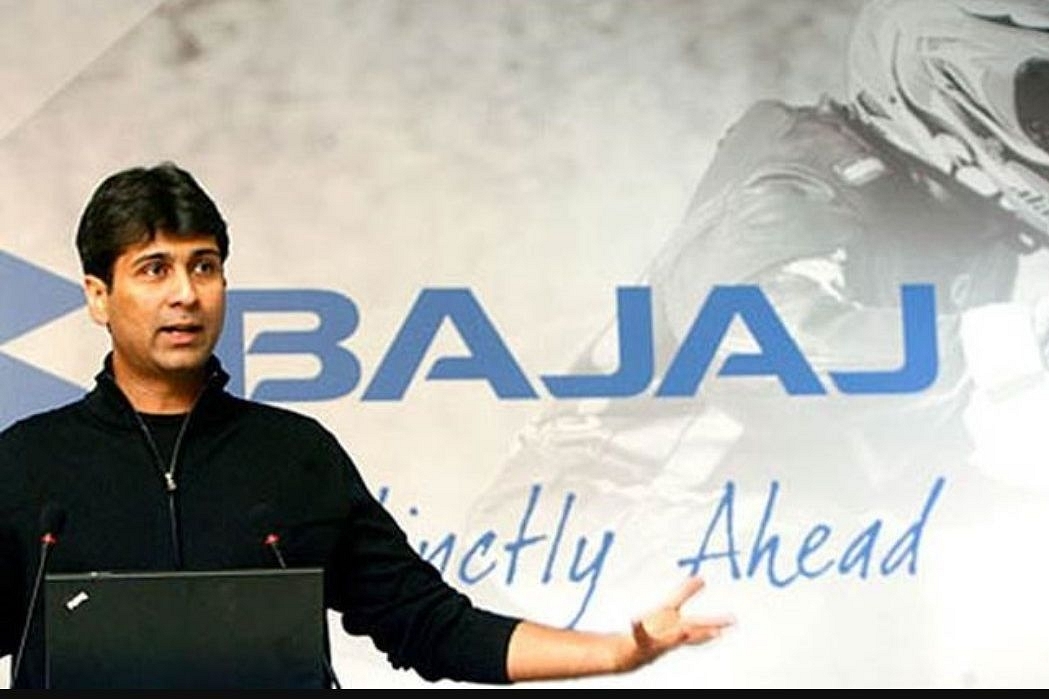

Bajaj Auto managing director Rajiv Bajaj.

Rajiv Bajaj, the managing director of Bajaj Auto, is known to speak frankly. He made news last year when he criticised the Narendra Modi government’s lockdown strategy in an online interaction with Congress leader Rahul Gandhi. The lockdown flattened the wrong curve — that of the economy rather than the intended Covid-19 curve of daily new cases, he said.

Of course, as Swarajya argued here and here, Bajaj couldn’t be more wrong. Lockdowns were the right strategy when we knew little about the virus and needed time to expand medical capacity as per the needs of our large population.

It ended up saving lives of lakhs of people. Had that happened, the panic generated in the public would have made sure that economy comes to a halt anyway. And as we now know, half-hearted measures such as night curfews or weekend lockdowns don’t help at all.

But Bajaj refuses to accept he was wrong. In an interview to NDTV in February, he pointed towards plummeting cases of Covid-19 in India to say that the country has achieved herd immunity.

He said that this happened because "we are a very populist country of relatively large number of illiterate, ignorant and very large number of in-disciplined people". Now that number of cases are touching 1 lakh per day again, his analysis has been proven wrong again.

Nonetheless, one can excuse Bajaj for being wrong on something he knows little about. But sadly, his judgement needs to be put on the dock when it comes to his business as well, something he is supposed to be an expert at.

In 2019, Rajiv Bajaj relaunched the iconic brand of Chetak scooter, this time as an electric vehicle, after it was discontinued in 2005. At the launch event, he took a dig at the existing EV two-wheeler makers, especially the startups, in his typical style.

“I am surprised that battery, motor makers have launched electric vehicles and what surprised me even more is that some who were importing TV, fridge, mobiles have also started selling electric scooters. Whereas some other failed automakers have launched products in electric scooter space and some other two-wheeler makers went down south and invested in electric two-wheeler startups as if it was not their job. But we at Bajaj are engineers and we make our own things,” he said.

Further he joked saying “I have seen the stock price of new startups going up because they are burning cash. So, this is our venture to burn cash and make our stock prices go up.”

It seemed that Bajaj was launching this new product not out of passion to offer something valuable to customers but was making a non-serious attempt to simply follow the crowd and actually believed in the superiority of his own company’s abilities which would blow the competition out of the water.

None of that happened. The Chetak electric scooter has turned out to be a dud just like Bajaj’s joke. In February 2021, Bajaj sold only 111 units of Chetak despite being in the market since October 2019. Its market share was tiny 1.83 per cent and the company stood at ninth place behind many startups which Bajaj had mocked.

Jitendra New EV, a company many reading this article would have heard for the first time, sold 124 units, marginally more than Bajaj. Hero Electric led the segment with sales of 2,201 units followed by Okinawa, Ampere, Ather Energy, Pure EV, Benling and TVS.

Interestingly, Bajaj had taken a shot at market leaders like Hero who invested in startups like Ather (Hero owns 35 per cent stake in it) but while Hero is far ahead of everyone else, even Ather is outselling Chetak by over five times.

One can cite many reasons for Chetak’s failure — poor design which is unlikely to appeal to young generation, outdated instrument cluster which is nowhere close to the likes of what startups like Ather are offering, high cost when compared to the features offered and so on. Nothing stands out except the name which could elicit nostalgia among the folks who owned this once-iconic brand in the 1990s.

However, the makers forgot that the intended audience for the electric scooters isn’t the same that the name Chetak would appeal to. Most of the prospective buyers weren’t even born at the time.

Maybe the failure to make a mark in the EV sector by Rajiv Bajaj is only an extension of his inability in sustain the Bajaj brand that it once was in the conventional two-wheeler market. Rahul Bajaj divided his business empire in 2008 and handed it over to his two sons — Rajiv and Sanjiv.

The former got the auto business and the latter was entrusted with the financial services arms (Bajaj Finance and Bajaj Finserv).

In 2008, market cap of both the companies was almost the same with financial service part of the business marginally lower than the auto one.

But in the last 13 years, while market cap of Bajaj Auto has increased by more than Rs 95,000 crores, Bajaj Finance and Finserv are now valued more than 4.1 lakh crore — a Himalayan difference. Of course, the two business couldn’t be more different but the growth is certainly a proxy to the acumen of both the brothers.

In 2008, Bajaj Auto had a market share of over 21 per cent in domestic motorcycle sales. It has now fallen to 18 per cent. Since 2008, Bajaj Auto has slipped to fourth position from its second spot in domestic sales even after the split of Hero and Honda who are individually far ahead of Bajaj at present. TVS has also got ahead of Bajaj.

Most of Bajaj’s best selling offerings — Pulsar, Platina, Discover (discontinued last year), Avenger, CD 100 — were launched when Rajiv’s father was at the helm of affairs.

Of course, one shouldn’t forget that Bajaj leads the market in exports cornering majority of the market. It’s because of this that its market cap has breached the Rs 1 lakh crore mark and is world’s most-valued two-wheeler company.

However, on this too there is danger of it ceding space to other players. In 2016, it cornered over 66 per cent of the motorcycle exports but that shrank to 59 per cent by 2020.

Maybe more humility and less cockiness is in order for Rajiv Bajaj.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest